Marti Investor Presentation Deck

5. Strong unit economics (cont'd)

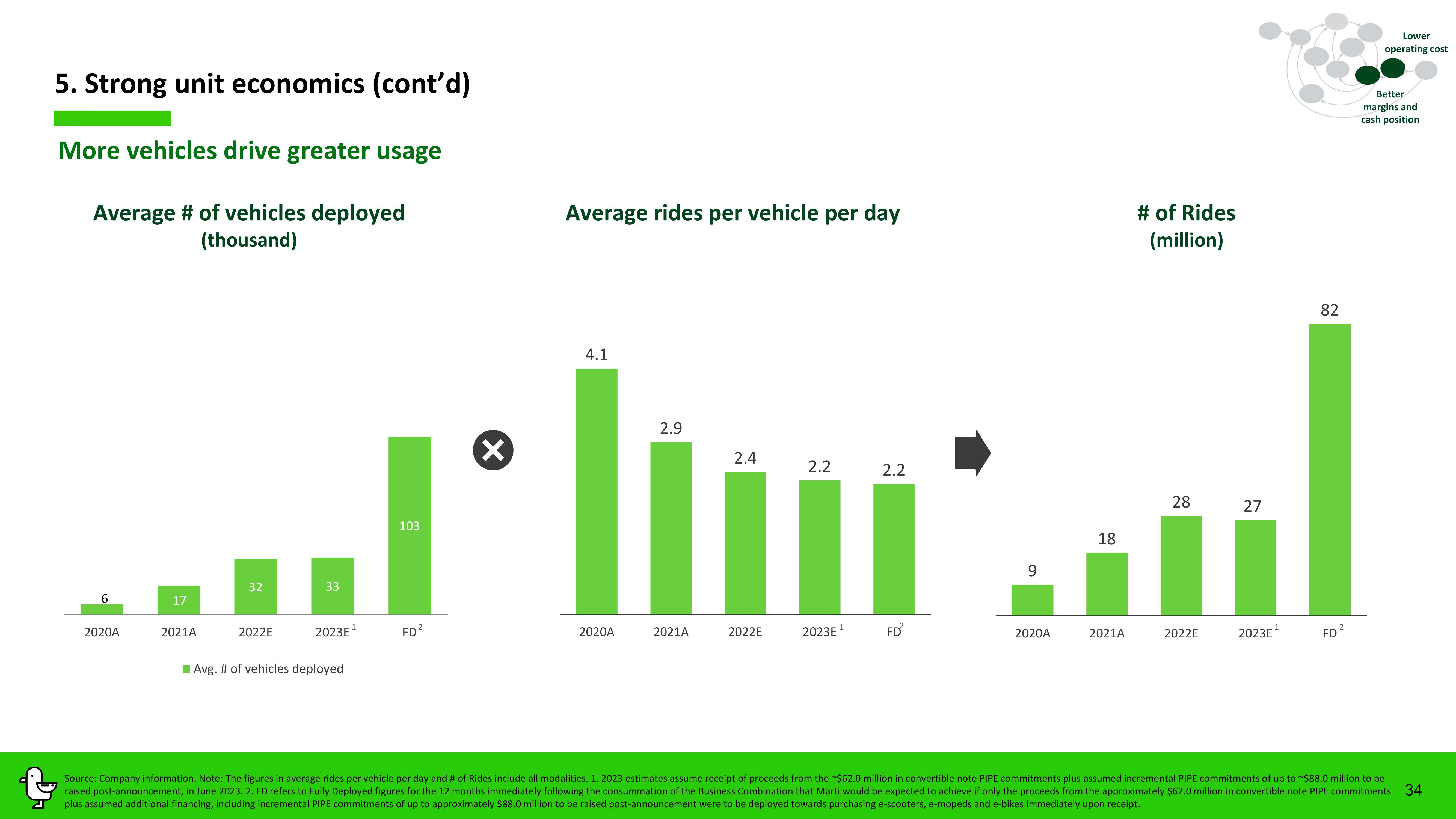

More vehicles drive greater usage

Average # of vehicles deployed

(thousand)

6

2020A

17

2021A

32

2022E

33

2023E¹

Avg. # of vehicles deployed

103

FD²

X

Average rides per vehicle per day

4.1

2020A

2.9

2021A

2.4

2022E

2.2

2023E¹

2.2

FD²

9

2020A

18

2021A

# of Rides

(million)

28

2022E

27

2023E

82

FD

Lower

operating cost

Better

margins and

cash position

Source: Company information. Note: The figures in average rides per vehicle per day and # of Rides include all modalities. 1. 2023 estimates assume receipt of proceeds from the ~$62.0 million in convertible note PIPE commitments plus assumed incremental PIPE commitments of up to $88.0 million to be

raised post-announcement, in June 2023. 2. FD refers to Fully Deployed figures for the 12 months immediately following the consummation of the Business Combination that Marti would be expected to achieve if only the proceeds from the approximately $62.0 million in convertible note PIPE commitments

plus assumed additional financing, including incremental PIPE commitments of up to approximately $88.0 million to be raised post-announcement were to be deployed towards purchasing e-scooters, e-mopeds and e-bikes immediately upon receipt.

34View entire presentation