IGI SPAC Presentation Deck

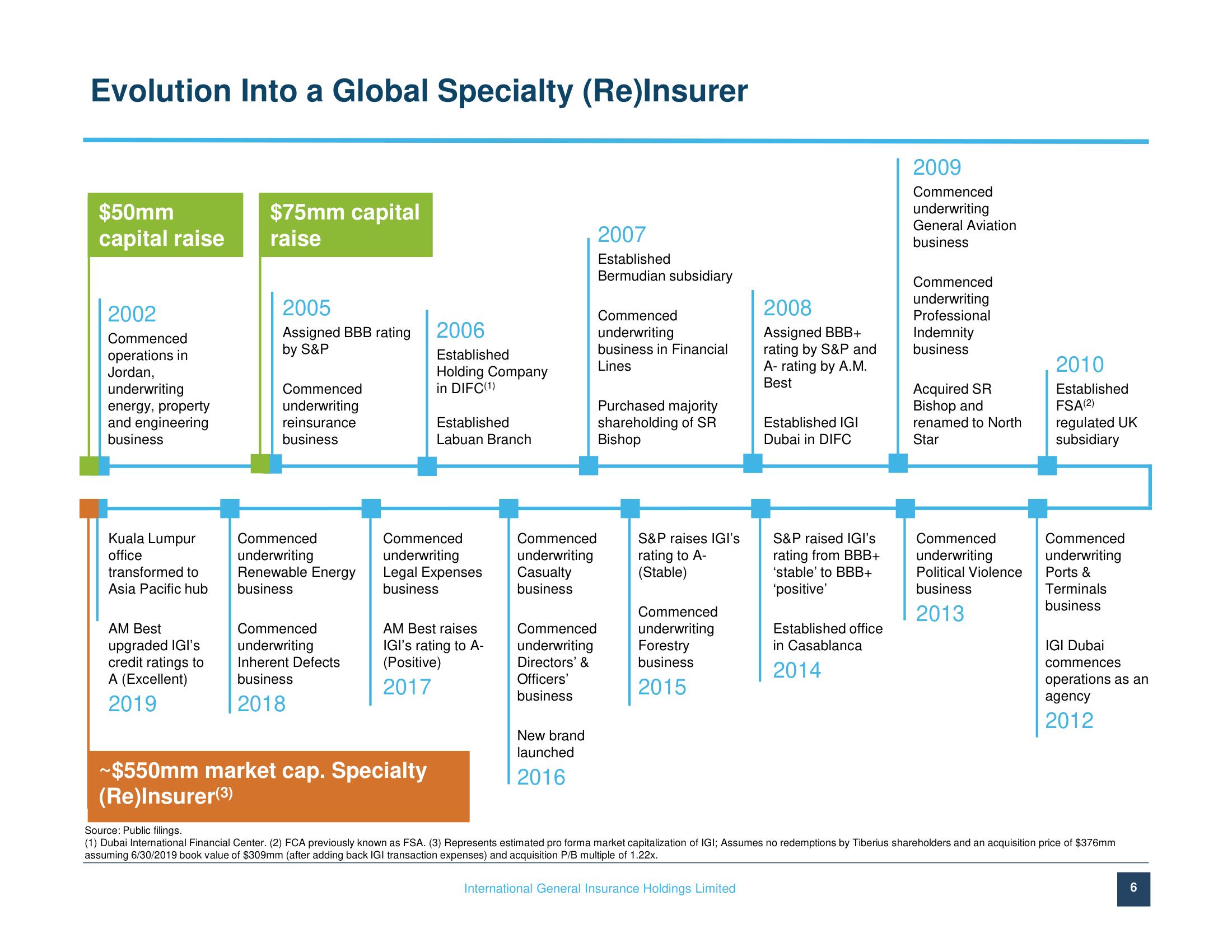

Evolution Into a Global Specialty (Re)Insurer

$50mm

capital raise

2002

Commenced

operations in

Jordan,

underwriting

energy, property

and engineering

business

Kuala Lumpur

office

transformed to

Asia Pacific hub

AM Best

upgraded IGI's

credit ratings to

A (Excellent)

2019

$75mm capital

raise

2005

Assigned BBB rating

by S&P

Commenced

underwriting

reinsurance

business

Commenced

underwriting

Renewable Energy

business

Commenced

underwriting

Inherent Defects

business

2018

2006

Established

Holding Company

in DIFC(1)

Established

Labuan Branch

Commenced

underwriting

Legal Expenses

business

~$550mm market cap. Specialty

(Re)Insurer(3)

AM Best raises

IGI's rating to A-

(Positive)

2017

Commenced

underwriting

Casualty

business

Commenced

underwriting

Directors' &

Officers'

business

New brand

launched

2016

2007

Established

Bermudian subsidiary

Commenced

underwriting

business in Financial

Lines

Purchased majority

shareholding of SR

Bishop

S&P raises IGI's

rating to A-

(Stable)

Commenced

underwriting

Forestry

business

2015

2008

Assigned BBB+

rating by S&P and

A- rating by A.M.

Best

Established IGI

Dubai in DIFC

S&P raised IGI's

rating from BBB+

'stable' to BBB+

'positive'

Established office

in Casablanca

2014

2009

Commenced

underwriting

General Aviation

business

Commenced

underwriting

Professional

Indemnity

business

Acquired SR

Bishop and

renamed to North

Star

Commenced

underwriting

Political Violence

business

2013

2010

Established

FSA (2)

regulated UK

subsidiary

Commenced

underwriting

Ports &

Terminals

business

IGI Dubai

commences

operations as an

agency

201

Source: Public filings.

(1) Dubai International Financial Center. (2) FCA previously known as FSA. (3) Represents estimated pro forma market capitalization of IGI; Assumes no redemptions by Tiberius shareholders and an acquisition price of $376mm

assuming 6/30/2019 book value of $309mm (after adding back IGI transaction expenses) and acquisition P/B multiple of 1.22x.

International General Insurance Holdings Limited

6View entire presentation