SmileDirectClub Investor Presentation Deck

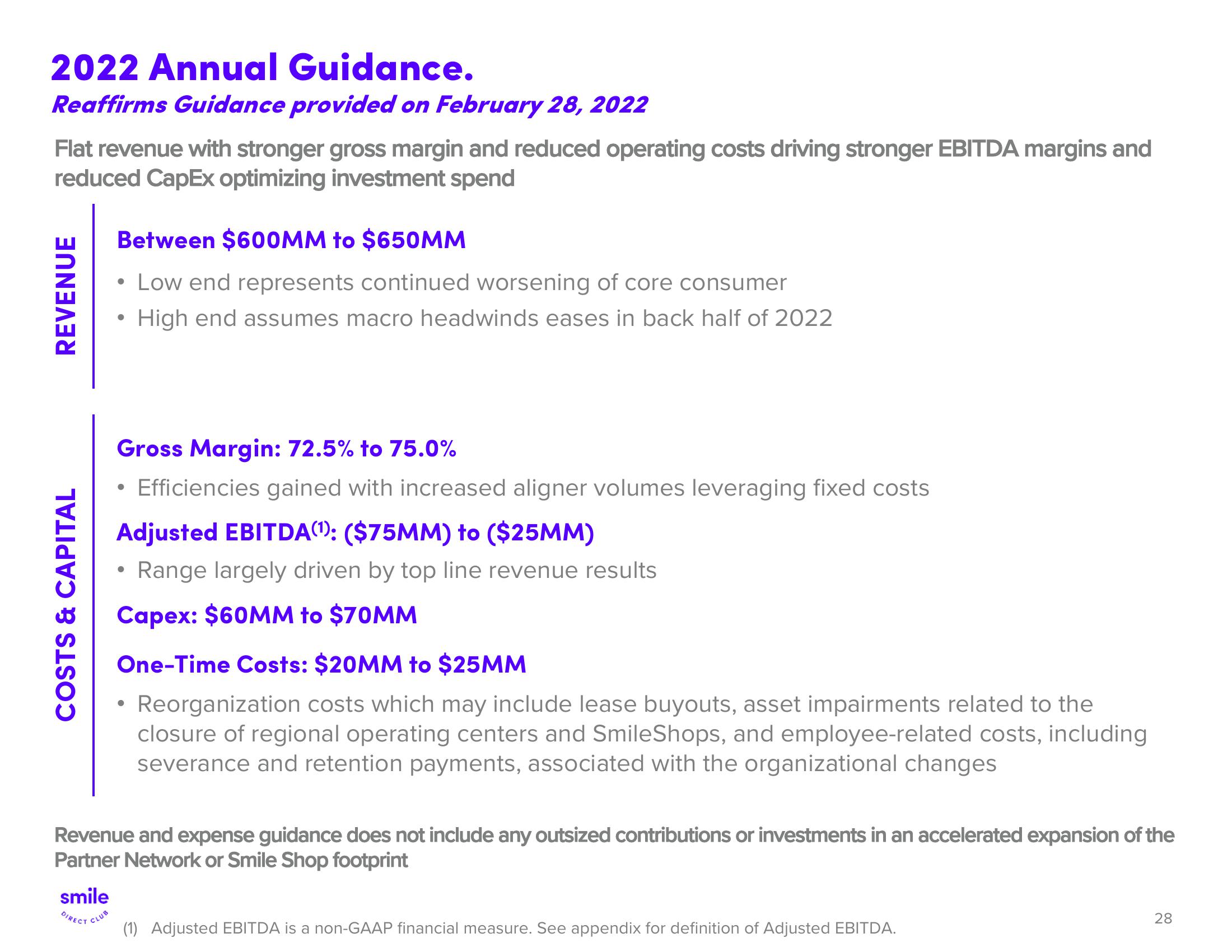

2022 Annual Guidance.

Reaffirms Guidance provided on February 28, 2022

Flat revenue with stronger gross margin and reduced operating costs driving stronger EBITDA margins and

reduced CapEx optimizing investment spend

REVENUE

COSTS & CAPITAL

smile

DIRECT

Between $600MM to $650MM

Low end represents continued worsening of core consumer

High end assumes macro headwinds eases in back half of 2022

CLUB

Gross Margin: 72.5% to 75.0%

Efficiencies gained with increased aligner volumes leveraging fixed costs

Adjusted EBITDA(): ($75MM) to ($25MM)

Range largely driven by top line revenue results

Capex: $60MM to $70MM

One-Time Costs: $20MM to $25MM

Reorganization costs which may include lease buyouts, asset impairments related to the

closure of regional operating centers and SmileShops, and employee-related costs, including

severance and retention payments, associated with the organizational changes

Revenue and expense guidance does not include any outsized contributions or investments in an accelerated expansion of the

Partner Network or Smile Shop footprint

●

(1) Adjusted EBITDA is a non-GAAP financial measure. See appendix for definition of Adjusted EBITDA.

28View entire presentation