Baird Investment Banking Pitch Book

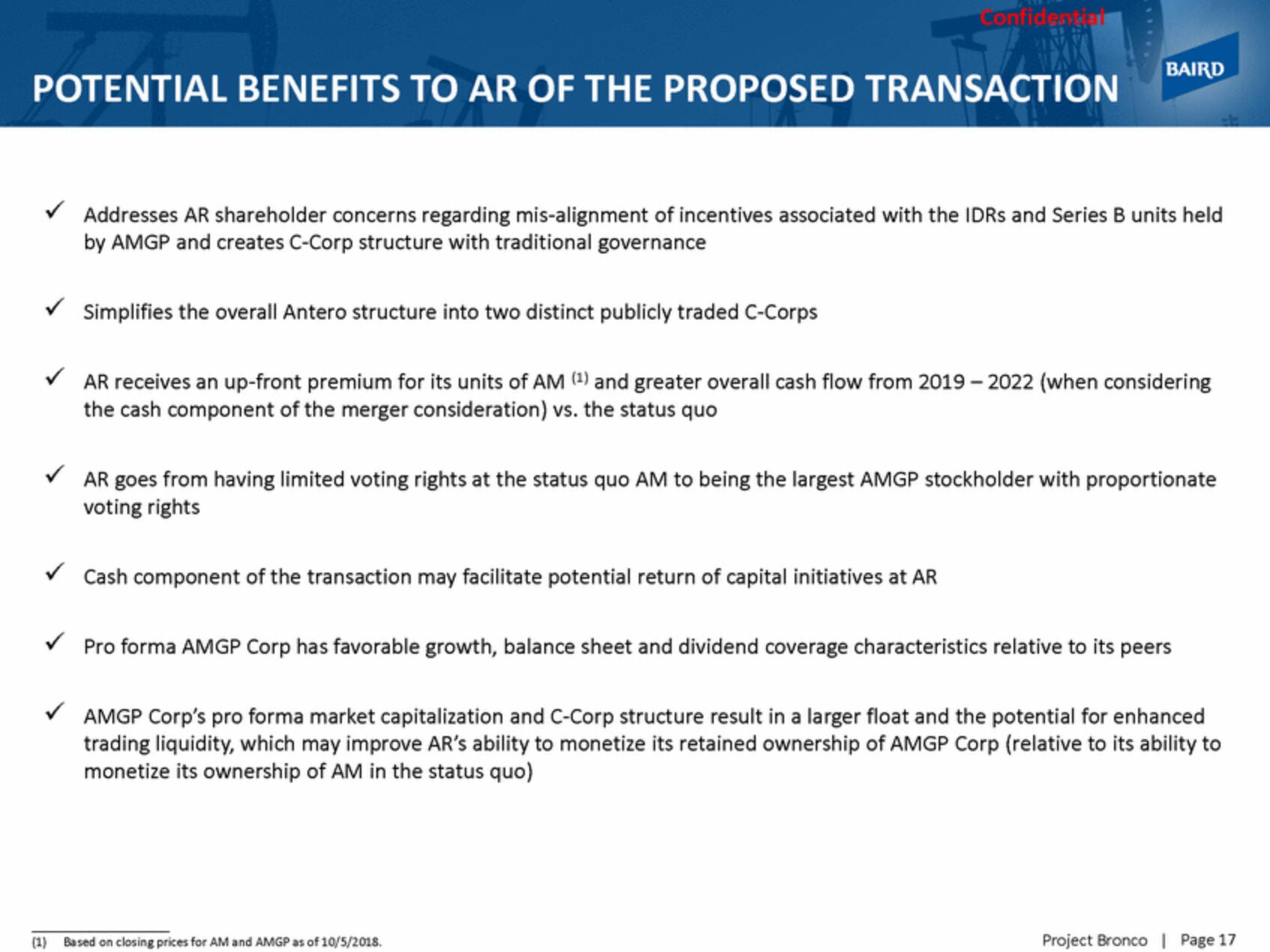

POTENTIAL BENEFITS TO AR OF THE PROPOSED TRANSACTION

Confidential

✓ Simplifies the overall Antero structure into two distinct publicly traded C-Corps

Addresses AR shareholder concerns regarding mis-alignment of incentives associated with the IDRs and Series B units held

by AMGP and creates C-Corp structure with traditional governance

BAIRD

AR receives an up-front premium for its units of AM (¹) and greater overall cash flow from 2019-2022 (when considering

the cash component of the merger consideration) vs. the status quo

✓ AR goes from having limited voting rights at the status quo AM to being the largest AMGP stockholder with proportionate

voting rights

✓ Cash component of the transaction may facilitate potential return of capital initiatives at AR

(1) Based on closing prices for AM and AMGP as of 10/5/2018.

✓ Pro forma AMGP Corp has favorable growth, balance sheet and dividend coverage characteristics relative to its peers

✓ AMGP Corp's pro forma market capitalization and C-Corp structure result in a larger float and the potential for enhanced

trading liquidity, which may improve AR's ability to monetize its retained ownership of AMGP Corp (relative to its ability to

monetize its ownership of AM in the status quo)

Project Bronco | Page 17View entire presentation