Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

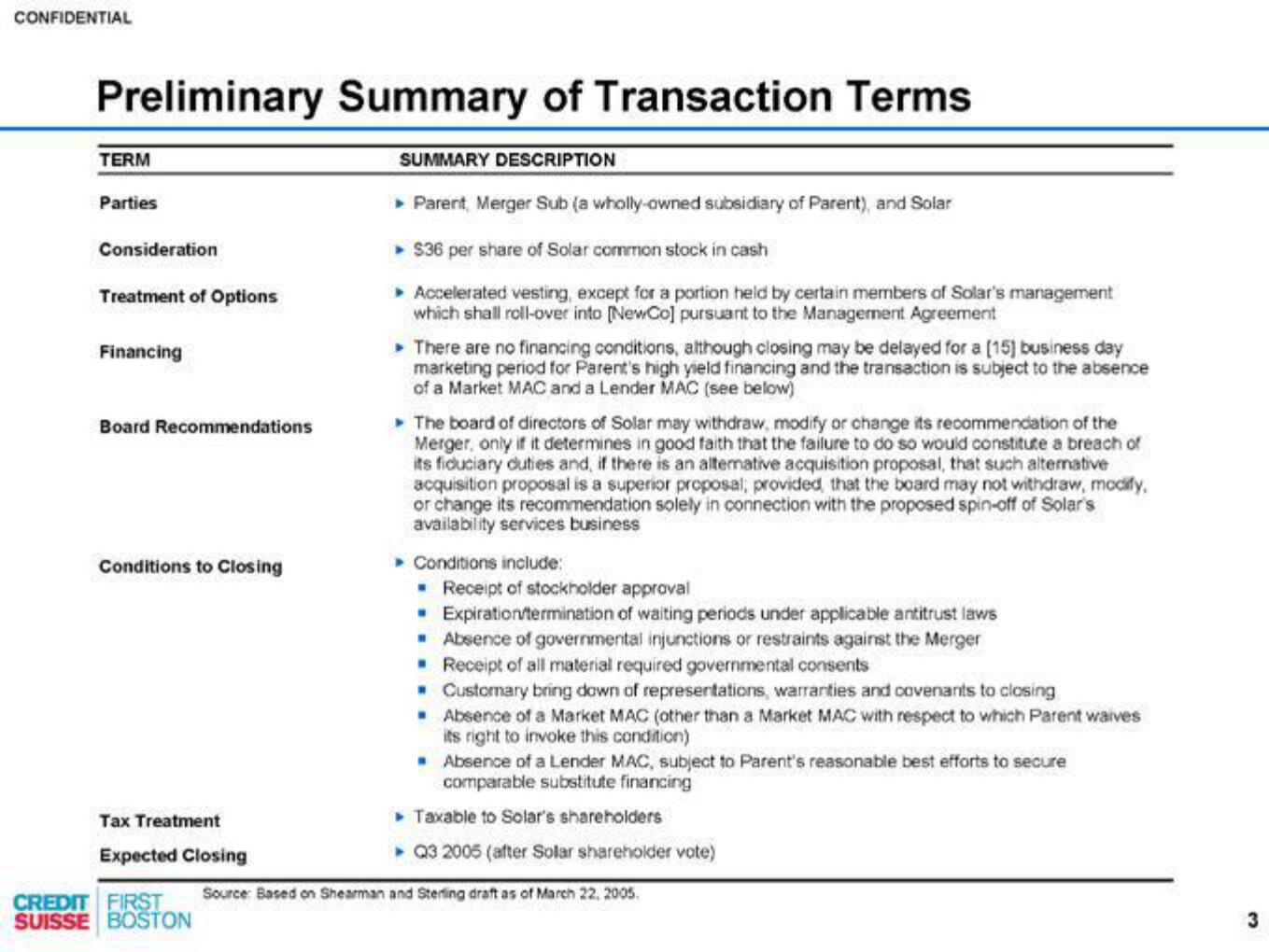

Preliminary Summary of Transaction Terms

SUMMARY DESCRIPTION

▸ Parent, Merger Sub (a wholly-owned subsidiary of Parent), and Solar

► $36 per share of Solar common stock in cash

> Accelerated vesting, except for a portion held by certain members of Solar's management

which shall roll-over into [NewCo] pursuant to the Management Agreement

TERM

Parties

Consideration

Treatment of Options

Financing

Board Recommendations

Conditions to Closing

Tax Treatment

Expected Closing

CREDIT FIRST

SUISSE BOSTON

> There are no financing conditions, although closing may be delayed for a [15] business day

marketing period for Parent's high yield financing and the transaction is subject to the absence

of a Market MAC and a Lender MAC (see below)

The board of directors of Solar may withdraw, modify or change its recommendation of the

Merger, only if it determines in good faith that the failure to do so would constitute a breach of

its fiduciary duties and, if there is an alternative acquisition proposal, that such alternative

acquisition proposal is a superior proposal, provided that the board may not withdraw, modify,

or change its recommendation solely in connection with the proposed spin-off of Solar's

availability services business

▸ Conditions include:

▪ Receipt of stockholder approval

☐ Expiration/termination of waiting periods under applicable antitrust laws

W Absence of governmental injunctions or restraints against the Merger

. Receipt of all material required governmental consents

Customary bring down of representations, warranties and covenants to closing

Absence of a Market MAC (other than a Market MAC with respect to which Parent waives

its right to invoke this condition)

.

.

• Absence of a Lender MAC, subject to Parent's reasonable best efforts to secure

comparable substitute financing

▸ Taxable to Solar's shareholders

► Q3 2005 (after Solar shareholder vote)

Source: Based on Shearman and Sterling draft as of March 22, 2005.

3View entire presentation