Affirm Results Presentation Deck

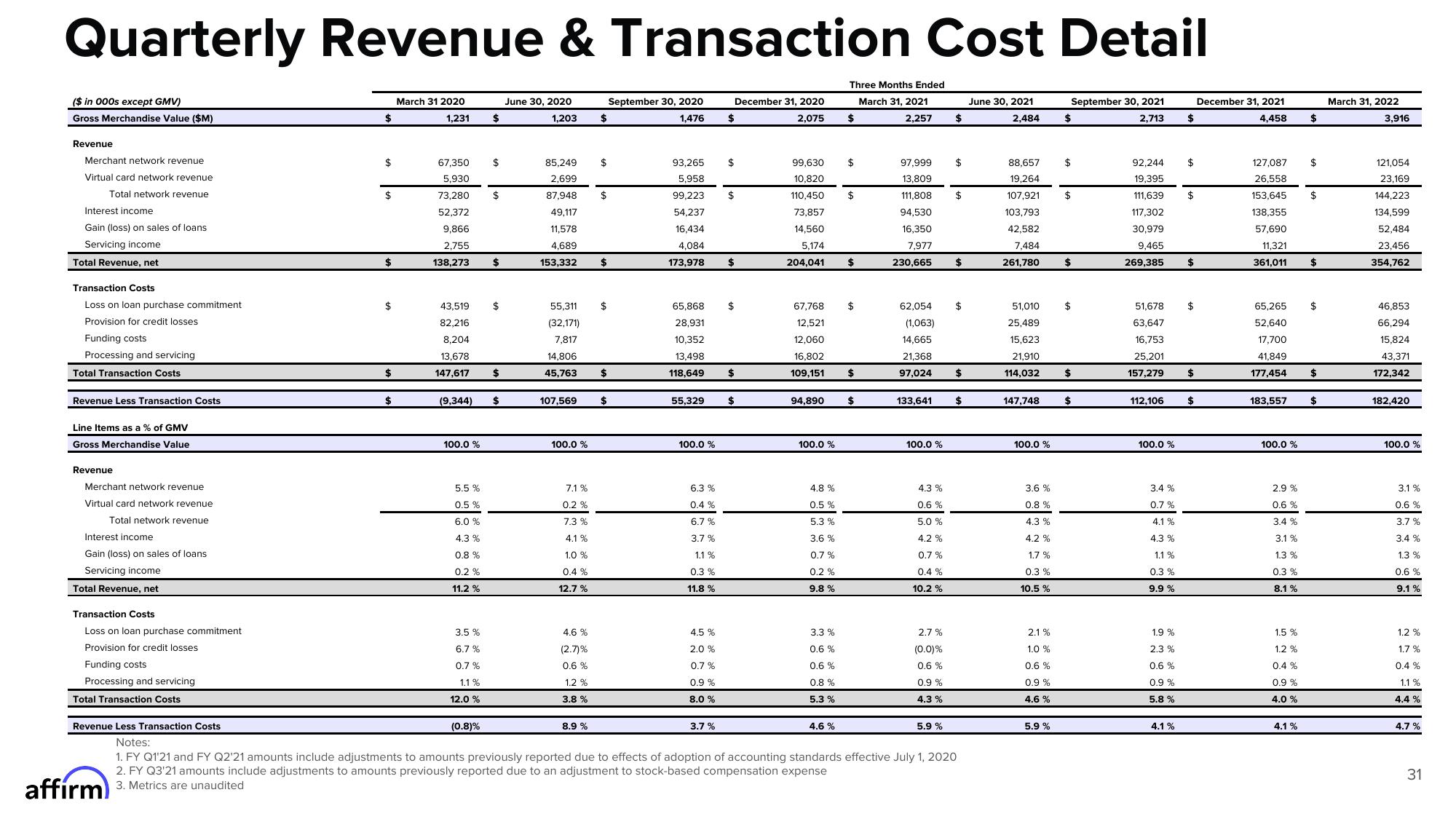

Quarterly Revenue & Transaction Cost Detail

December 31, 2020

2,075

June 30, 2021

2,484

($ in 000s except GMV)

Gross Merchandise Value ($M)

Revenue

Merchant network revenue

Virtual card network revenue

Total network revenue

Interest income

Gain (loss) on sales of loans

Servicing income

Total Revenue, net

Transaction Costs

Loss on loan purchase commitment

Provision for credit losses

Funding costs

Processing and servicing

Total Transaction Costs

Revenue Less Transaction Costs

Line Items as a % of GMV

Gross Merchandise Value

Revenue

Merchant network revenue

Virtual card network revenue

Total network revenue

Interest income

Gain (loss) on sales of loans

Servicing income

Total Revenue, net

Transaction Costs

Loss on loan purchase commitment

Provision for credit losses.

Funding costs

Processing and servicing

Total Transaction Costs

$

affirm) 3. Metrics are unaudited

$

$

$

$

$

$

March 31 2020

1,231

67,350

5,930

73,280

52,372

9,866

2,755

138,273

(9,344)

100.0 %

5.5 %

0.5%

6.0 %

4.3 %

0.8%

0.2 %

11.2 %

43,519 $

82,216

8,204

13,678

147,617 $

3.5 %

6.7 %

0.7%

1.1 %

12.0%

$

(0.8)%

$

$

$

$

June 30, 2020

1,203 $

85,249

2,699

87,948

49,117

11,578

4,689

153,332

55,311

(32,171)

7,817

14,806

45,763

107,569

100.0 %

7.1%

0.2 %

7.3 %

4.1%

1.0 %

0.4 %

12.7 %

4.6 %

(2.7)%

0.6 %

1.2 %

3.8 %

8.9 %

$

$

$

September 30, 2020

1,476

$

$

$

93,265

5,958

99,223

54,237

16,434

4,084

173,978

65,868

28,931

10,352

13,498

118,649

55,329

100.0 %

6.3 %

0.4 %

6.7 %

3.7 %

1.1 %

0.3%

11.8%

4.5 %

2.0 %

0.7%

0.9 %

8.0 %

3.7%

$

$

$

$

$

$

$

67,768

12,521

12,060

16,802

109,151

99,630

10,820

110,450

73,857

14,560

5,174

204,041 $

94,890

100.0 %

4.8 %

0.5 %

5.3 %

3.6 %

0.7%

0.2 %

9.8 %

3.3 %

0.6 %

0.6 %

0.8 %

5.3%

Three Months Ended

March 31, 2021

4.6 %

$

$

$

$

$

$

2,257 $

97,999

13,809

111,808

94,530

16,350

7,977

230,665

62,054 $

(1,063)

14,665

21,368

97,024 $

100.0 %

Revenue Less Transaction Costs

Notes:

1. FY Q1'21 and FY Q2'21 amounts include adjustments to amounts previously reported due to effects of adoption of accounting standards effective July 1, 2020

2. FY Q3'21 amounts include adjustments to amounts previously reported due to an adjustment to stock-based compensation expense

133,641 $

4.3 %

0.6 %

5.0 %

4.2 %

0.7 %

0.4 %

10.2 %

$

2.7%

(0.0)%

0.6 %

0.9 %

4.3 %

$

5.9 %

88,657

19,264

107,921

103,793

42,582

7,484

261,780

51,010

25,489

15,623

21,910

114,032

147,748

100.0 %

3.6 %

0.8%

4.3 %

4.2 %

1.7 %

0.3 %

10.5 %

2.1%

1.0 %

0.6 %

0.9 %

4.6%

5.9 %

September 30, 2021

2,713

$

$

$

$

$

$

92,244

19,395

111,639

117,302

30,979

9,465

269,385

51,678

63,647

16,753

25,201

157,279

112,106

100.0 %

3.4 %

0.7 %

4.1 %

4.3 %

1.1 %

0.3%

9.9 %

1.9 %

2.3 %

0.6 %

0.9 %

5.8 %

4.1 %

$

$

$

$

$

$

$

December 31, 2021

4,458

127,087

26,558

153,645

138,355

57,690

11,321

361,011

65,265

52,640

17,700

41,849

177,454

183,557

100.0 %

2.9 %

0.6 %

3.4 %

3.1 %

1.3 %

0.3 %

8.1 %

1.5 %

1.2 %

0.4 %

0.9 %

4.0 %

4.1 %

$

$

$

$

$

$

$

March 31, 2022

3,916

121,054

23,169

144,223

134,599

52,484

23,456

354,762

46,853

66,294

15,824

43,371

172,342

182,420

100.0 %

3.1 %

0.6 %

3.7 %

3.4 %

1.3 %

0.6 %

9.1 %

1.2 %

1.7 %

0.4 %

1.1 %

4.4 %

4.7%

31View entire presentation