Grab SPAC Presentation Deck

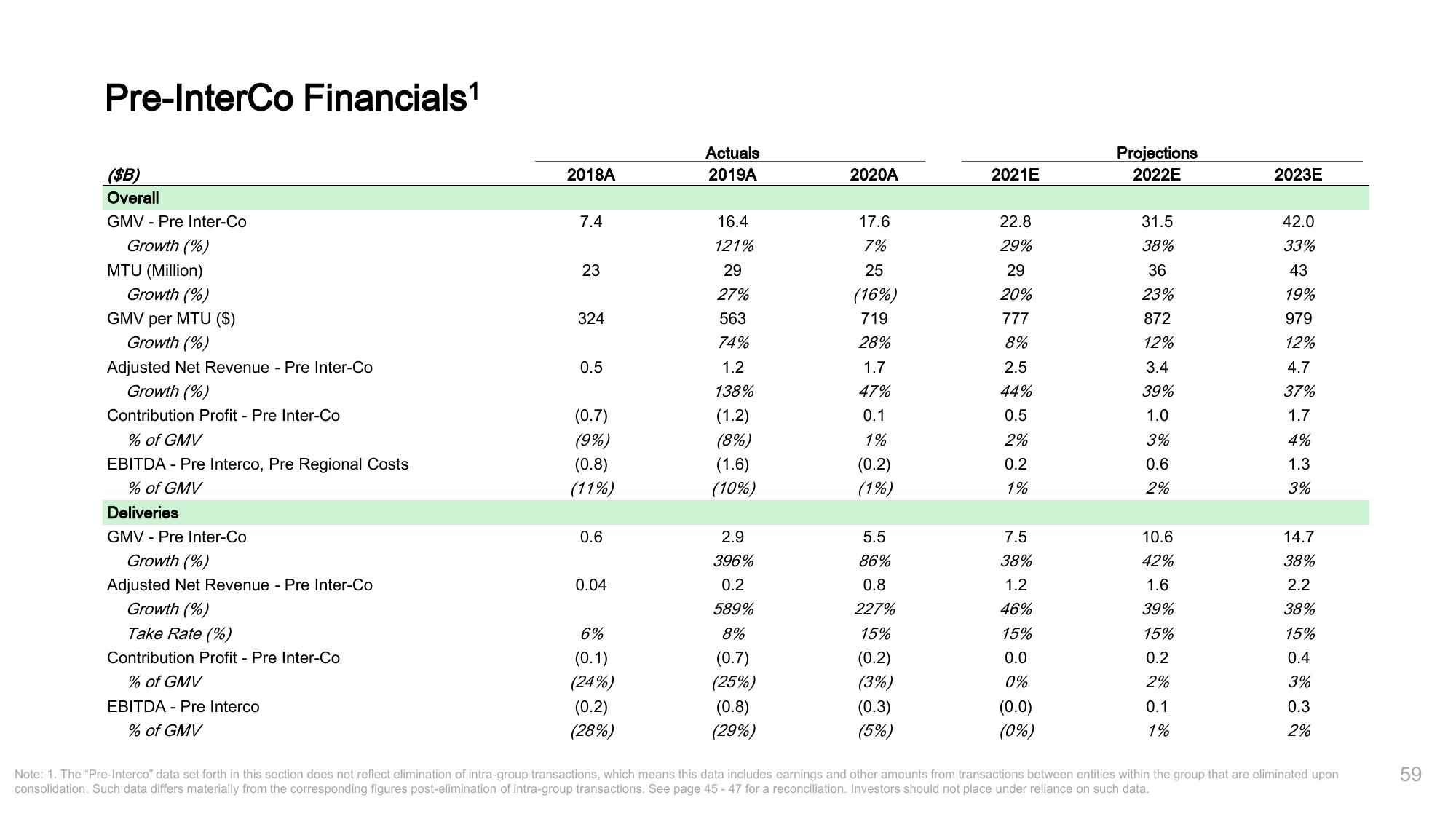

Pre-InterCo Financials¹

($B)

Overall

GMV Pre Inter-Co

Growth (%)

MTU (Million)

Growth (%)

GMV per MTU ($)

Growth (%)

Adjusted Net Revenue - Pre Inter-Co

Growth (%)

Contribution Profit - Pre Inter-Co

% of GMV

EBITDA - Pre Interco, Pre Regional Costs

% of GMV

Deliveries

GMV Pre Inter-Co

Growth (%)

Adjusted Net Revenue - Pre Inter-Co

Growth (%)

Take Rate (%)

Contribution Profit - Pre Inter-Co

% of GMV

EBITDA - Pre Interco

% of GMV

2018A

7.4

23

324

0.5

(0.7)

(9%)

(0.8)

(11%)

0.6

0.04

6%

(0.1)

(24%)

(0.2)

(28%)

Actuals

2019A

16.4

121%

29

27%

563

74%

1.2

138%

(1.2)

(8%)

(1.6)

(10%)

2.9

396%

0.2

589%

8%

(0.7)

(25%)

(0.8)

(29%)

2020A

17.6

7%

25

(16%)

719

28%

1.7

47%

0.1

1%

(0.2)

(1%)

5.5

86%

0.8

227%

15%

(0.2)

(3%)

(0.3)

(5%)

2021E

22.8

29%

29

20%

777

8%

2.5

44%

0.5

2%

0.2

1%

7.5

38%

1.2

46%

15%

0.0

0%

(0.0)

(0%)

Projections

2022E

31.5

38%

36

23%

872

12%

3.4

39%

1.0

3%

0.6

2%

10.6

42%

1.6

39%

15%

0.2

2%

0.1

1%

2023E

42.0

33%

43

19%

979

12%

4.7

37%

1.7

4%

1.3

3%

14.7

38%

2.2

38%

15%

0.4

3%

0.3

2%

Note: 1. The "Pre-Interco" data set forth in this section does not reflect elimination of intra-group transactions, which means this data includes earnings and other amounts from transactions between entities within the group that are eliminated upon

consolidation. Such data differs materially from the corresponding figures post-elimination of intra-group transactions. See page 45-47 for a reconciliation. Investors should not place under reliance on such data.

59View entire presentation