Embracer Group Results Presentation Deck

EARNOUTS AND APM UPDATE

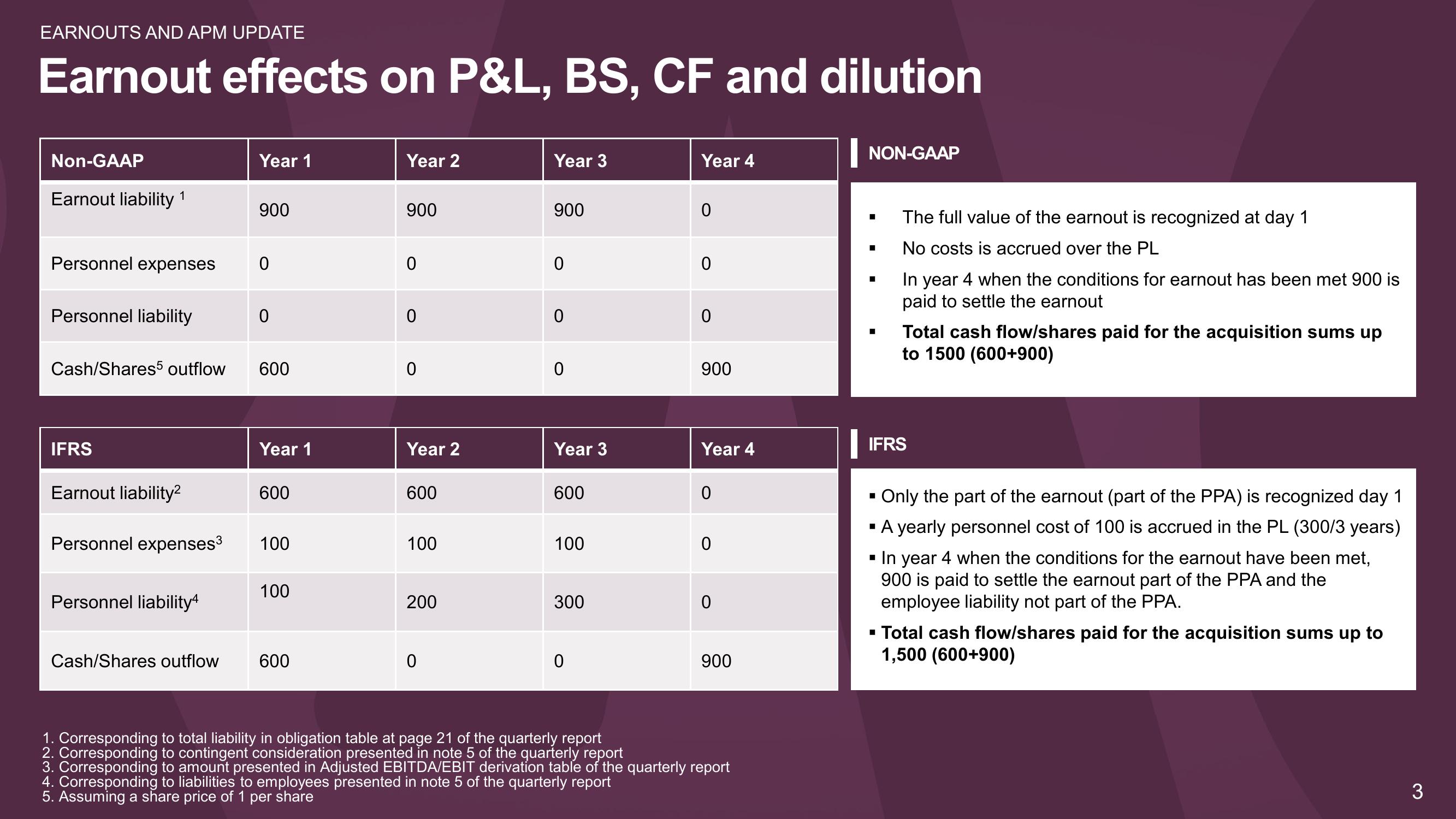

Earnout effects on P&L, BS, CF and dilution

Non-GAAP

Earnout liability 1

Cash/Shares5 outflow

Personnel expenses 0

Personnel liability

IFRS

Earnout liability²

Personnel expenses³

Personnel liability4

Year 1

Cash/Shares outflow

900

0

600

Year 1

600

100

100

600

Year 2

900

0

0

0

Year 2

600

100

200

0

Year 3

900

0

0

0

Year 3

600

100

300

0

Year 4

0

0

0

900

Year 4

0

0

0

900

1. Corresponding to total liability in obligation table at page 21 of the quarterly report

2. Corresponding to contingent consideration presented in note 5 of the quarterly report

3. Corresponding to amount presented in Adjusted EBITDA/EBIT derivation table of the quarterly report

4. Corresponding to liabilities to employees presented in note 5 of the quarterly report

5. Assuming a share price of 1 per share

NON-GAAP

The full value of the earnout is recognized at day 1

No costs is accrued over the PL

In year 4 when the conditions for earnout has been met 900 is

paid to settle the earnout

I

Total cash flow/shares paid for the acquisition sums up

to 1500 (600+900)

IFRS

Only the part of the earnout (part of the PPA) is recognized day 1

A yearly personnel cost of 100 is accrued in the PL (300/3 years)

▪ In year 4 when the conditions for the earnout have been met,

900 is paid to settle the earnout part of the PPA and the

employee liability not part of the PPA.

▪ Total cash flow/shares paid for the acquisition sums up to

1,500 (600+900)

3View entire presentation