Main Street Capital Investor Day Presentation Deck

Alignment of Interests Between

MAIN Management and MAIN Investors

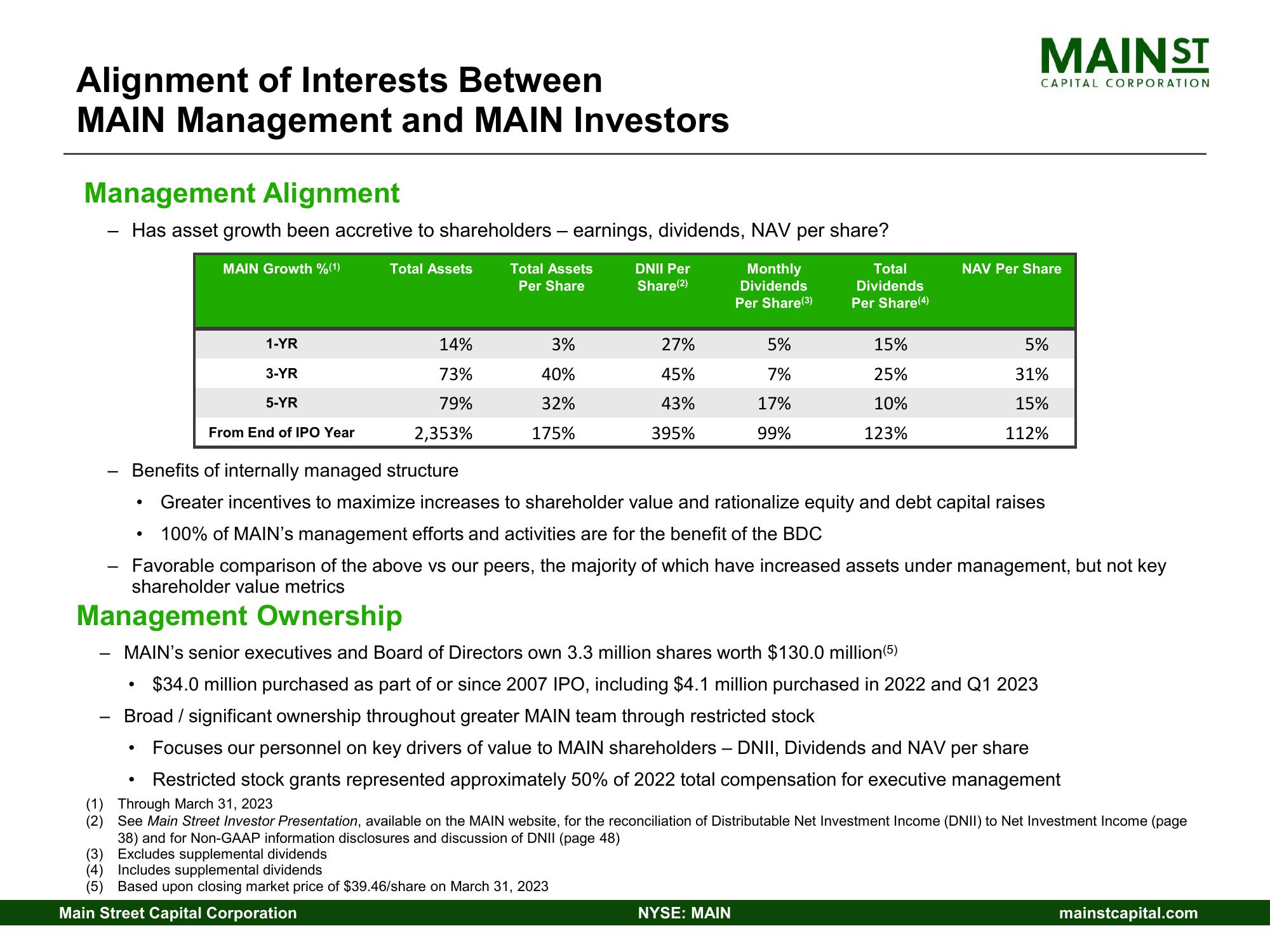

Management Alignment

Has asset growth been accretive to shareholders - earnings, dividends, NAV per share?

MAIN Growth %(1)

●

1-YR

3-YR

5-YR

From End of IPO Year

●

Total Assets

14%

73%

79%

2,353%

Total Assets

Per Share

3%

40%

32%

175%

DNII Per

Share(2)

27%

45%

43%

395%

Monthly

Dividends

Per Share (3)

5%

7%

17%

99%

Total

Dividends

Per Share (4)

NYSE: MAIN

15%

25%

10%

123%

MAINST

CAPITAL CORPORATION

Benefits of internally managed structure

Greater incentives to maximize increases to shareholder value and rationalize equity and debt capital raises

•100% of MAIN's management efforts and activities are for the benefit of the BDC

Favorable comparison of the above vs our peers, the majority of which have increased assets under management, but not key

shareholder value metrics

Management Ownership

MAIN's senior executives and Board of Directors own 3.3 million shares worth $130.0 million (5)

NAV Per Share

$34.0 million purchased as part of or since 2007 IPO, including $4.1 million purchased in 2022 and Q1 2023

Broad / significant ownership throughout greater MAIN team through restricted stock

Focuses our personnel on key drivers of value to MAIN shareholders - DNII, Dividends and NAV per share

Restricted stock grants represented approximately 50% of 2022 total compensation for executive management

(1) Through March 31, 2023

(2)

5%

31%

15%

112%

See Main Street Investor Presentation, available on the MAIN website, for the reconciliation of Distributable Net Investment Income (DNII) to Net Investment Income (page

38) and for Non-GAAP information disclosures and discussion of DNII (page 48)

(3) Excludes supplemental dividends

(4) Includes supplemental dividends

(5) Based upon closing market price of $39.46/share on March 31, 2023

Main Street Capital Corporation

mainstcapital.comView entire presentation