HBT Financial Results Presentation Deck

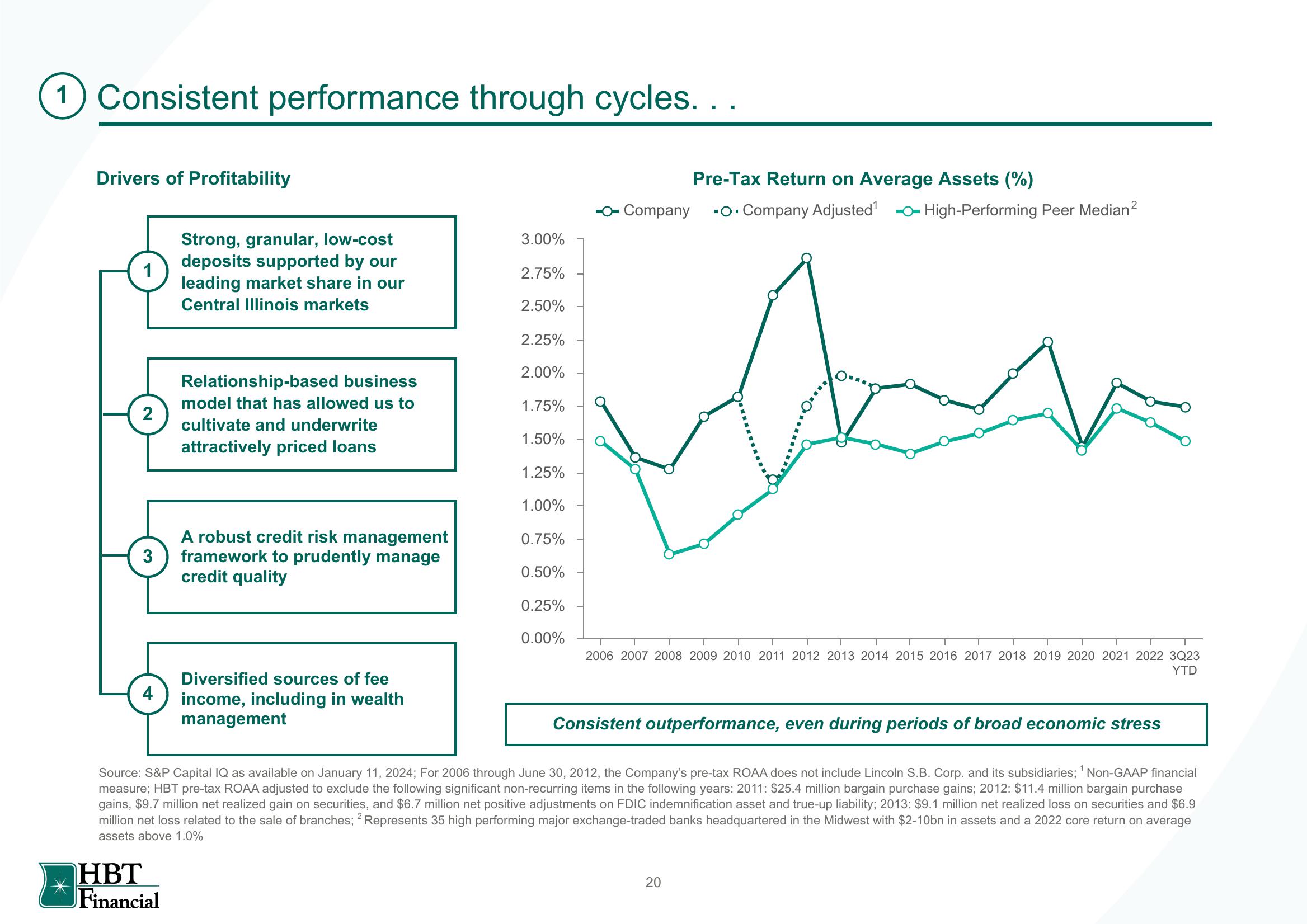

1) Consistent performance through cycles. . .

Drivers of Profitability

1

2

3

4

Strong, granular, low-cost

deposits supported by our

leading market share in our

Central Illinois markets

HBT

Financial

Relationship-based business

model that has allowed us to

cultivate and underwrite

attractively priced loans

A robust credit risk management

framework to prudently manage

credit quality

Diversified sources of fee

income, including in wealth

management

3.00%

2.75%

2.50%

2.25%

2.00%

1.75%

1.50%

1.25%

1.00%

0.75%

0.50%

0.25%

0.00%

Pre-Tax Return on Average Assets (%)

-- Company ▪O. Company Adjusted¹ - High-Performing Peer Median²

han

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 3Q23

YTD

Consistent outperformance, even during periods of broad economic stress

Source: S&P Capital IQ as available on January 11, 2024; For 2006 through June 30, 2012, the Company's pre-tax ROAA does not include Lincoln S.B. Corp. and its subsidiaries; Non-GAAP financial

measure; HBT pre-tax ROAA adjusted to exclude the following significant non-recurring items in the following years: 2011: $25.4 million bargain purchase gains; 2012: $11.4 million bargain purchase

gains, $9.7 million net realized gain on securities, and $6.7 million net positive adjustments on FDIC indemnification asset and true-up liability; 2013: $9.1 million net realized loss on securities and $6.9

million net loss related to the sale of branches; 2 Represents 35 high performing major exchange-traded banks headquartered in the Midwest with $2-10bn in assets and a 2022 core return on average

assets above 1.0%

1

20View entire presentation