Telia Company Results Presentation Deck

Operational free cash flow

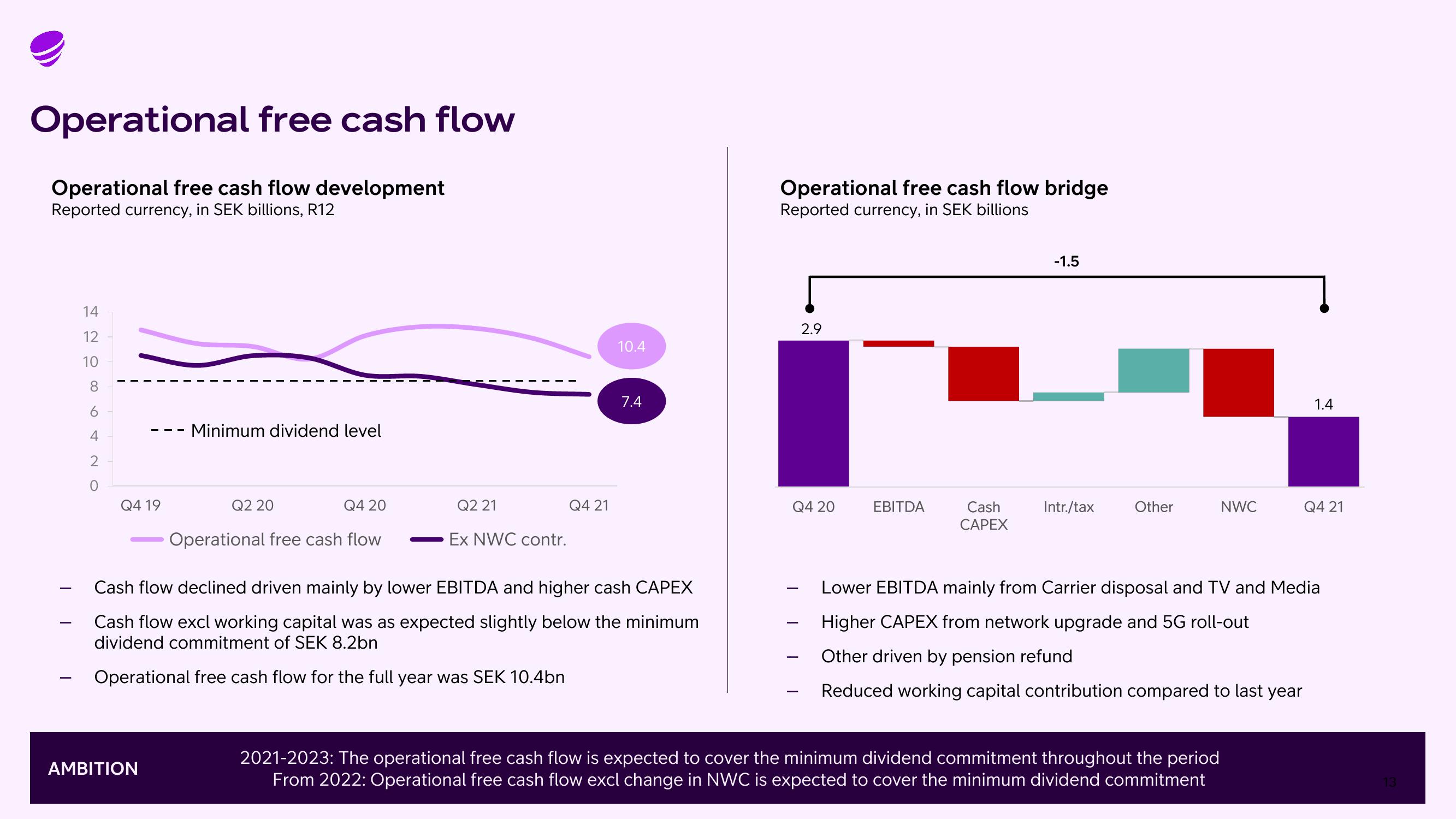

Operational free cash flow development

Reported currency, in SEK billions, R12

14

12

10

8

6

4

2

0

Q4 19

Minimum dividend level

AMBITION

Q2 20

Q4 20

Operational free cash flow

Q2 21

Ex NWC contr.

Q4 21

10.4

7.4

Cash flow declined driven mainly by lower EBITDA and higher cash CAPEX

Cash flow excl working capital was as expected slightly below the minimum

dividend commitment of SEK 8.2bn

Operational free cash flow for the full year was SEK 10.4bn

Operational free cash flow bridge

Reported currency, in SEK billions

2.9

Q4 20

-

EBITDA

Cash

CAPEX

-1.5

Intr./tax

Other

NWC

2021-2023: The operational free cash flow is expected to cover the minimum dividend commitment throughout the period

From 2022: Operational free cash flow excl change in NWC is expected to cover the minimum dividend commitment

1.4

Q4 21

Lower EBITDA mainly from Carrier disposal and TV and Media

Higher CAPEX from network upgrade and 5G roll-out

Other driven by pension refund

Reduced working capital contribution compared to last year

13View entire presentation