Baird Investment Banking Pitch Book

EARN-OUT ACCELERATION PRICING RECOMMENDATION

14%

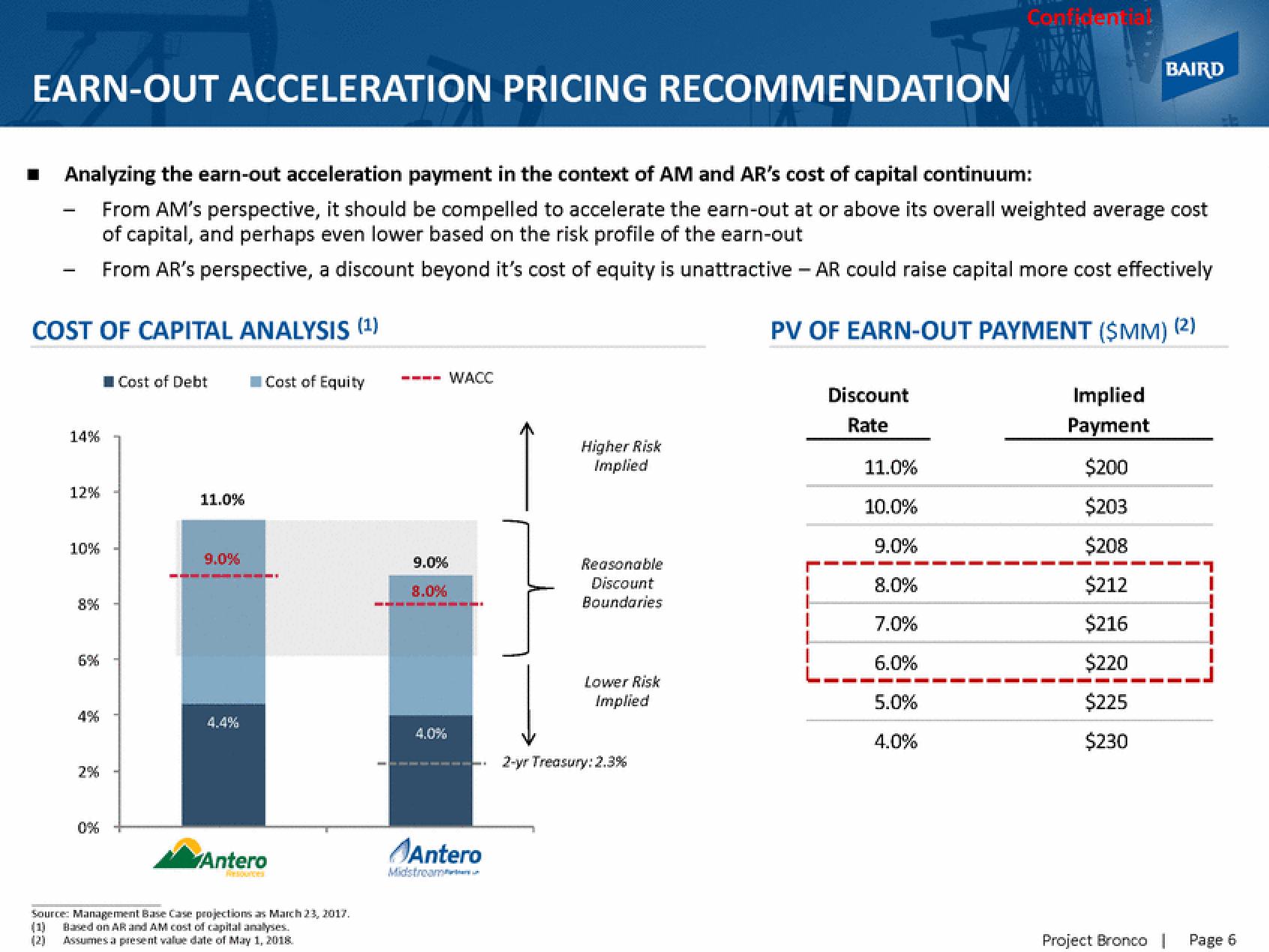

■ Analyzing the earn-out acceleration payment in the context of AM and AR's cost of capital continuum:

From AM's perspective, it should be compelled to accelerate the earn-out at or above its overall weighted average cost

of capital, and perhaps even lower based on the risk profile of the earn-out

From AR's perspective, a discount beyond it's cost of equity is unattractive - AR could raise capital more cost effectively

COST OF CAPITAL ANALYSIS (¹)

PV OF EARN-OUT PAYMENT (SMM) (2)

12%

10%

8%

6%

4%

2%

0%

Cost of Debt

11.0%

9.0%

Cost of Equity

▬ ▬ KANE DE A MAI

4.4%

Antero

Source: Management Base Case projections as March 23, 2017.

(1) Based on AR and AM cost of capital analyses.

(2) Assumes a present value date of May 1, 2018

9.0%

8.0%

4.0%

WACC

Antero

Midstreamtare un

Higher Risk

Implied

Reasonable

Discount

Boundaries

Lower Risk

Implied

2-yr Treasury: 2.3%

I

L

I

Discount

Rate

11.0%

10.0%

Confidential

9.0%

8.0%

7.0%

6.0%

5.0%

4.0%

Implied

Payment

$200

$203

$208

$212

$216

$220

$225

$230

BAIRD

Project Bronco

Page 6View entire presentation