Silicon Valley Bank Results Presentation Deck

Enhance client

experience

●

●

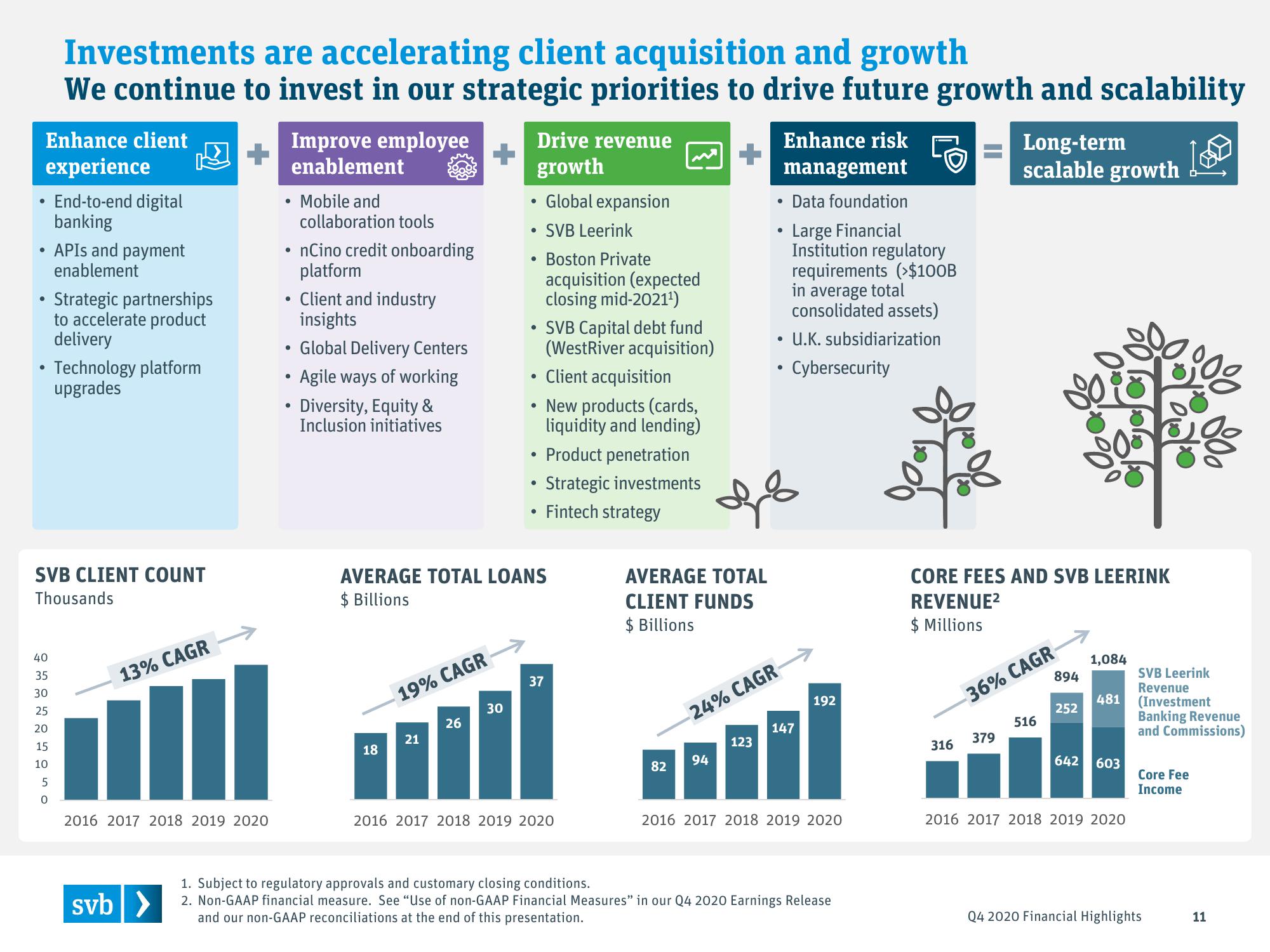

Investments are accelerating client acquisition and growth

We continue to invest in our strategic priorities to drive future growth and scalability

+

40

35

30

25

20

15

10

5

0

End-to-end digital

banking

APIs and payment

enablement

Strategic partnerships

to accelerate product

delivery

Technology platform

upgrades

SVB CLIENT COUNT

Thousands

13% CAGR

2016 2017 2018 2019 2020

svb >

Improve employee

enablement

●

●

●

●

●

Mobile and

collaboration tools

nCino credit onboarding

platform

Client and industry

insights

Global Delivery Centers

Agile ways of working

Diversity, Equity &

Inclusion initiatives

18

19% CAGR

21

26

Drive revenue

growth

Global expansion

SVB Leerink

30

●

●

• Boston Private

acquisition (expected

closing mid-2021¹)

SVB Capital debt fund

(WestRiver acquisition)

●

AVERAGE TOTAL LOANS

$ Billions

●

●

• Strategic investments

Fintech strategy

●

Client acquisition

New products (cards,

liquidity and lending)

Product penetration

37

2016 2017 2018 2019 2020

AVERAGE TOTAL

CLIENT FUNDS

$ Billions

82

94

Enhance risk

management

●

123

.

дв

●

●

-24% CAGR

Data foundation

Large Financial

Institution regulatory

requirements (>$100B

in average total

consolidated assets)

U.K. subsidiarization

Cybersecurity

147

192

2016 2017 2018 2019 2020

1. Subject to regulatory approvals and customary closing conditions.

2. Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q4 2020 Earnings Release

and our non-GAAP reconciliations at the end of this presentation.

CORE FEES AND SVB LEERINK

REVENUE²

$ Millions

316

Long-term

scalable growth

379

-36% CAGR

894

516

252

642

1,084

SVB Leerink

Revenue

481 (Investment

603

2016 2017 2018 2019 2020

Banking Revenue

and Commissions)

Core Fee

Income

Q4 2020 Financial Highlights

11View entire presentation