Evercore Investment Banking Pitch Book

SIRE Situation Analysis

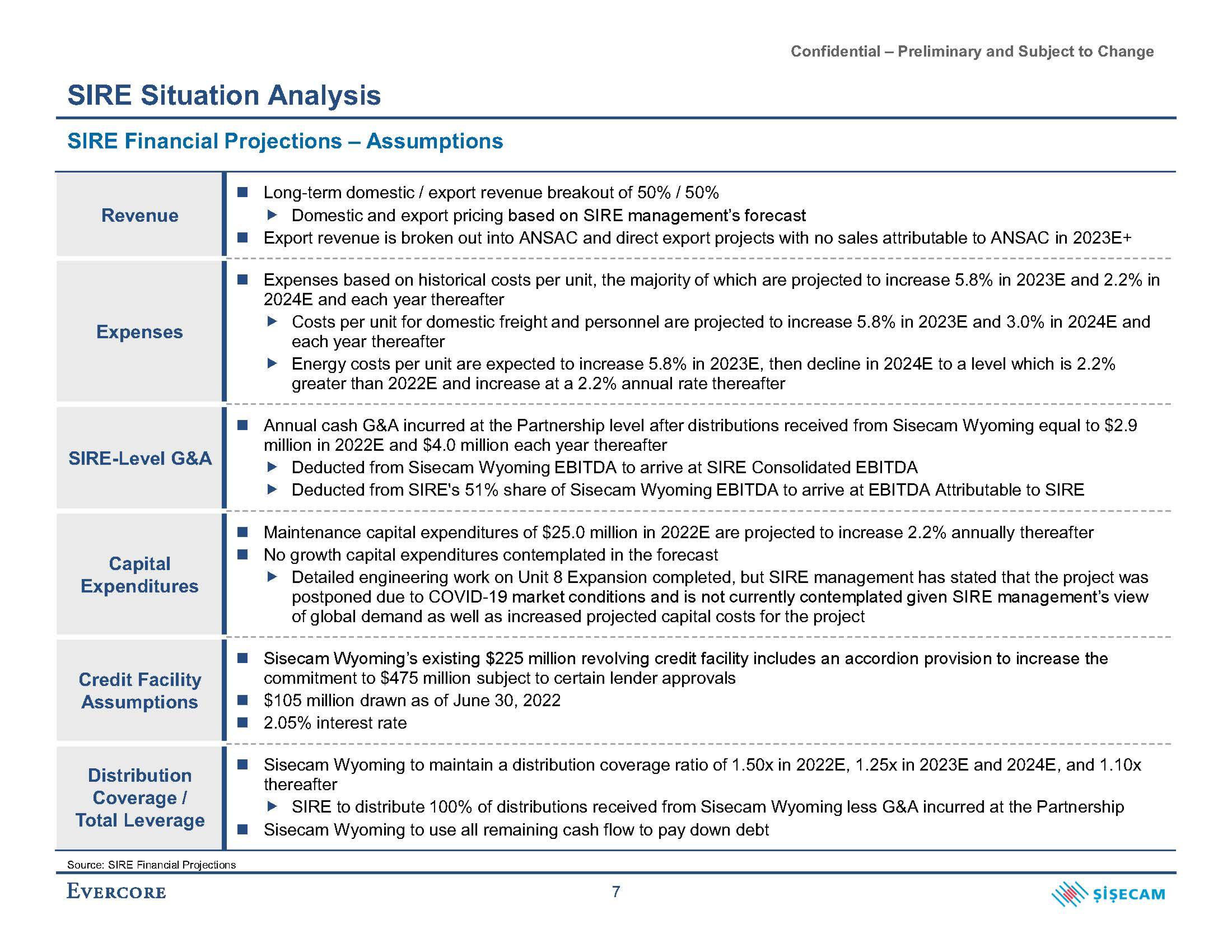

SIRE Financial Projections - Assumptions

Revenue

Expenses

SIRE-Level G&A

Capital

Expenditures

Credit Facility

Assumptions

Distribution

Coverage /

Total Leverage

■

Source: SIRE Financial Projections

EVERCORE

Confidential - Preliminary and Subject to Change

Long-term domestic / export revenue breakout of 50% / 50%

► Domestic and export pricing based on SIRE management's forecast

Export revenue is broken out into ANSAC and direct export projects with no sales attributable to ANSAC in 2023E+

Expenses based on historical costs per unit, the majority of which are projected to increase 5.8% in 2023E and 2.2% in

2024E and each year thereafter

►

Costs per unit for domestic freight and personnel are projected to increase 5.8% in 2023E and 3.0% in 2024E and

each year thereafter

►

Energy costs per unit are expected to increase 5.8% in 2023E, then decline in 2024E to a level which is 2.2%

greater than 2022E and increase at a 2.2% annual rate thereafter

Annual cash G&A incurred at the Partnership level after distributions received from Sisecam Wyoming equal to $2.9

million in 2022E and $4.0 million each year thereafter

Deducted from Sisecam Wyoming EBITDA to arrive at SIRE Consolidated EBITDA

► Deducted from SIRE's 51% share of Sisecam Wyoming EBITDA to arrive at EBITDA Attributable to SIRE

■ Sisecam Wyoming's existing $225 million revolving credit facility includes an accordion provision to increase the

commitment to $475 million subject to certain lender approvals

$105 million drawn as of June 30, 2022

2.05% interest rate

Maintenance capital expenditures of $25.0 million in 2022E are projected to increase 2.2% annually thereafter

No growth capital expenditures contemplated in the forecast

► Detailed engineering work on Unit 8 Expansion completed, but SIRE management has stated that the project was

postponed due to COVID-19 market conditions and is not currently contemplated given SIRE management's view

of global demand as well as increased projected capital costs for the project

Sisecam Wyoming to maintain a distribution coverage ratio of 1.50x in 2022E, 1.25x in 2023E and 2024E, and 1.10x

thereafter

SIRE to distribute 100% of distributions received from Sisecam Wyoming less G&A incurred at the Partnership

Sisecam Wyoming to use all remaining cash flow to pay down debt

7

ŞİŞECAMView entire presentation