LSE Mergers and Acquisitions Presentation Deck

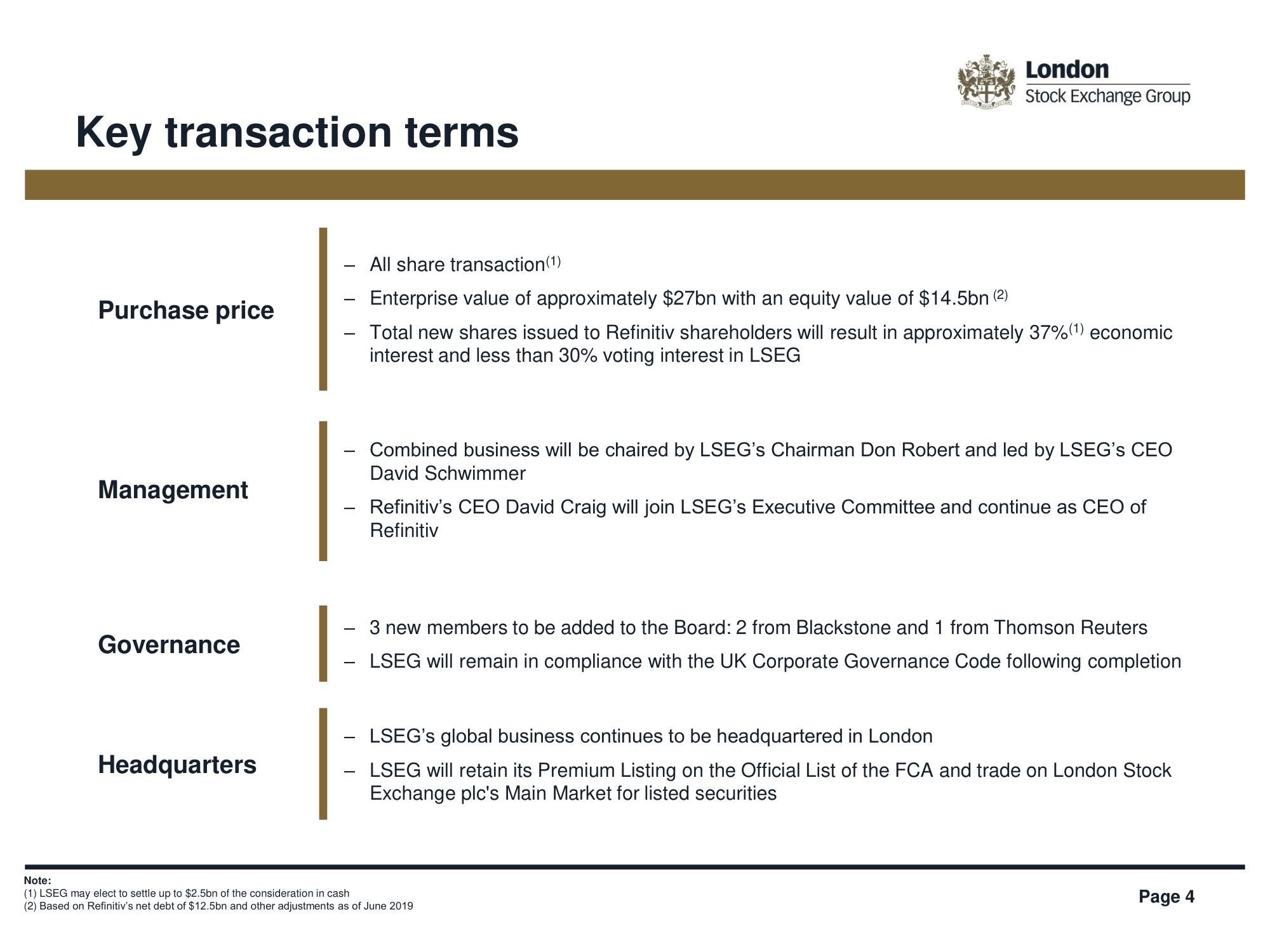

Key transaction terms

Purchase price

Management

Governance

Headquarters

London

Stock Exchange Group

All share transaction (1)

Enterprise value of approximately $27bn with an equity value of $14.5bn (²)

Total new shares issued to Refinitiv shareholders will result in approximately 37% (1) economic

interest and less than 30% voting interest in LSEG

Combined business will be chaired by LSEG's Chairman Don Robert and led by LSEG's CEO

David Schwimmer

Refinitiv's CEO David Craig will join LSEG's Executive Committee and continue as CEO of

Refinitiv

3 new members to be added to the Board: 2 from Blackstone and 1 from Thomson Reuters

LSEG will remain in compliance with the UK Corporate Governance Code following completion

LSEG's global business continues to be headquartered in London

LSEG will retain its Premium Listing on the Official List of the FCA and trade on London Stock

Exchange plc's Main Market for listed securities

Note:

(1) LSEG may elect to settle up to $2.5bn of the consideration in cash

(2) Based on Refinitiv's net debt of $12.5bn and other adjustments as of June 2019

Page 4View entire presentation