AeroFarms SPAC Presentation Deck

Transaction Overview

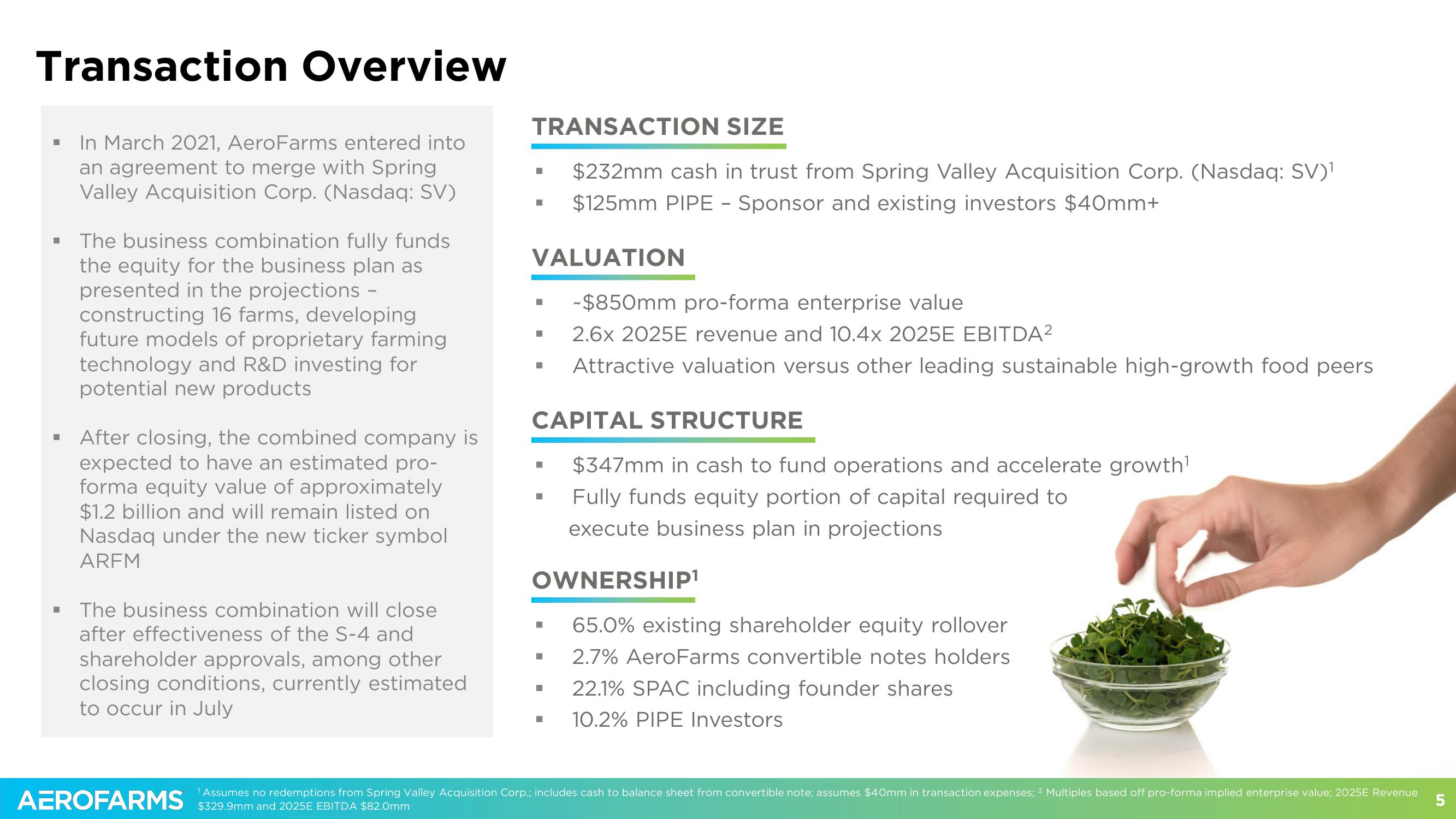

In March 2021, AeroFarms entered into

an agreement to merge with Spring

Valley Acquisition Corp. (Nasdaq: SV)

■

■

■

■

The business combination fully funds

the equity for the business plan as

presented in the projections -

constructing 16 farms, developing

future models of proprietary farming

technology and R&D investing for

potential new products

After closing, the combined company is

expected to have an estimated pro-

forma equity value of approximately

$1.2 billion and will remain listed on

Nasdaq under the new ticker symbol

ARFM

The business combination will close

after effectiveness of the S-4 and

shareholder approvals, among other

closing conditions, currently estimated

to occur in July

AEROFARMS

TRANSACTION SIZE

$232mm cash in trust from Spring Valley Acquisition Corp. (Nasdaq: SV)¹

$125mm PIPE - Sponsor and existing investors $40mm+

■

■

VALUATION

■

■

CAPITAL STRUCTURE

$347mm in cash to fund operations and accelerate growth¹

Fully funds equity portion of capital required to

execute business plan in projections

■

■

-$850mm pro-forma enterprise value

2.6x 2025E revenue and 10.4x 2025E EBITDA²

Attractive valuation versus other leading sustainable high-growth food peers

OWNERSHIP¹

65.0% existing shareholder equity rollover

2.7% AeroFarms convertible notes holders

22.1% SPAC including founder shares

■ 10.2% PIPE Investors

■

■

¹ Assumes no redemptions from Spring Valley Acquisition Corp.; includes cash to balance sheet from convertible note; assumes $40mm in transaction expenses; 2 Multiples based off pro-forma implied enterprise value; 2025E Revenue

$329.9mm and 2025E EBITDA $82.0mm

5View entire presentation