CorpAcq SPAC Presentation Deck

3E Proposed Transaction Overview

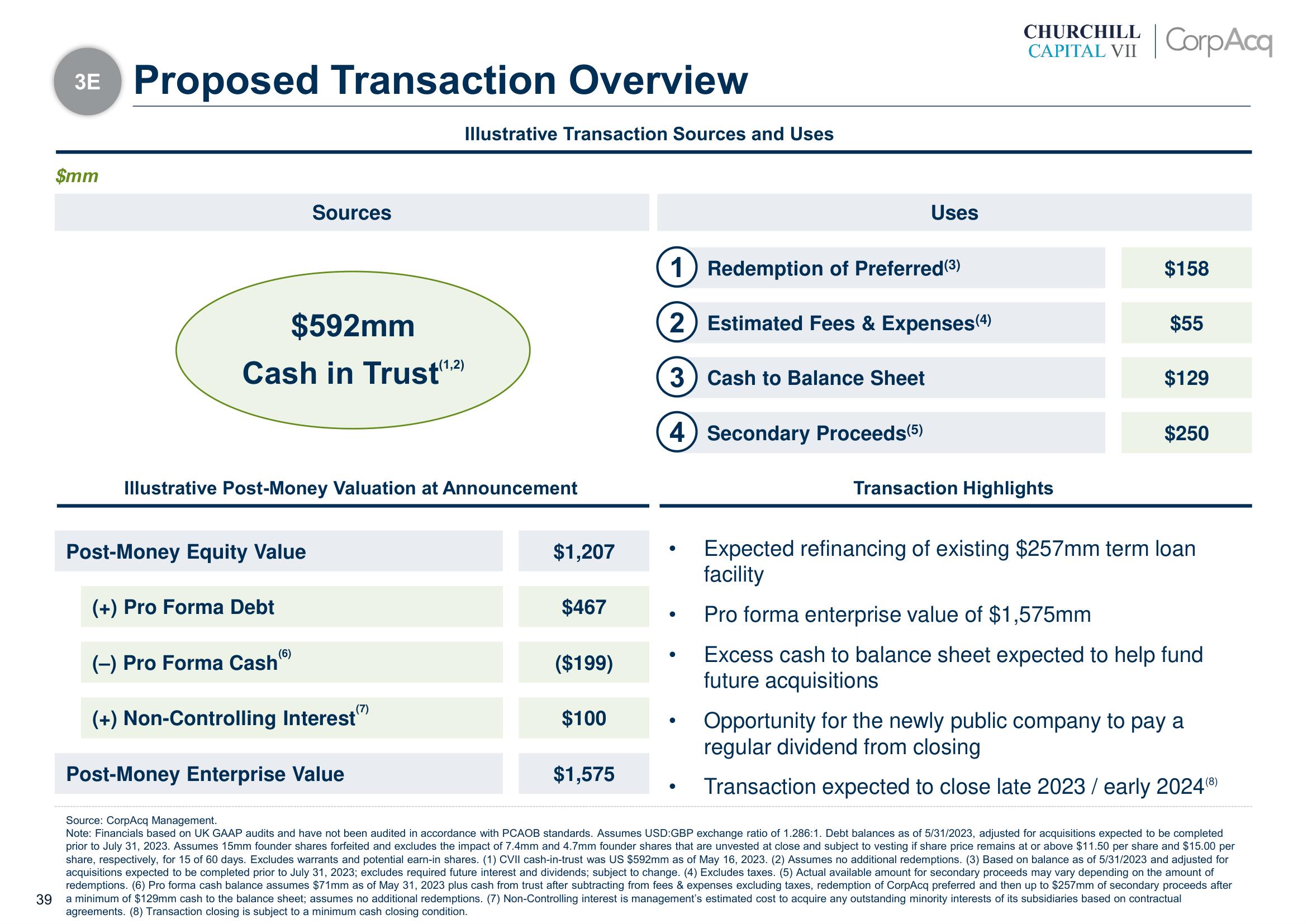

$mm

$592mm

Cash in Trust(¹,2)

Post-Money Equity Value

Sources

Illustrative Post-Money Valuation at Announcement

(+) Pro Forma Debt

(6)

(-) Pro Forma Cash

Illustrative Transaction Sources and Uses

(7)

(+) Non-Controlling Interest"

$1,207

$467

($199)

$100

$1,575

1) Redemption of Preferred (3)

2) Estimated Fees & Expenses(4)

3) Cash to Balance Sheet

4) Secondary Proceeds (5)

●

●

●

●

Uses

●

CHURCHILL CorpAcq

CAPITAL VII

Transaction Highlights

$158

$55

$129

$250

Expected refinancing of existing $257mm term loan

facility

Pro forma enterprise value of $1,575mm

Excess cash to balance sheet expected to help fund

future acquisitions

Post-Money Enterprise Value

Source: CorpAcq Management.

Note: Financials based on UK GAAP audits and have not been audited in accordance with PCAOB standards. Assumes USD:GBP exchange ratio of 1.286:1. Debt balances as of 5/31/2023, adjusted for acquisitions expected to be completed

prior to July 31, 2023. Assumes 15mm founder shares forfeited and excludes the impact of 7.4mm and 4.7mm founder shares that are unvested at close and subject to vesting if share price remains at or above $11.50 per share and $15.00 per

share, respectively, for 15 of 60 days. Excludes warrants and potential earn-in shares. (1) CVII cash-in-trust was US $592mm as of May 16, 2023. (2) Assumes no additional redemptions. (3) Based on balance as of 5/31/2023 and adjusted for

acquisitions expected to be completed prior to July 31, 2023; excludes required future interest and dividends; subject to change. (4) Excludes taxes. (5) Actual available amount for secondary proceeds may vary depending on the amount of

redemptions. (6) Pro forma cash balance assumes $71mm as of May 31, 2023 plus cash from trust after subtracting from fees & expenses excluding taxes, redemption of CorpAcq preferred and then up to $257mm of secondary proceeds after

a minimum of $129mm cash to the balance sheet; assumes no additional redemptions. (7) Non-Controlling interest is management's estimated cost to acquire any outstanding minority interests of its subsidiaries based on contractual

agreements. (8) Transaction closing is subject to a minimum cash closing condition.

39

Opportunity for the newly public company to pay a

regular dividend from closing

Transaction expected to close late 2023 / early 2024 (8)View entire presentation