LionTree Investment Banking Pitch Book

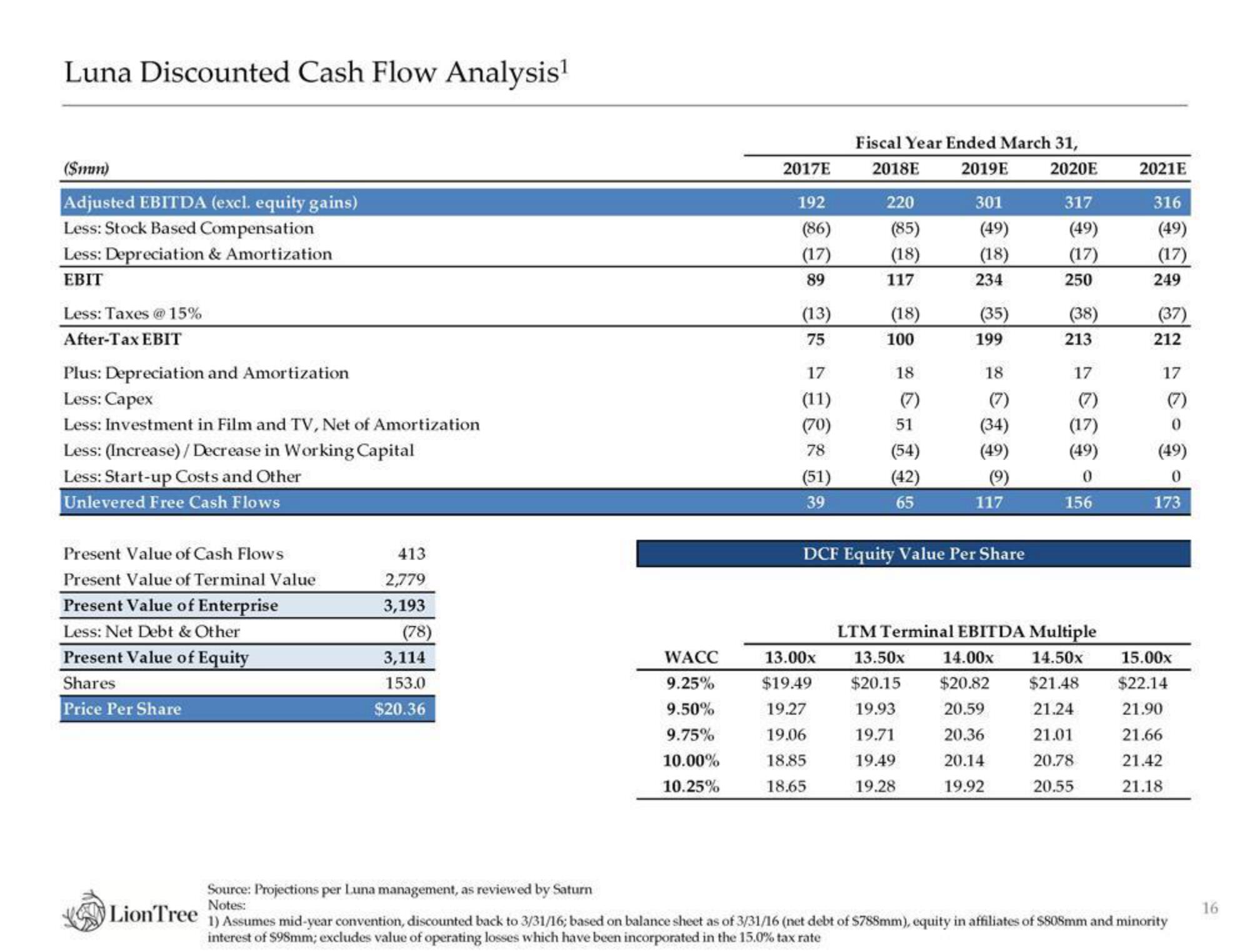

Luna Discounted Cash Flow Analysis¹

($mm)

Adjusted EBITDA (excl. equity gains)

Less: Stock Based Compensation

Less: Depreciation & Amortization

EBIT

Less: Taxes @ 15%

After-Tax EBIT

Plus: Depreciation and Amortization

Less: Capex

Less: Investment in Film and TV, Net of Amortization

Less: (Increase) /Decrease in Working Capital

Less: Start-up Costs and Other

Unlevered Free Cash Flows

Present Value of Cash Flows

Present Value of Terminal Value

Present Value of Enterprise

Less: Net Debt & Other

Present Value of Equity

Shares

Price Per Share

Lion Tree

413

2,779

3,193

(78)

3,114

153.0

$20.36

Source: Projections per Luna management, as reviewed by Saturn

Notes:

WACC

9.25%

9.50%

9.75%

10.00%

10.25%

2017E

192

(86)

(17)

89

(13)

75

17

(11)

(70)

78

(51)

39

Fiscal Year Ended March 31,

2018E

2019E

2020E

220

(85)

(18)

117

(18)

100

18

51

(54)

(42)

65

301

(49)

(18)

13.00x

13.50x

$19.49 $20.15

19.27

19.93

19.06

19.71

18.85

19.49

18.65

19.28

234

(35)

199

18

(7)

(34)

(49)

(9)

117

DCF Equity Value Per Share

317

14.00x

$20.82

20.59

20.36

20.14

19.92

(49)

(17)

250

(38)

213

17

LTM Terminal EBITDA Multiple

14.50x

$21.48

21.24

21.01

20.78

20.55

(7)

(17)

(49)

0

156

2021E

316

(49)

(17)

249

(37)

212

17

(7)

(49)

0

173

15.00x

$22.14

21.90

21.66

21.42

21.18

1) Assumes mid-year convention, discounted back to 3/31/16; based on balance sheet as of 3/31/16 (net debt of $788mm), equity in affiliates of $808mm and minority

interest of $98mm; excludes value of operating losses which have been incorporated in the 15.0% tax rate

16View entire presentation