Babylon SPAC Presentation Deck

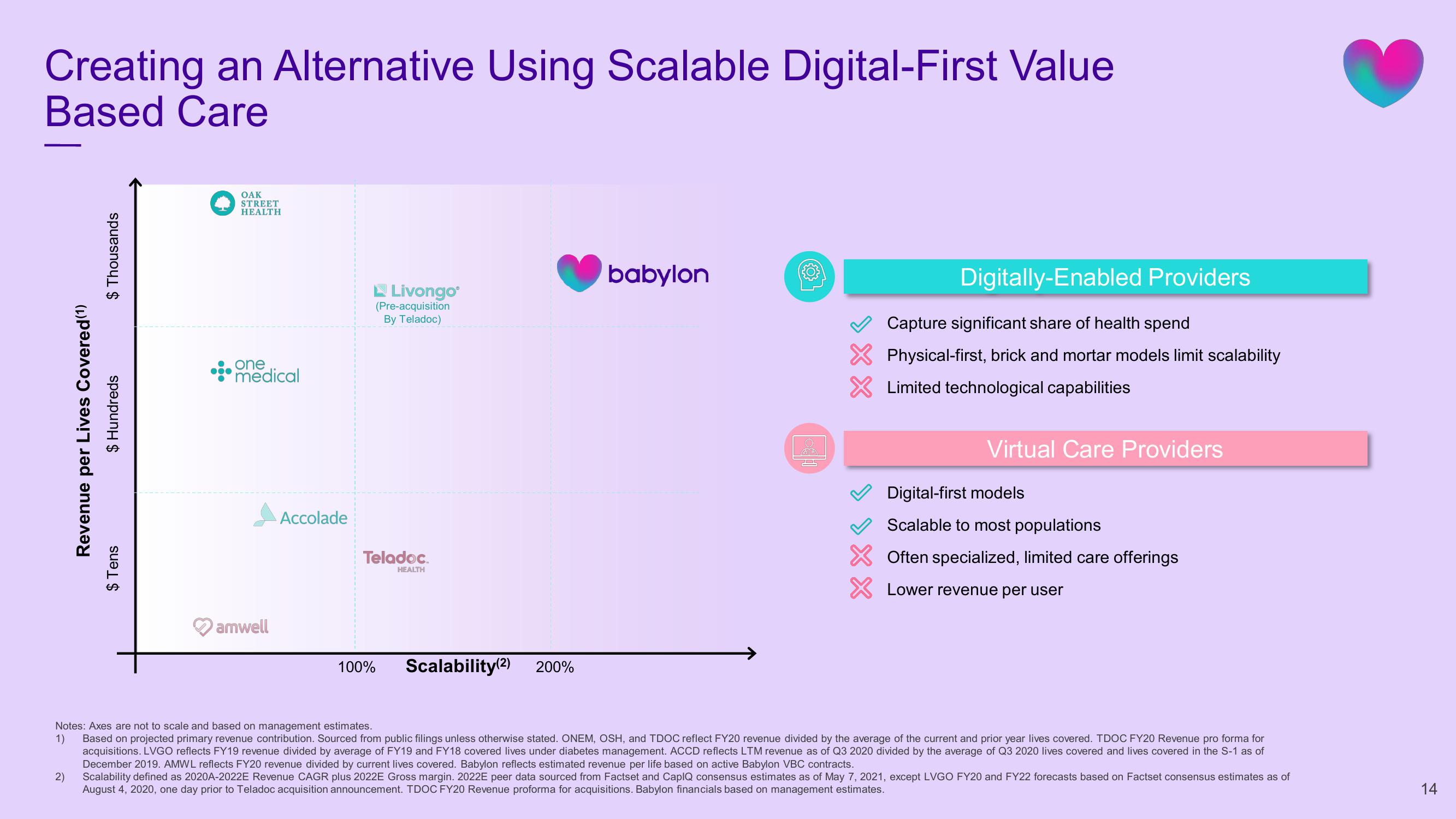

Creating an Alternative Using Scalable Digital-First Value

Based Care

$ Thousands

2)

Revenue per Lives Covered (1)

Hundreds

$

$ Tens

OAK

STREET

HEALTH

one

medical

amwell

Accolade

Livongo

(Pre-acquisition

By Teladoc)

Teladoc.

HEALTH

100%

Scalability(2)

200%

babylon

Digitally-Enabled Providers

Capture significant share of health spend

X Physical-first, brick and mortar models limit scalability

X Limited technological capabilities

Virtual Care Providers

Digital-first models

Scalable to most populations

X

Often specialized, limited care offerings

X Lower revenue per user

Notes: Axes are not to scale and based on management estimates.

1) Based on projected primary revenue contribution. Sourced from public filings unless otherwise stated. ONEM, OSH, and TDOC reflect FY20 revenue divided by the average of the current and prior year lives covered. TDOC FY20 Revenue pro forma for

acquisitions. LVGO reflects FY19 revenue divided by average of FY19 and FY18 covered lives under diabetes management. ACCD reflects LTM revenue as of Q3 2020 divided by the average of Q3 2020 lives covered and lives covered in the S-1 as of

December 2019. AMWL reflects FY20 revenue divided by current lives covered. Babylon reflects estimated revenue per life based active Babylon VBC contracts.

Scalability defined as 2020A-2022E Revenue CAGR plus 2022E Gross margin. 2022E peer data sourced from Factset and CapIQ consensus estimates as of May 7, 2021, except LVGO FY20 and FY22 forecasts based on Factset consensus estimates as of

August 4, 2020, one day prior to Teladoc acquisition announcement. TDOC FY20 Revenue proforma for acquisitions. Babylon financials based on management estimates.

14View entire presentation