J.P.Morgan Results Presentation Deck

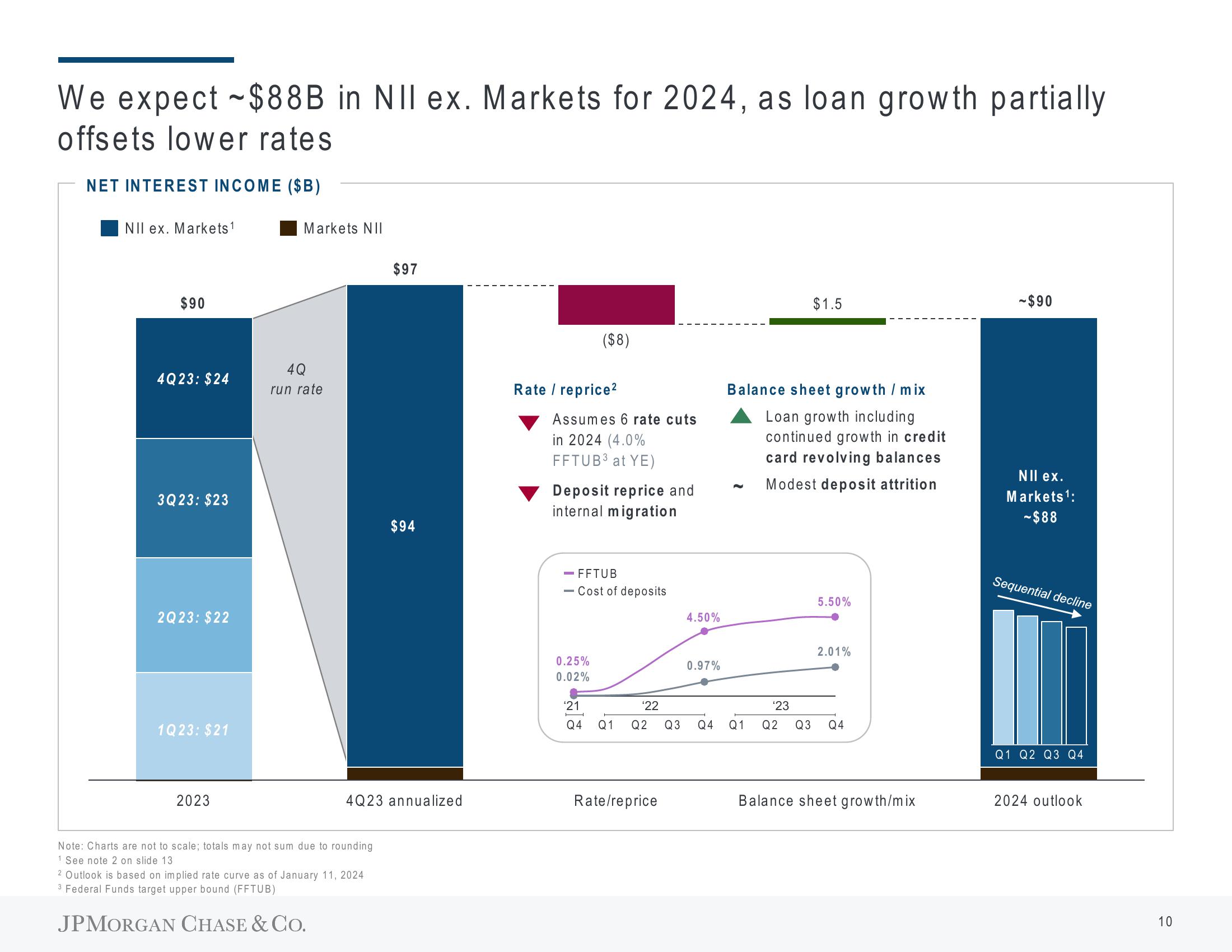

We expect ~$88B in NII ex. Markets for 2024, as loan growth partially

offsets lower rates

NET INTEREST INCOME ($B)

NII ex. Markets ¹

$90

4Q23: $24

3Q23: $23

2Q23: $22

1Q23: $21

2023

Markets NII

4Q

run rate

Note: Charts are not to scale; totals may not sum due to rounding

1 See note 2 on slide 13

$97

4Q23 annualized

2 Outlook is based on implied rate curve as of January 11, 2024

3 Federal Funds target upper bound (FFTUB)

JPMORGAN CHASE & CO.

$94

($8)

Rate / reprice²

Assumes 6 rate cuts

in 2024 (4.0%

FFTUB3 at YE)

Deposit reprice and

internal migration

- FFTUB

- Cost of deposits

0.25%

0.02%

4.50%

Rate/reprice

0.97%

$21

¹22

Q4 Q1 Q2 Q3 Q4 Q1

$1.5

Balance sheet growth / mix

Loan growth including

continued growth in credit

card revolving balances

Modest deposit attrition

5.50%

2.01%

¹23

Q2 Q3 Q4

Balance sheet growth/mix

-$90

NII ex.

Markets ¹:

-$88

Sequential decline

Q1 Q2 Q3 Q4

2024 outlook

10View entire presentation