Plastiq SPAC Presentation Deck

IQ

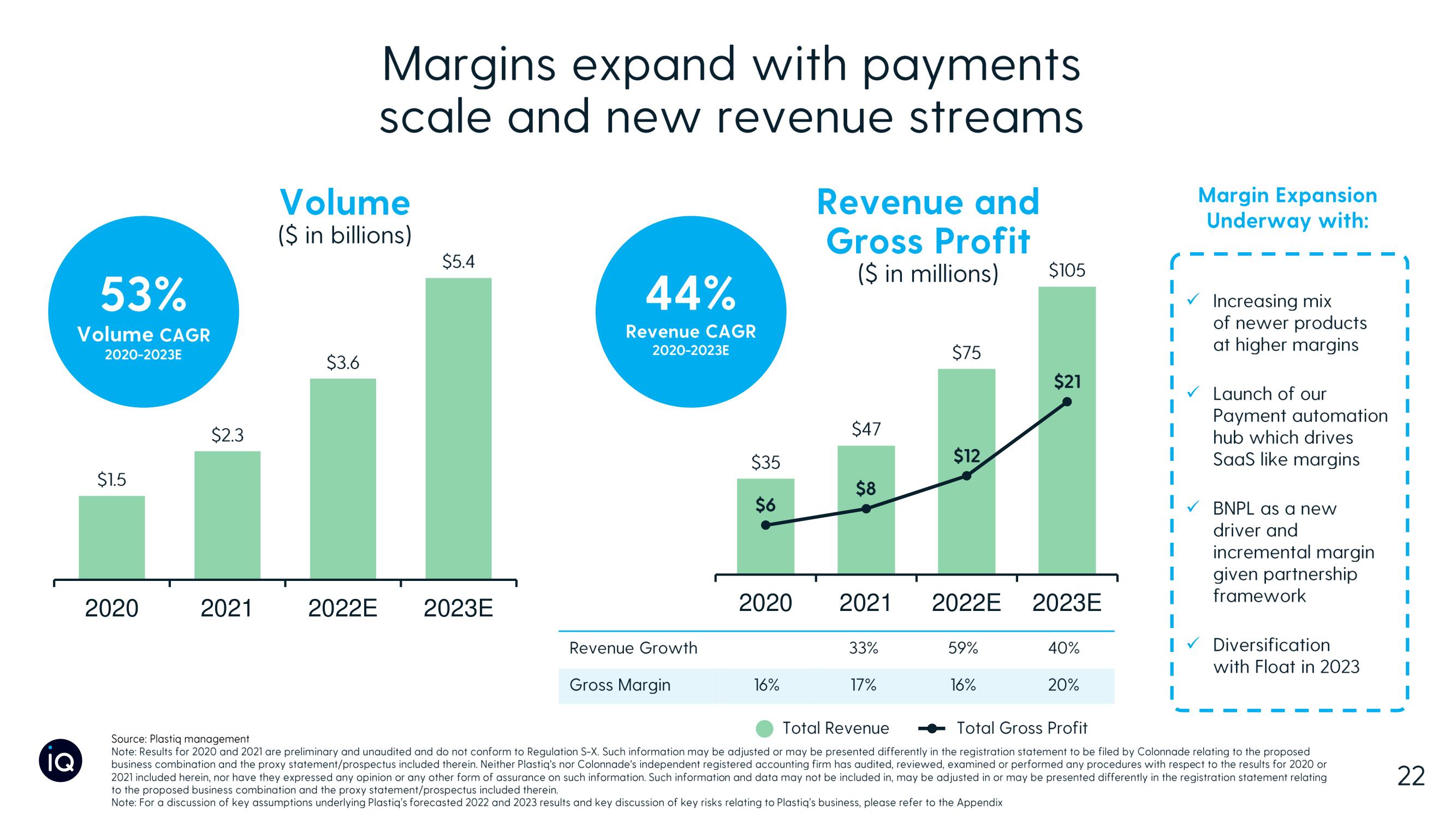

53%

Volume CAGR

2020-2023E

$1.5

2020

$2.3

2021

Volume

($ in billions)

$3.6

Margins expand with payments

scale and new revenue streams

2022E

$5.4

2023E

44%

Revenue CAGR

2020-2023E

Revenue Growth

Gross Margin

$35

$6

2020

16%

Revenue and

Gross Profit

($ in millions)

$47

$8

33%

$75

17%

$12

2021 2022E 2023E

59%

$105

16%

$21

40%

20%

Margin Expansion

Underway with:

✓ Increasing mix

of newer products

at higher margins

Launch of our

Payment automation

hub which drives

SaaS like margins

BNPL as a new

driver and

incremental margin

given partnership

framework

Diversification

with Float in 2023

Total Revenue

Total Gross Profit

Source: Plastiq management

Note: Results for 2020 and 2021 are preliminary and unaudited and do not conform to Regulation S-X. Such information may be adjusted or may be presented differently in the registration statement to be filed by Colonnade relating to the proposed

business combination and the proxy statement/prospectus included therein. Neither Plastiq's nor Colonnade's independent registered accounting firm has audited, reviewed, examined or performed any procedures with respect to the results for 2020 or

2021 included herein, nor have they expressed any opinion or any other form of assurance on such information. Such information and data may not be included in, may be adjusted in or may be presented differently in the registration statement relating

to the proposed business combination and the proxy statement/prospectus included therein.

Note: For a discussion of key assumptions underlying Plastiq's forecasted 2022 and 2023 results and key discussion of key risks relating to Plastiq's business, please refer to the Appendix

22View entire presentation