UBS ESG Presentation Deck

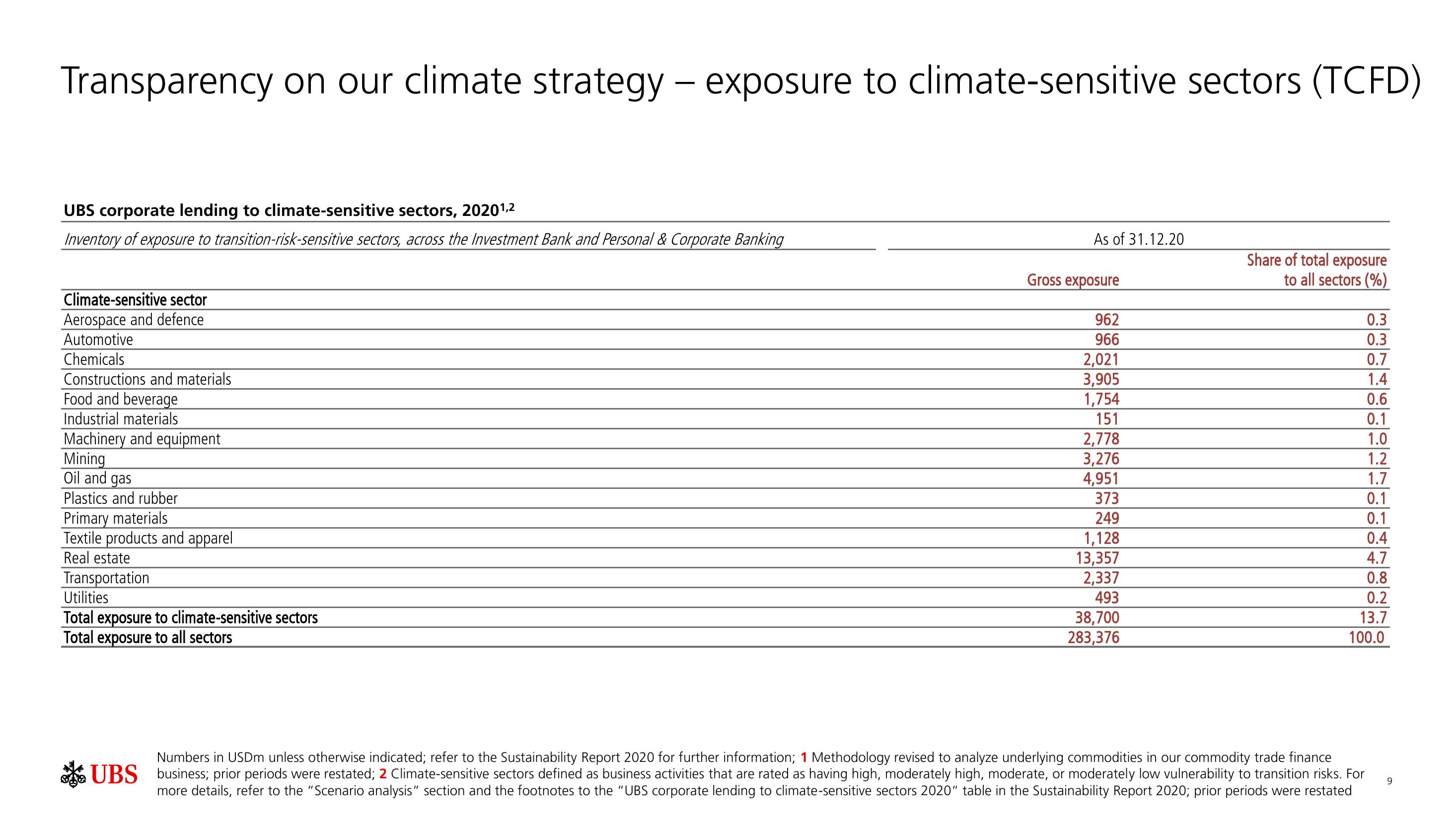

Transparency on our climate strategy - exposure to climate-sensitive sectors (TCFD)

UBS corporate lending to climate-sensitive sectors, 20201,2

Inventory of exposure to transition-risk-sensitive sectors, across the Investment Bank and Personal & Corporate Banking

Climate-sensitive sector

Aerospace and defence

Automotive

Chemicals

Constructions and materials

Food and beverage

Industrial materials

Machinery and equipment

Mining

Oil and gas

Plastics and rubber

Primary materials

Textile products and apparel

Real estate

Transportation

Utilities

Total exposure to climate-sensitive sectors

Total exposure to all sectors

As of 31.12.20

Gross exposure

962

966

2,021

3,905

1,754

151

2,778

3,276

4,951

373

249

1,128

13,357

2,337

493

38,700

283,376

Share of total exposure

to all sectors (%)

0.3

0.3

0.7

1.4

0.6

0.1

1.0

1.2

1.7

0.1

0.1

0.4

4.7

0.8

0.2

13.7

100.0

Numbers in USDm unless otherwise indicated; refer to the Sustainability Report 2020 for further information; 1 Methodology revised to analyze underlying commodities in our commodity trade finance

UBS business; prior periods were restated; 2 Climate-sensitive sectors defined as business activities that are rated as having high, moderately high, moderate, or moderately low vulnerability to transition risks. For

more details, refer to the "Scenario analysis" section and the footnotes to the "UBS corporate lending to climate-sensitive sectors 2020" table in the Sustainability Report 2020; prior periods were restated

9View entire presentation