Mondi Credit Presentation Deck

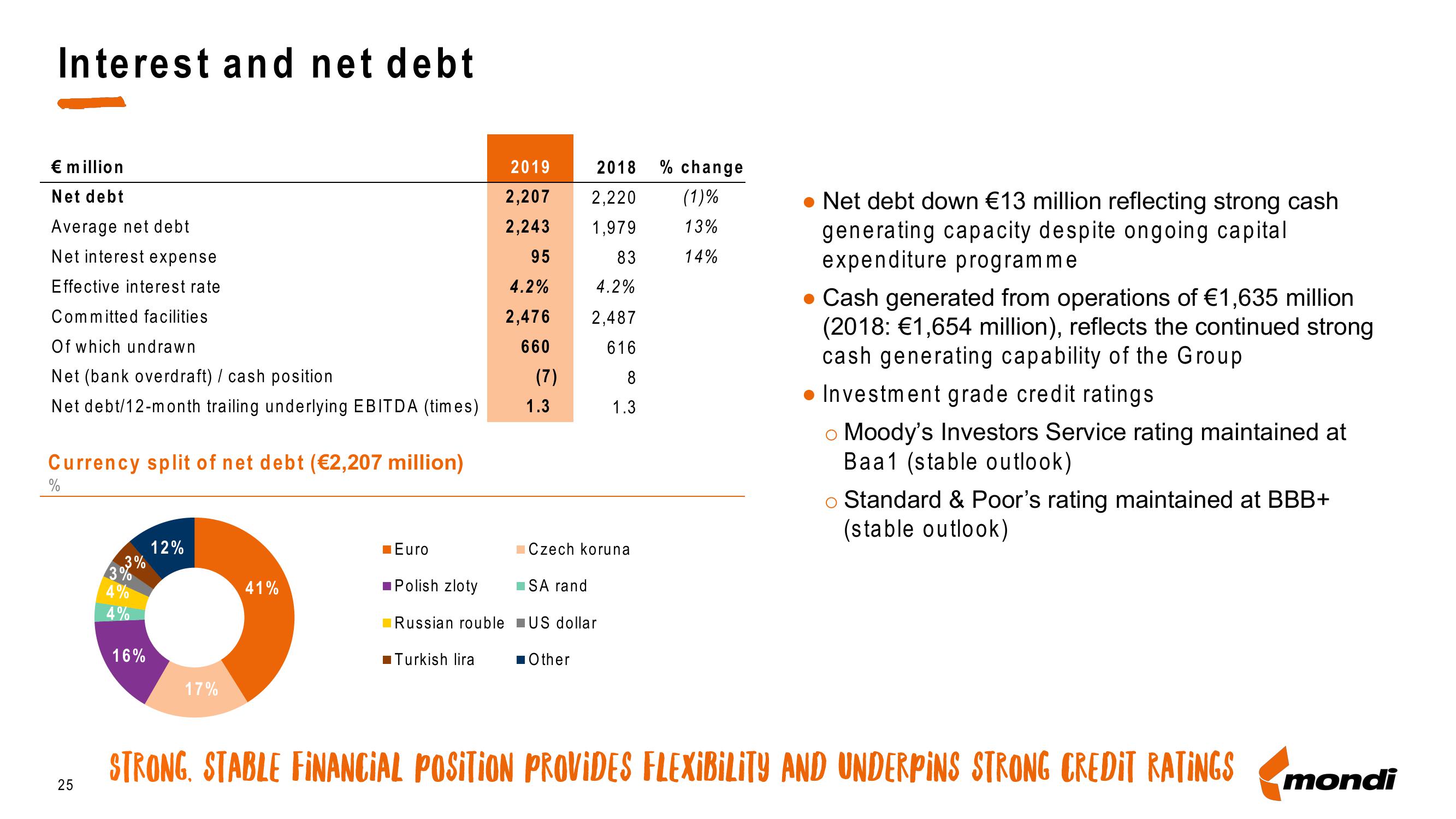

Interest and net debt

€ million

Net debt

Average net debt

Net interest expense

Effective interest rate

Committed facilities

Of which undrawn

Net (bank overdraft) / cash position

Net debt/12-month trailing underlying EBITDA (times)

Currency split of net debt (€2,207 million)

%

25

3%

3%

4%

4%

16%

12%

17%

41%

2019

2,207

2,243

95

4.2%

2,476

660

(7)

1.3

Euro

Polish zloty

Russian rouble US dollar

Turkish lira

Czech koruna

2018

2,220

1,979

83

4.2%

2,487

616

8

1.3

■SA rand

■ Other

% change

(1)%

13%

14%

• Net debt down €13 million reflecting strong cash

generating capacity despite ongoing capital

expenditure programme

• Cash generated from operations of €1,635 million

(2018: €1,654 million), reflects the continued strong

cash generating capability of the Group

• Investment grade credit ratings

o Moody's Investors Service rating maintained at

Baa1 (stable outlook)

Standard & Poor's rating maintained at BBB+

(stable outlook)

STRONG, STABLE FINANCIAL POSITION PROVIDES FLEXIBILITY AND UNDERPINS STRONG CREDIT RATINGS

mondiView entire presentation