Playboy SPAC Presentation Deck

PLAYBOY 2020

34

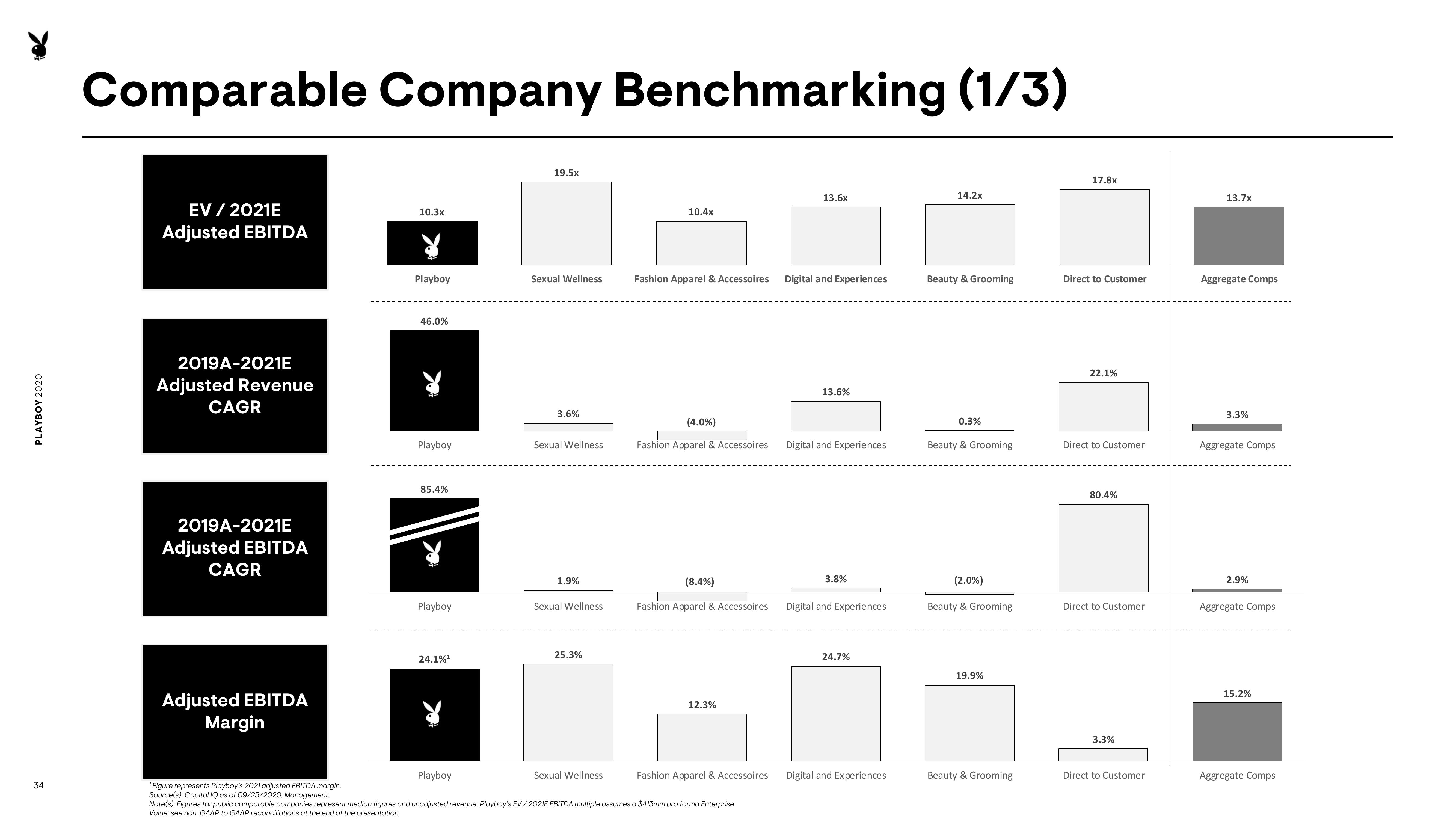

Comparable Company Benchmarking (1/3)

EV / 2021E

Adjusted EBITDA

2019A-2021E

Adjusted Revenue

CAGR

2019A-2021E

Adjusted EBITDA

CAGR

Adjusted EBITDA

Margin

10.3x

Playboy

46.0%

Playboy

85.4%

Playboy

24.1% ¹

Playboy

19.5x

Sexual Wellness

3.6%

Sexual Wellness

1.9%

Sexual Wellness

25.3%

Sexual Wellness

10.4x

Fashion Apparel & Accessoires Digital and Experiences

(4.0%)

Fashion Apparel & Accessoires

12.3%

13.6x

Fashion Apparel & Accessoires

¹ Figure represents Playboy's 2021 adjusted EBITDA margin.

Source(s): Capital IQ as of 09/25/2020; Management.

Note(s): Figures for public comparable companies represent median figures and unadjusted revenue; Playboy's EV/2021E EBITDA multiple assumes a $413mm pro forma Enterprise

Value; see non-GAAP to GAAP reconciliations at the end of the presentation.

13.6%

(8.4%)

Fashion Apparel & Accessoires Digital and Experiences

Digital and Experiences

3.8%

24.7%

Digital and Experiences.

14.2x

Beauty & Grooming

0.3%

Beauty & Grooming

(2.0%)

Beauty & Grooming

19.9%

Beauty & Grooming

17.8x

Direct to Customer

22.1%

Direct to Customer

80.4%

Direct to Customer

3.3%

Direct to Customer

13.7x

Aggregate Comps

3.3%

Aggregate Comps

2.9%

Aggregate Comps

15.2%

Aggregate CompsView entire presentation