Cboe Results Presentation Deck

Non-GAAP Information

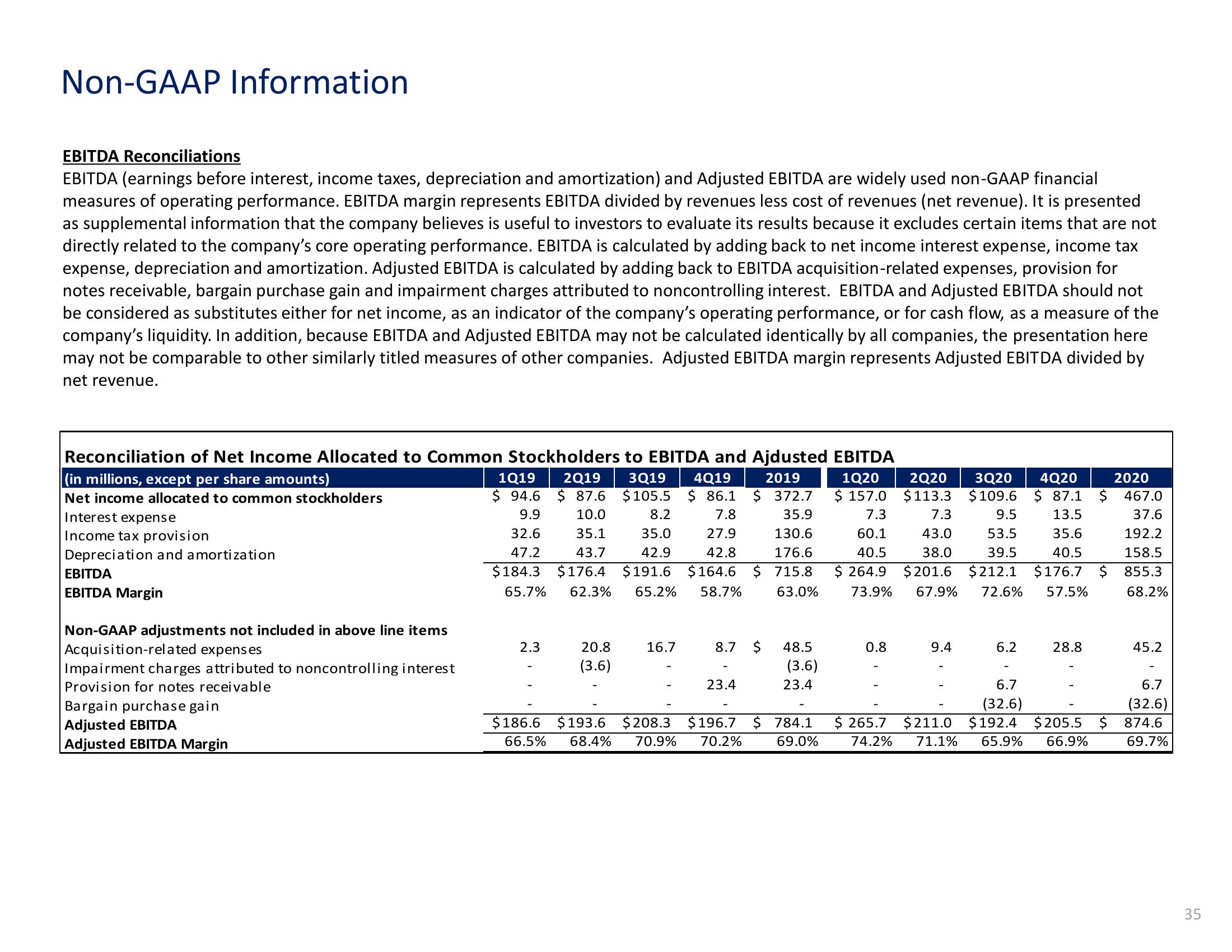

EBITDA Reconciliations

EBITDA (earnings before interest, income taxes, depreciation and amortization) and Adjusted EBITDA are widely used non-GAAP financial

measures of operating performance. EBITDA margin represents EBITDA divided by revenues less cost of revenues (net revenue). It is presented

as supplemental information that the company believes is useful to investors to evaluate its results because it excludes certain items that are not

directly related to the company's core operating performance. EBITDA is calculated by adding back to net income interest expense, income tax

expense, depreciation and amortization. Adjusted EBITDA is calculated by adding back to EBITDA acquisition-related expenses, provision for

notes receivable, bargain purchase gain and impairment charges attributed to noncontrolling interest. EBITDA and Adjusted EBITDA should not

be considered as substitutes either for net income, as an indicator of the company's operating performance, or for cash flow, as a measure of the

company's liquidity. In addition, because EBITDA and Adjusted EBITDA may not be calculated identically by all companies, the presentation here

may not be comparable to other similarly titled measures of other companies. Adjusted EBITDA margin represents Adjusted EBITDA divided by

net revenue.

Reconciliation of Net Income Allocated to Common Stockholders to EBITDA and Ajdusted EBITDA

(in millions, except per share amounts)

4Q19

2019

1Q20

Net income allocated to common stockholders

$ 86.1

$ 157.0

2Q20 3Q20 4Q20 2020

$113.3 $109.6 $ 87.1 $ 467.0

7.3

13.5

9.5

1Q19 2Q19 3Q19

$94.6 $ 87.6 $105.5

9.9

10.0

8.2

32.6 35.1 35.0

47.2 43.7 42.9

$184.3 $176.4 $191.6 $164.6 $ 715.8 $ 264.9 $201.6 $212.1 $176.7 $

65.7% 62.3% 65.2% 58.7% 63.0% 73.9% 67.9% 72.6% 57.5%

7.8

27.9

42.8

$ 372.7

35.9

130.6

176.6

7.3

60.1

40.5

43.0

53.5

35.6

37.6

192.2

158.5

38.0

39.5

40.5

855.3

68.2%

Interest expense

Income tax provision

Depreciation and amortization

EBITDA

EBITDA Margin

Non-GAAP adjustments not included in above line items

Acquisition-related expenses

Impairment charges attributed to noncontrolling interest

Provision for notes receivable

Bargain purchase gain

Adjusted EBITDA

Adjusted EBITDA Margin

2.3

20.8

(3.6)

16.7

$186.6 $193.6 $208.3

66.5% 68.4% 70.9%

8.7 $ 48.5

(3.6)

23.4

23.4

$196.7 $ 784.1

70.2%

69.0%

0.8

$ 265.7

74.2%

9.4

6.2

28.8

6.7

(32.6)

$211.0 $192.4 $205.5 $

71.1% 65.9% 66.9%

45.2

6.7

(32.6)

874.6

69.7%

35View entire presentation