Baird Investment Banking Pitch Book

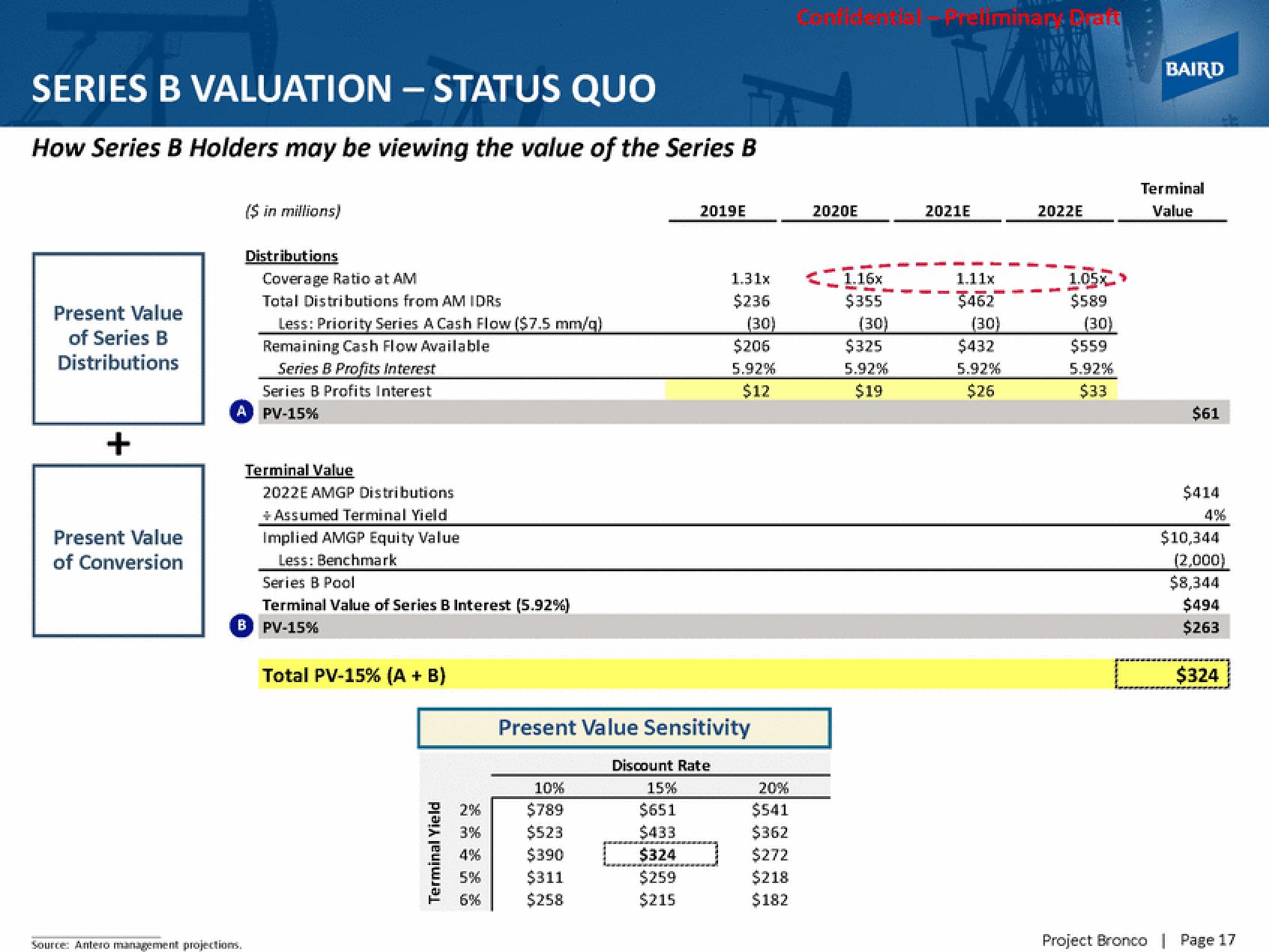

SERIES B VALUATION - STATUS QUO

How Series B Holders may be viewing the value of the Series B

Present Value

of Series B

Distributions

+

Present Value

of Conversion

($ in millions)

Distributions

Source: Antero management projections.

Coverage Ratio at AM

Total Distributions from AM IDRs

Less: Priority Series A Cash Flow ($7.5 mm/q)

Remaining Cash Flow Available

Series B Profits Interest

Series B Profits Interest

A PV-15%

Terminal Value

2022E AMGP Distributions

+ Assumed Terminal Yield

Implied AMGP Equity Value

Less: Benchmark

Series B Pool

Terminal Value of Series B Interest (5.92%)

B PV-15%

Total PV-15% (A + B)

Terminal Yield

2%

3%

4%

5%

6%

2019E

10%

$789

$523

$390

$311

$258

1.31x

$236

(30)

$206

5.92%

$12

Present Value Sensitivity

Discount Rate

15%

$651

$433

$324

$259

$215

20%

$541

$362

$272

$218

$182

2020E

<1.16x

$355

(30)

$325

5.92%

$19

Tellminary Prart

2021E

1.11x

$462

(30)

$432

5.92%

$26

2022E

1.05x

$589

(30)

$559

5.92%

$33

*****

BAIRD

Terminal

Value

$61

$414

4%

$10,344

(2,000)

$8,344

$494

$263

$324

Project Bronco | Page 17View entire presentation