Alternus Energy SPAC Presentation Deck

5

$m's

24.0

22.0

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

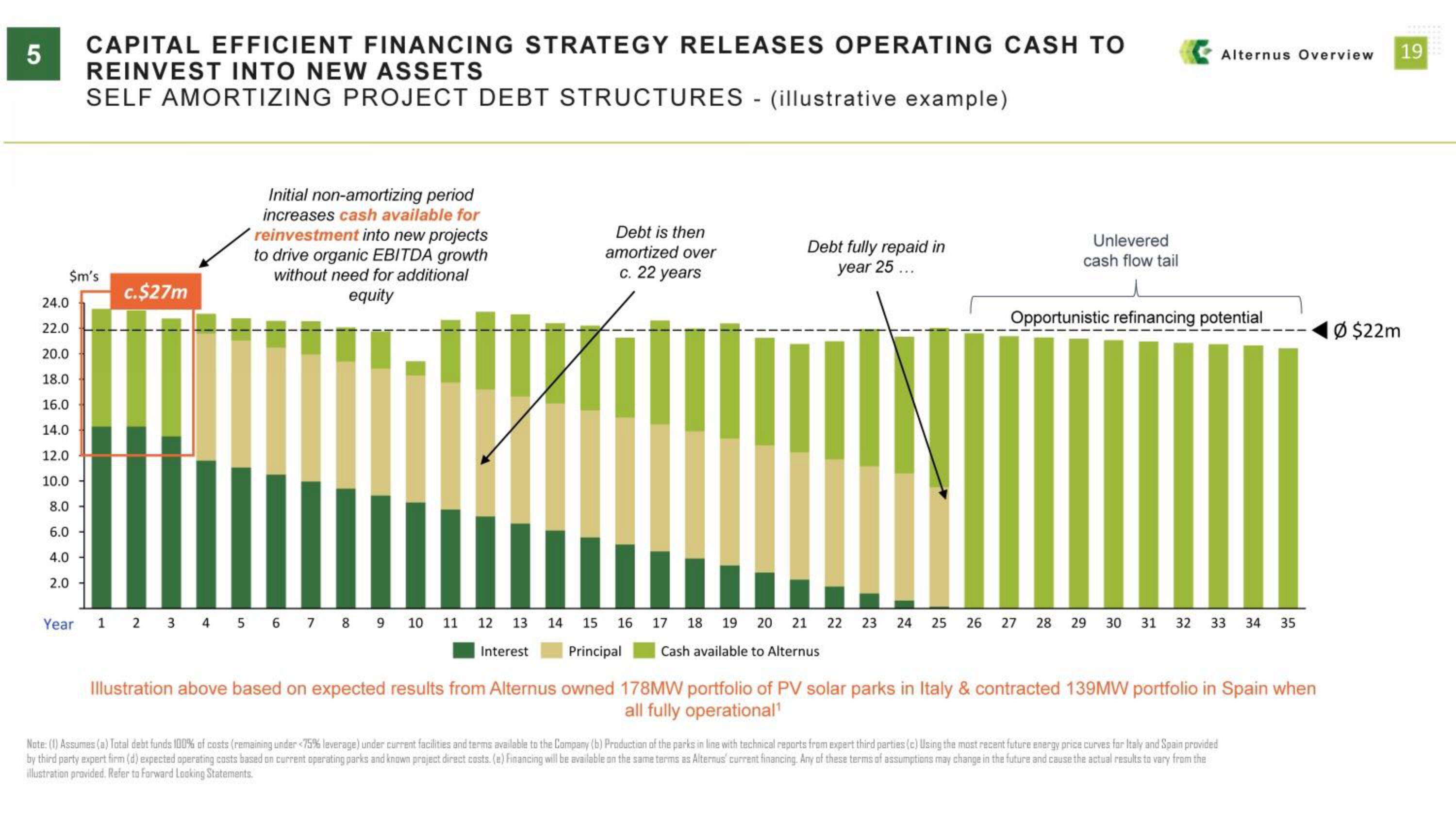

CAPITAL EFFICIENT FINANCING STRATEGY RELEASES OPERATING CASH TO

REINVEST INTO NEW ASSETS

SELF AMORTIZING PROJECT DEBT STRUCTURES - (illustrative example)

Year

c.$27m

Initial non-amortizing period

increases cash available for

reinvestment into new projects

to drive organic EBITDA growth

without need for additional

equity

1 2 3 4 5 6 7 8 9 10 11

12 13

Interest

Debt is then

amortized over

c. 22 years

14 15 16

Principal

Debt fully repaid in

year 25 ...

17 18 19 20 21 22 23 24

Cash available to Alternus

25 26 27

Unlevered

cash flow tail

Opportunistic refinancing potential

28

Alternus Overview 19

29 30 31 32 33 34 35

Note: (1) Assumes (a) Total debt funds 100% of costs (remaining under <75% leverage) under current facilities and terms available to the Company (b) Production of the parks in line with technical reports from expert third parties (c) Using the most recent future energy price curves for Italy and Spain provided

by third party expert firm (d) expected operating costs based on current operating parks and known project direct costs. (e) Financing will be available on the same terms as Alternus' current financing. Any of these terms of assumptions may change in the future and cause the actual results to vary from the

illustration provided. Refer to Forward Looking Statements.

◄Ø $22m

Illustration above based on expected results from Alternus owned 178MW portfolio of PV solar parks in Italy & contracted 139MW portfolio in Spain when

all fully operational¹View entire presentation