Metals Acquisition Corp SPAC Presentation Deck

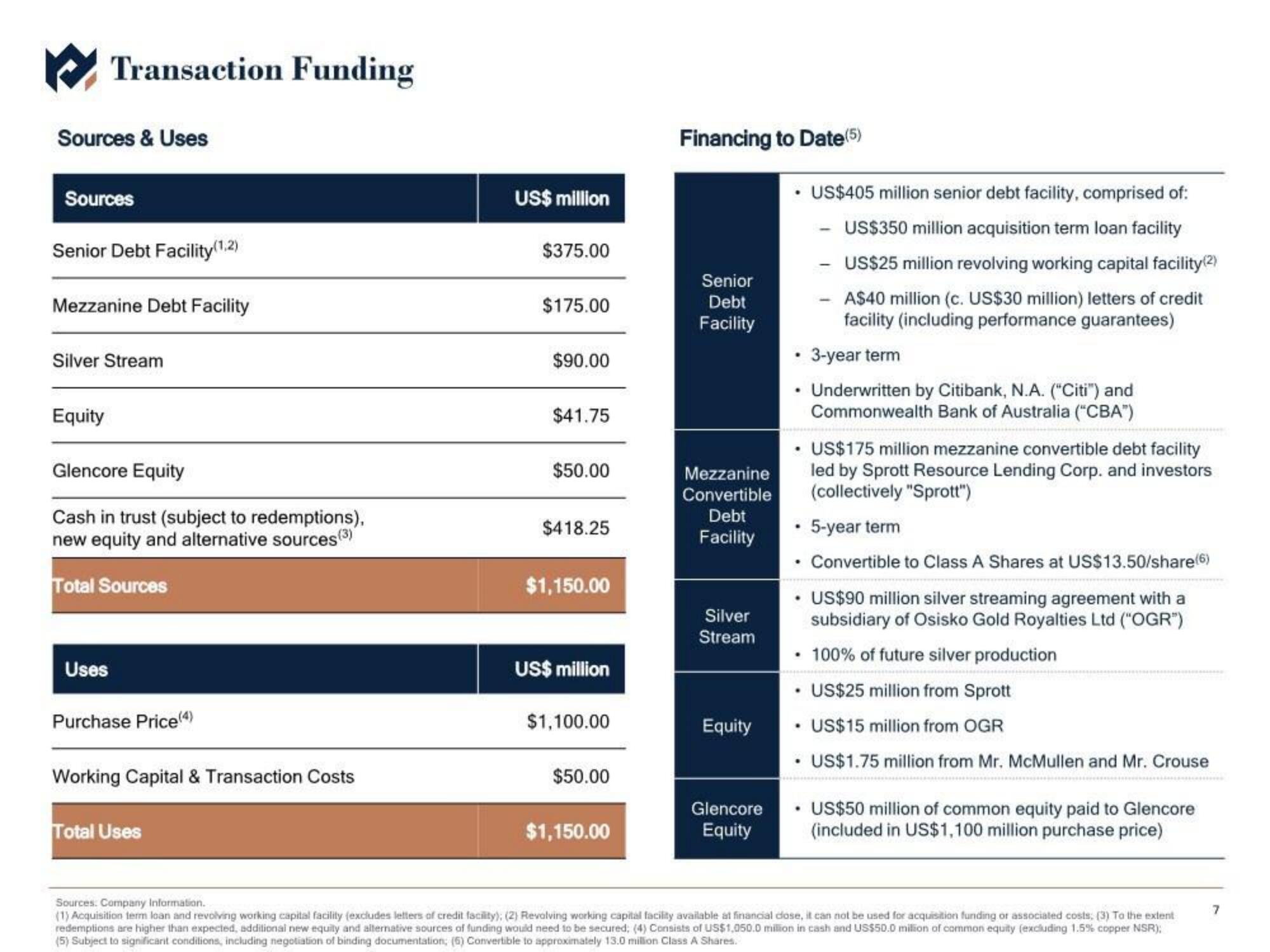

Sources & Uses

Transaction Funding

Sources

Senior Debt Facility (1,2)

Mezzanine Debt Facility

Silver Stream

Equity

Glencore Equity

Cash in trust (subject to redemptions),

new equity and alternative sources (3)

Total Sources

Uses

Purchase Price (4)

Working Capital & Transaction Costs

Total Uses

US$ million

$375.00

$175.00

$90.00

$41.75

$50.00

$418.25

$1,150.00

US$ million

$1,100.00

$50.00

$1,150.00

Financing to Date (5)

Senior

Debt

Facility

Mezzanine

Convertible

Debt

Facility

Silver

Stream

Equity

Glencore

Equity

• US$405 million senior debt facility, comprised of:

US$350 million acquisition term loan facility

- US$25 million revolving working capital facility(2)

A$40 million (c. US$30 million) letters of credit

facility (including performance guarantees)

• 3-year term

Underwritten by Citibank, N.A. ("Citi") and

Commonwealth Bank of Australia ("CBA")

• US$175 million mezzanine convertible debt facility

led by Sprott Resource Lending Corp. and investors

(collectively "Sprott")

• 5-year term

Convertible to Class A Shares at US$13.50/share(6)

• US$90 million silver streaming agreement with a

subsidiary of Osisko Gold Royalties Ltd ("OGR")

100% of future silver production

US$25 million from Sprott

• US$15 million from OGR

• US$1.75 million from Mr. McMullen and Mr. Crouse

• US$50 million of common equity paid to Glencore

(included in US$1,100 million purchase price)

Sources: Company Information.

(1) Acquisition term loan and revolving working capital facility (excludes letters of credit facility); (2) Revolving working capital facility available at financial dose, it can not be used for acquisition funding or associated costs; (3) To the extent

redemptions are higher than expected, additional new equity and alternative sources of funding would need to be secured; (4) Consists of US$1,050.0 million in cash and US$50.0 milion of common equity (excluding 1.5% copper NSR);

(5) Subject to significant conditions, including negotiation of binding documentation; (6) Convertible to approximately 13.0 million Class A Shares.

7View entire presentation