Main Street Capital Investor Day Presentation Deck

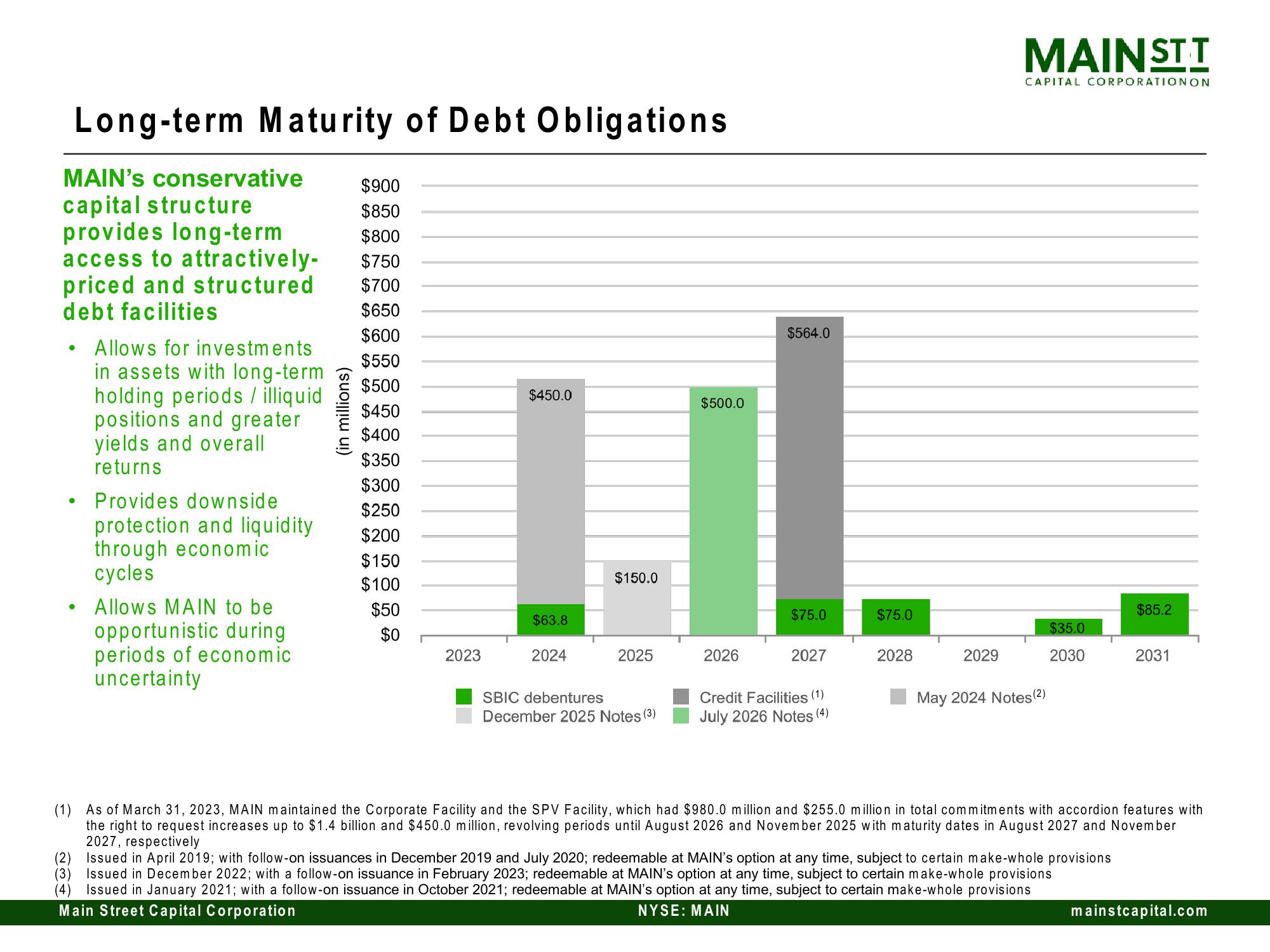

Long-term Maturity of Debt Obligations

MAIN's conservative

capital structure

provides long-term

access to attractively-

priced and structured

debt facilities

Allows for investments

in assets with long-term

holding periods / illiquid

positions and greater

yields and overall

returns

Provides downside

protection and liquidity

through economic

cycles

Allows MAIN to be

opportunistic during

periods of economic

uncertainty

(in millions)

$900

$850

$800

$750

$700

$650

$600

$550

$500

$450

$400

$350

$300

$250

$200

$150

$100

$50

$0

2023

$450.0

$63.8

2024

$150.0

2025

SBIC debentures

December 2025 Notes (3)

$500.0

2026

$564.0

$75.0

2027

Credit Facilities

July 2026 Notes (4)

$75.0

2028

2029

MAINST T

CAPITAL CORPORATIONON

May 2024 Notes (2)

$35.0

2030

$85.2

2031

(1) As of March 31, 2023, MAIN maintained the Corporate Facility and the SPV Facility, which had $980.0 million and $255.0 million in total commitments with accordion features with

the right to request increases up to $1.4 billion and $450.0 million, revolving periods until August 2026 and November 2025 with maturity dates in August 2027 and November

2027, respectively

(2) Issued in April 2019; with follow-on issuances in December 2019 and July 2020; redeemable at MAIN's option at any time, subject to certain make-whole provisions

(3) Issued in December 2022; with a follow-on issuance in February 2023; redeemable at MAIN's option at any time, subject to certain make-whole provisions

(4) Issued in January 2021; with a follow-on issuance in October 2021; redeemable at MAIN's option at any time, subject to certain make-whole provisions

Main Street Capital Corporation

NYSE: MAIN

mainstcapital.comView entire presentation