Cameco IPO Presentation Deck

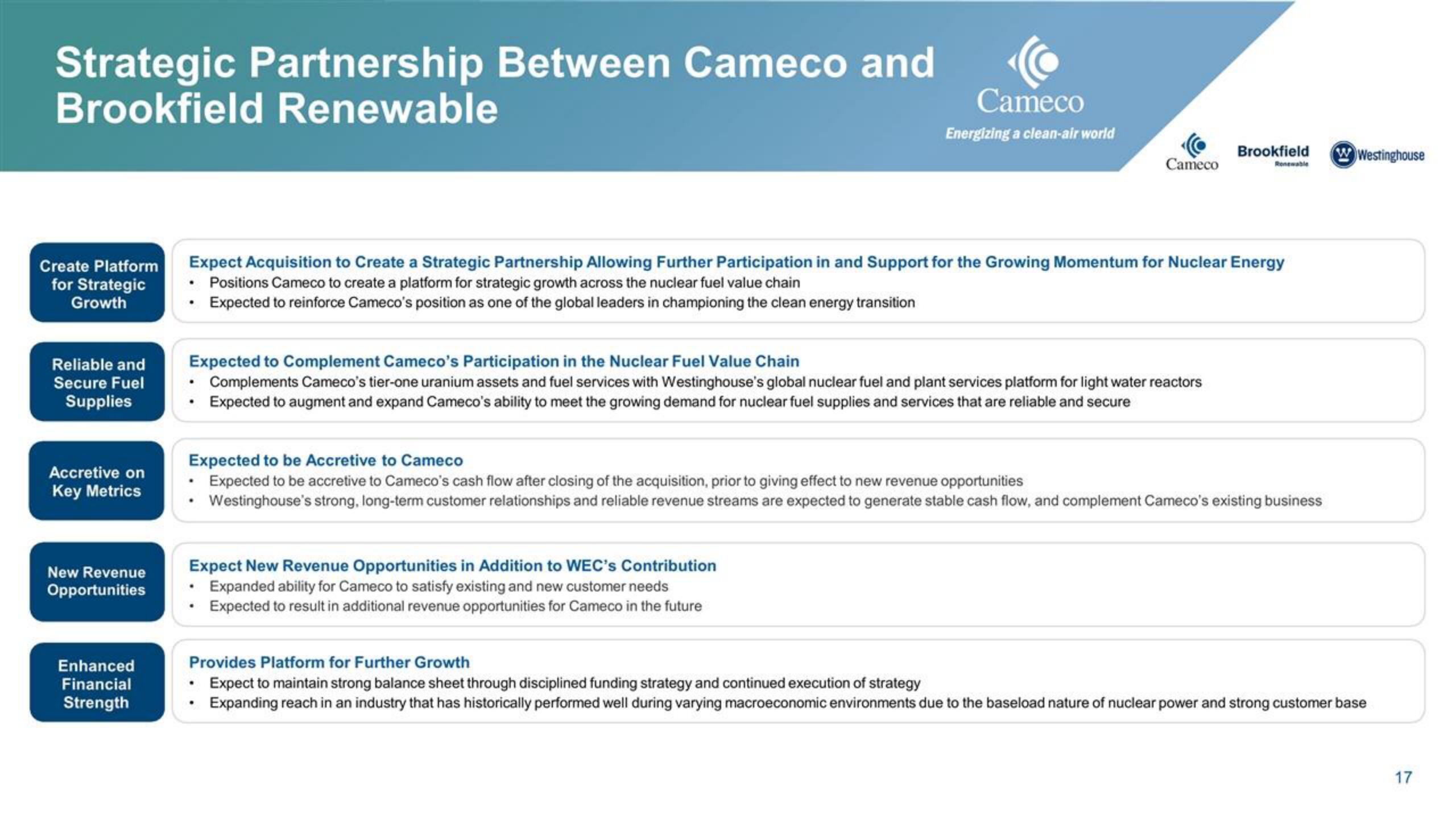

Strategic Partnership Between Cameco and

Brookfield Renewable

Create Platform

for Strategic

Growth

Reliable and

Secure Fuel

Supplies

Accretive on

Key Metrics

New Revenue

Opportunities

Enhanced

Financial

Strength

Cameco

Energizing a clean-air world

Cameco

Expected to Complement Cameco's Participation in the Nuclear Fuel Value Chain

• Complements Cameco's tier-one uranium assets and fuel services with Westinghouse's global nuclear fuel and plant services platform for light water reactors

• Expected to augment and expand Cameco's ability to meet the growing demand for nuclear fuel supplies and services that are reliable and secure

Expect New Revenue Opportunities in Addition to WEC's Contribution

• Expanded ability for Cameco to satisfy existing and new customer needs

• Expected to result in additional revenue opportunities for Cameco in the future

Brookfield WWestinghouse

Expect Acquisition to Create a Strategic Partnership Allowing Further Participation in and Support for the Growing Momentum for Nuclear Energy

• Positions Cameco to create a platform for strategic growth across the nuclear fuel value chain

• Expected to reinforce Cameco's position as one of the global leaders in championing the clean energy transition

Renewable

Expected to be Accretive to Cameco

• Expected to be accretive to Cameco's cash flow after closing of the acquisition, prior to giving effect to new revenue opportunities

Westinghouse's strong, long-term customer relationships and reliable revenue streams are expected to generate stable cash flow, and complement Cameco's existing business

Provides Platform for Further Growth

• Expect to maintain strong balance sheet through disciplined funding strategy and continued execution of strategy

• Expanding reach in an industry that has historically performed well during varying macroeconomic environments due to the baseload nature of nuclear power and strong customer base

17View entire presentation