Bunzl Results Presentation Deck

INCOME STATEMENT

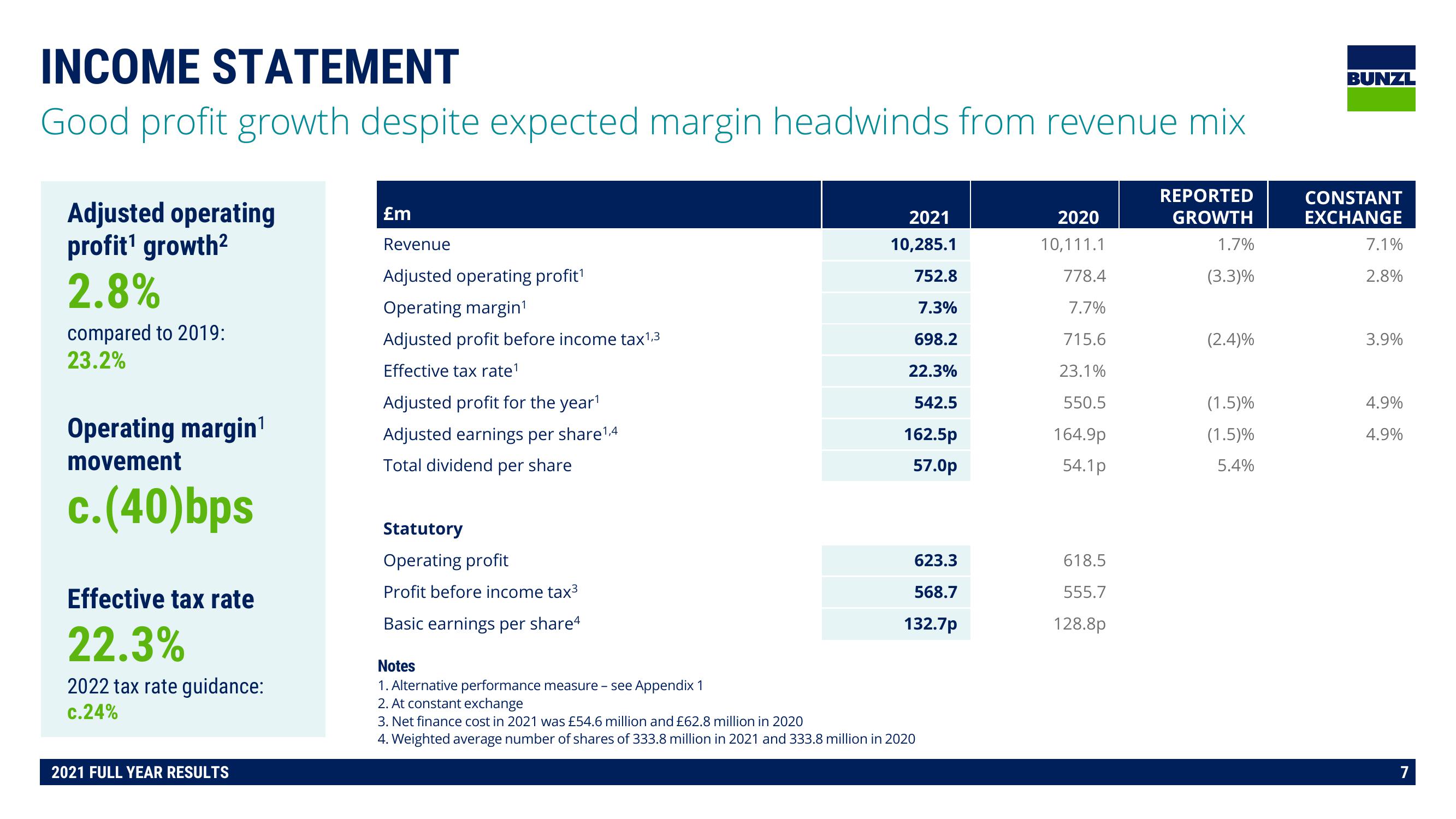

Good profit growth despite expected margin headwinds from revenue mix

Adjusted operating

profit¹ growth²

2.8%

compared to 2019:

23.2%

Operating margin¹

movement

c.(40)bps

Effective tax rate

22.3%

2022 tax rate guidance:

c.24%

2021 FULL YEAR RESULTS

£m

Revenue

Adjusted operating profit¹

Operating margin¹

Adjusted profit before income tax¹,3

Effective tax rate¹

Adjusted profit for the year¹

Adjusted earnings per share¹,4

Total dividend per share

Statutory

Operating profit

Profit before income tax³

Basic earnings per share4

2021

10,285.1

752.8

7.3%

698.2

22.3%

542.5

162.5p

57.0p

623.3

568.7

132.7p

Notes

1. Alternative performance measure - see Appendix 1

2. At constant exchange

3. Net finance cost in 2021 was £54.6 million and £62.8 million in 2020

4. Weighted average number of shares of 333.8 million in 2021 and 333.8 million in 2020

2020

10,111.1

778.4

7.7%

715.6

23.1%

550.5

164.9p

54.1p

618.5

555.7

128.8p

REPORTED

GROWTH

1.7%

(3.3)%

(2.4)%

(1.5)%

(1.5)%

5.4%

BUNZL

CONSTANT

EXCHANGE

7.1%

2.8%

3.9%

4.9%

4.9%

7View entire presentation