Ares U.S. Real Estate Opportunity Fund IV, L.P. (“AREOF IV”)

1

2

3

4

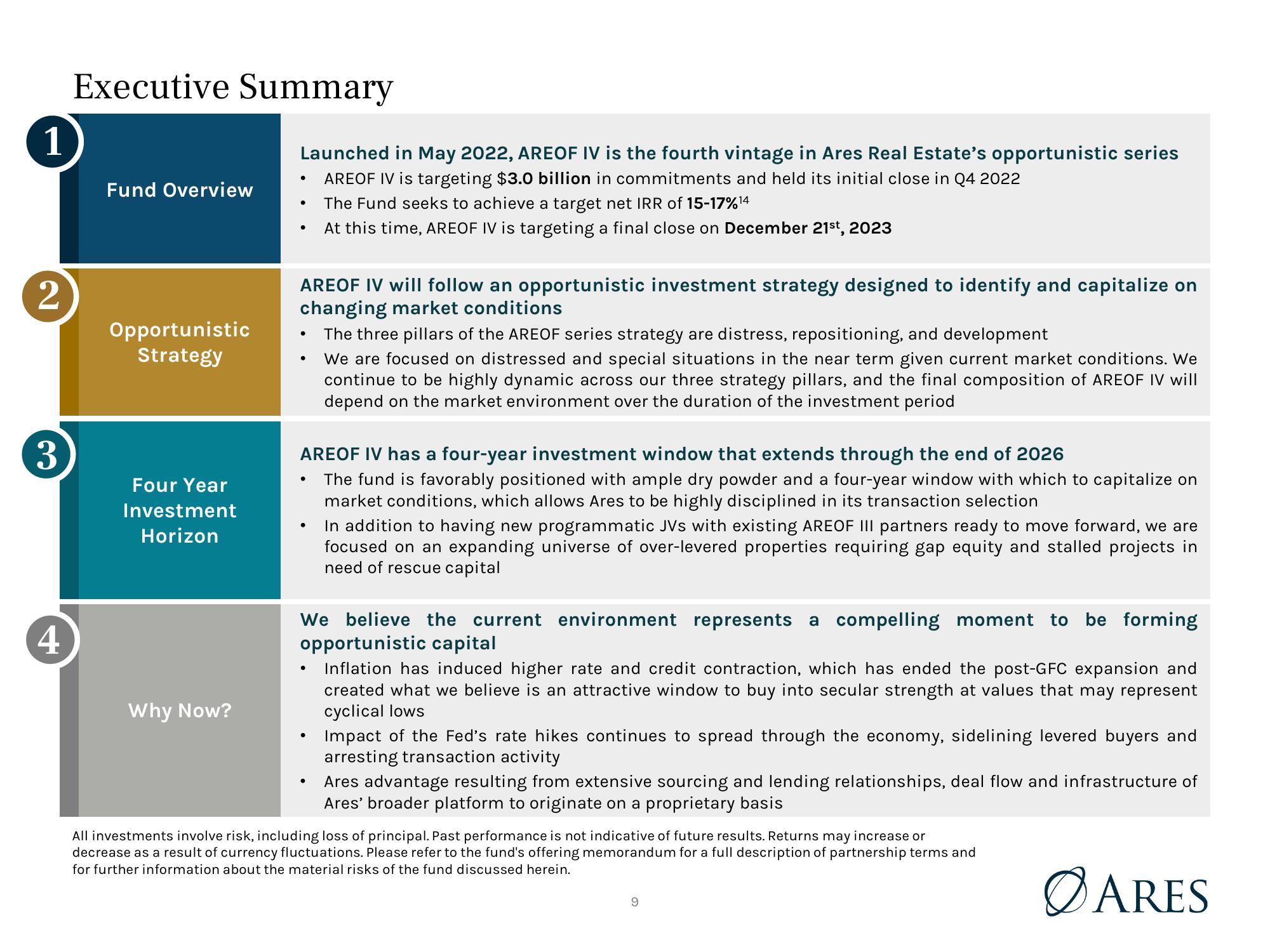

Executive Summary

Fund Overview

Opportunistic

Strategy

Four Year

Investment

Horizon

Why Now?

Launched in May 2022, AREOF IV is the fourth vintage in Ares Real Estate's opportunistic series

AREOF IV is targeting $3.0 billion in commitments and held its initial close in Q4 2022

The Fund seeks to achieve a target net IRR of 15-17% ¹4

At this time, AREOF IV is targeting a final close on December 21st, 2023

.

●

AREOF IV will follow an opportunistic investment strategy designed to identify and capitalize on

changing market conditions

AREOF IV has a four-year investment window that extends through the end of 2026

The fund is favorably positioned with ample dry powder and a four-year window with which to capitalize on

market conditions, which allows Ares to be highly disciplined in its transaction selection

●

The three pillars of the AREOF series strategy are distress, repositioning, and development

We are focused on distressed and special situations in the near term given current market conditions. We

continue to be highly dynamic across our three strategy pillars, and the final composition of AREOF IV will

depend on the market environment over the duration of the investment period

●

We believe the current environment represents a compelling moment to be forming

opportunistic capital

Inflation has induced higher rate and credit contraction, which has ended the post-GFC expansion and

created what we believe is an attractive window to buy into secular strength at values that may represent

cyclical lows

●

In addition to having new programmatic JVs with existing AREOF III partners ready to move forward, we are

focused on an expanding universe of over-levered properties requiring gap equity and stalled projects in

need of rescue capital

Impact of the Fed's rate hikes continues to spread through the economy, sidelining levered buyers and

arresting transaction activity

Ares advantage resulting from extensive sourcing and lending relationships, deal flow and infrastructure of

Ares' broader platform to originate on a proprietary basis

All investments involve risk, including loss of principal. Past performance is not indicative of future results. Returns may increase or

decrease as a result of currency fluctuations. Please refer to the fund's offering memorandum for a full description of partnership terms and

for further information about the material risks of the fund discussed herein.

9

ARESView entire presentation