Markforged SPAC Presentation Deck

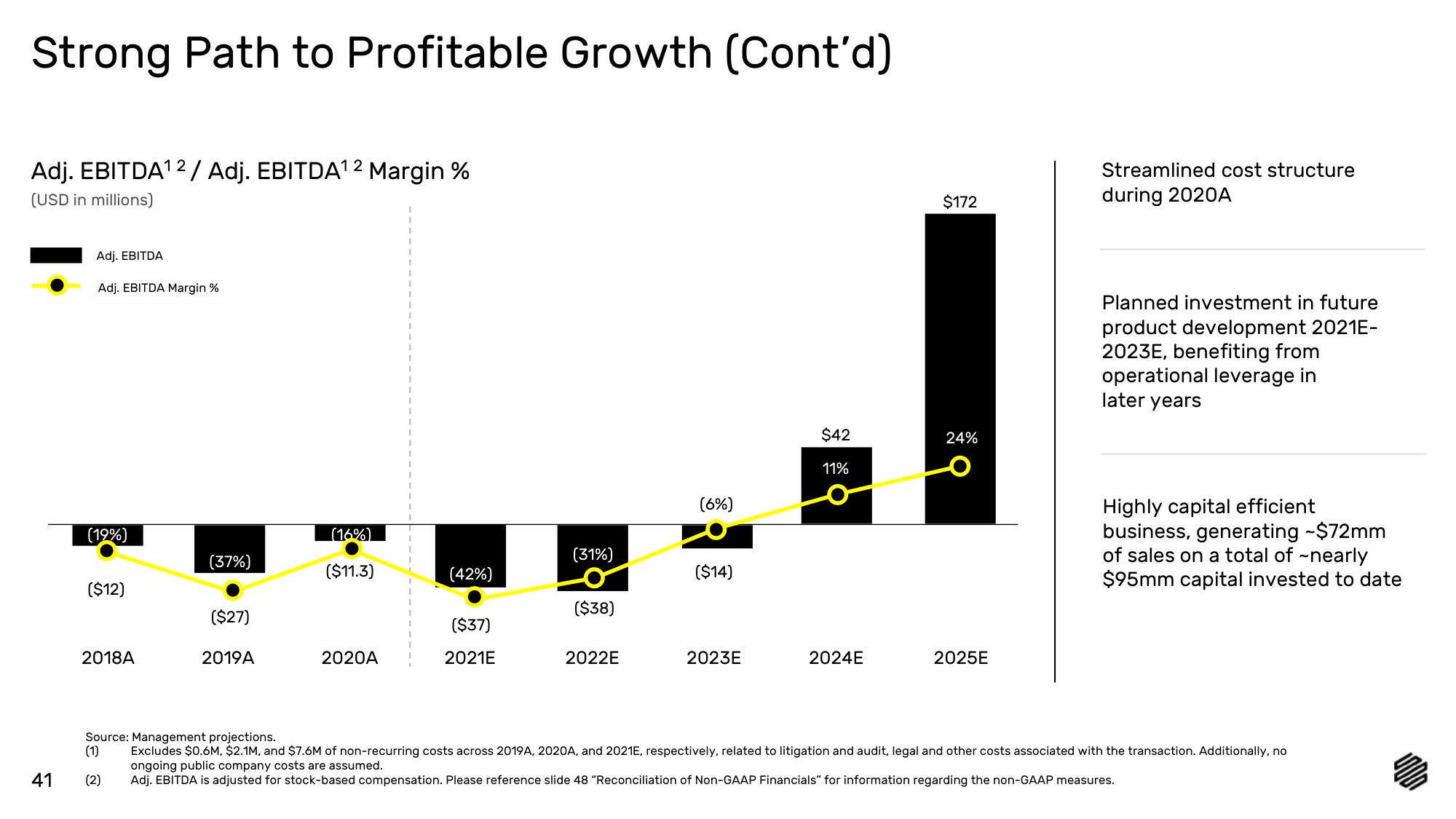

Strong Path to Profitable Growth (Cont'd)

Adj. EBITDA¹2 / Adj. EBITDA¹2 Margin %

(USD in millions)

41

Adj. EBITDA

Adj. EBITDA Margin %

(19%)

($12)

2018A

(37%)

($27)

2019A

(16%)

($11.3)

2020A

(42%)

($37)

2021E

(31%)

($38)

2022E

(6%)

($14)

2023E

$42

11%

2024E

$172

24%

2025E

Streamlined cost structure

during 2020A

Planned investment in future

product development 2021E-

2023E, benefiting from

operational leverage in

later years

Highly capital efficient

business, generating -$72mm

of sales on a total of -nearly

$95mm capital invested to date

Source: Management projections.

(1)

Excludes $0.6M, $2.1M, and $7.6M of non-recurring costs across 2019A, 2020A, and 2021E, respectively, related to litigation and audit, legal and other costs associated with the transaction. Additionally, no

ongoing public company costs are assumed.

(2)

Adj. EBITDA is adjusted for stock-based compensation. Please reference slide 48 "Reconciliation of Non-GAAP Financials" for information regarding the non-GAAP measures.View entire presentation