Spirit Mergers and Acquisitions Presentation Deck

》》》

10%

11%

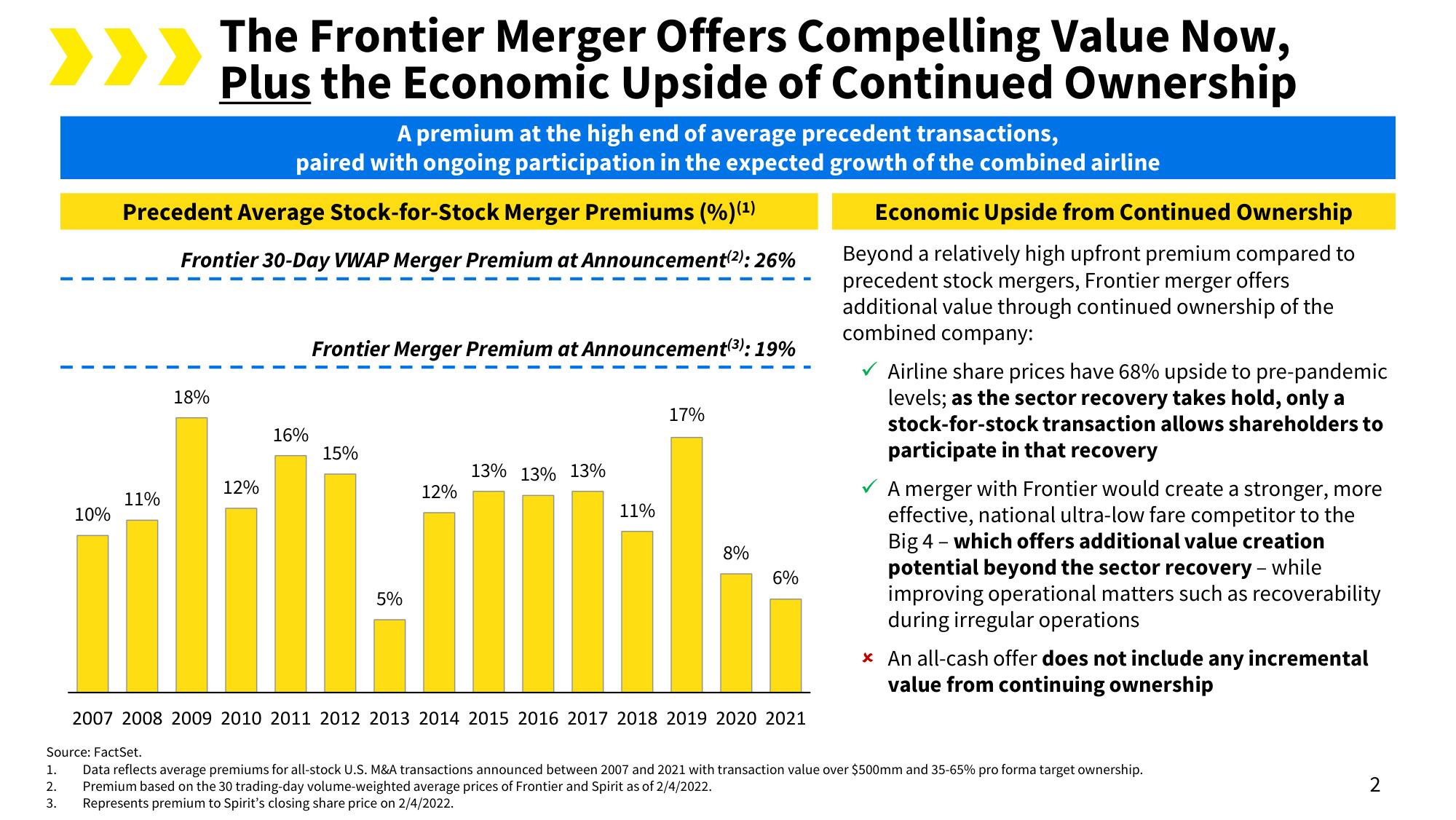

The Frontier Merger Offers Compelling Value Now,

Plus the Economic Upside of Continued Ownership

Precedent Average Stock-for-Stock Merger Premiums (%) (¹)

Frontier 30-Day VWAP Merger Premium at Announcement(2): 26%

18%

A premium at the high end of average precedent transactions,

paired with ongoing participation in the expected growth of the combined airline

12%

16%

Frontier Merger Premium at Announcement(3): 19%

15%

5%

12%

13% 13% 13%

11%

17%

8%

6%

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

Economic Upside from Continued Ownership

Beyond a relatively high upfront premium compared to

precedent stock mergers, Frontier merger offers

additional value through continued ownership of the

combined con bany:

✓ Airline share prices have 68% upside to pre-pandemic

levels; as the sector recovery takes hold, only a

stock-for-stock transaction allows shareholders to

participate in that recovery

A merger with Frontier would create a stronger, more

effective, national ultra-low fare competitor to the

Big 4 - which offers additional value creation

potential beyond the sector recovery - while

improving operational matters such as recoverability

during irregular operations

* An all-cash offer does not include any incremental

value from continuing ownership

Source: FactSet.

1.

Data reflects average premiums for all-stock U.S. M&A transactions announced between 2007 and 2021 with transaction value over $500mm and 35-65% pro forma target ownership.

Premium based on the 30 trading-day volume-weighted average prices of Frontier and Spirit as of 2/4/2022.

2.

3.

Represents premium to Spirit's closing share price on 2/4/2022.

2View entire presentation