Baird Investment Banking Pitch Book

Yield

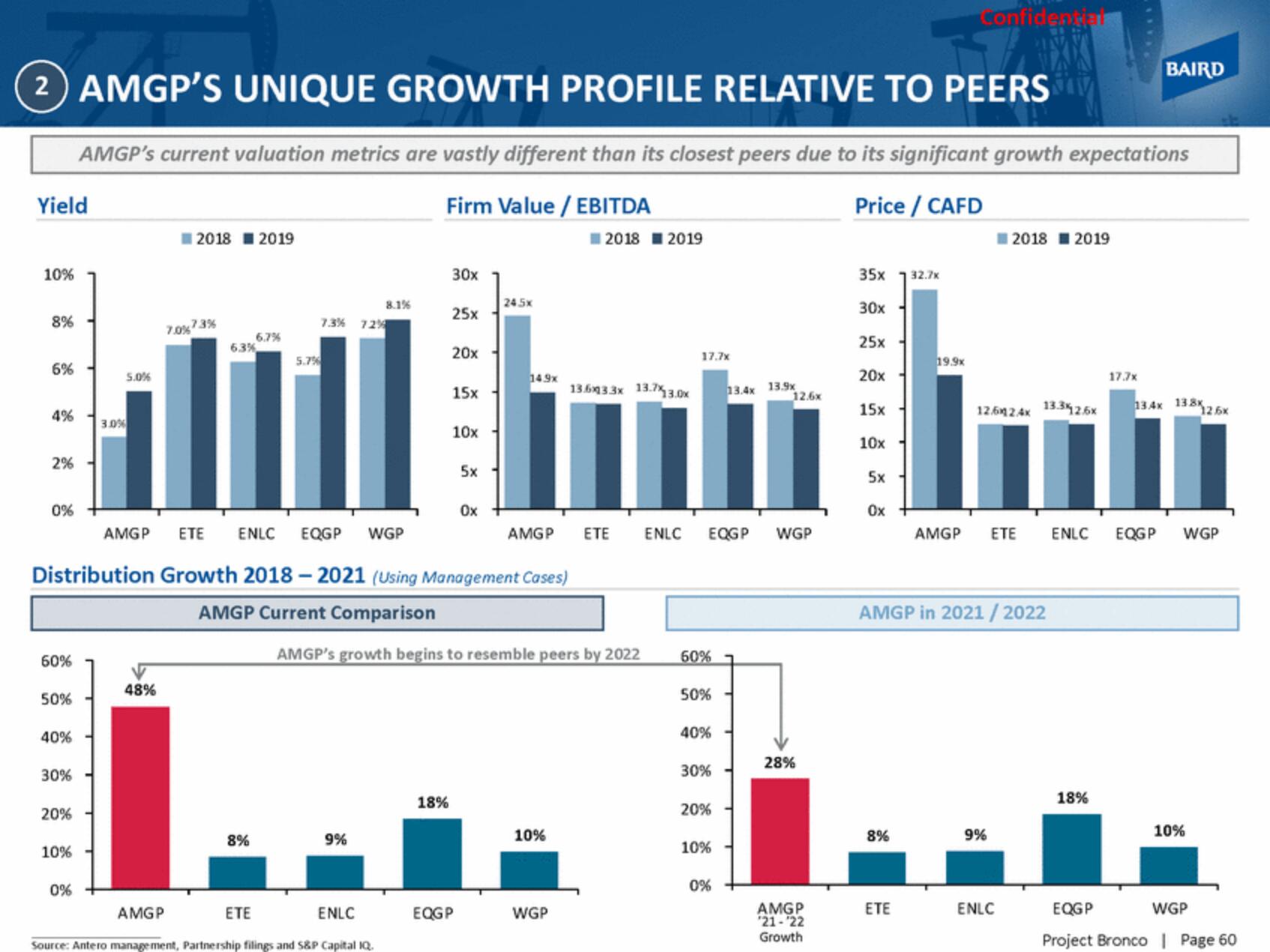

2) AMGP'S UNIQUE GROWTH PROFILE RELATIVE TO PEERS

AMGP's current valuation metrics are vastly different than its closest peers due to its significant growth expectations

Firm Value / EBITDA

Price / CAFD

10%

8%

6%

4%

2%

0%

60%

50%

40%

30%

20%

10%

5.0%

0%

3.0 %

2018 2019

48%

7.0% 7.3%

6.3%

6.7%

8%

ETE

7.3% 72%

5.7%

8.1%

AMGP ETE ENLC EQGP WGP

Distribution Growth 2018-2021 (Using Management Cases)

AMGP Current Comparison

9%

AMGP

ENLC

Source: Antero management, Partnership filings and S&P Capital IQ.

30x

25x

18%

20x

15x

10x

5x

Ox

EQGP

245,

14.9x

AMGP

AMGP's growth begins to resemble peers by 2022

10%

2018 2019

13.603.3x 13.7%13.0x

WGP

ΕΤΕ

ENLC

17.7x

60%

EQGP WGP

50%

40%

30%

20%

10%

13.4x 13.9x

0%

12.6x

28%

AMGP

'21-22

Growth

35x 32.7x

30x

25x

20x

15x

10x

5x

0x +

8%

19.9x

ETE

Confidential

AMGP

12.642.4x 13.3%2.5x

AMGP in 2021/2022

2018 2019

9%

ETE ENLC

ENLC

18%

BAIRD

17.7x

134x 138x

126x

EQGP WGP

10%

EQGP

WGP

Project Bronco | Page 60View entire presentation