PowerSchool Investor Presentation Deck

Non-GAAP Reconciliations

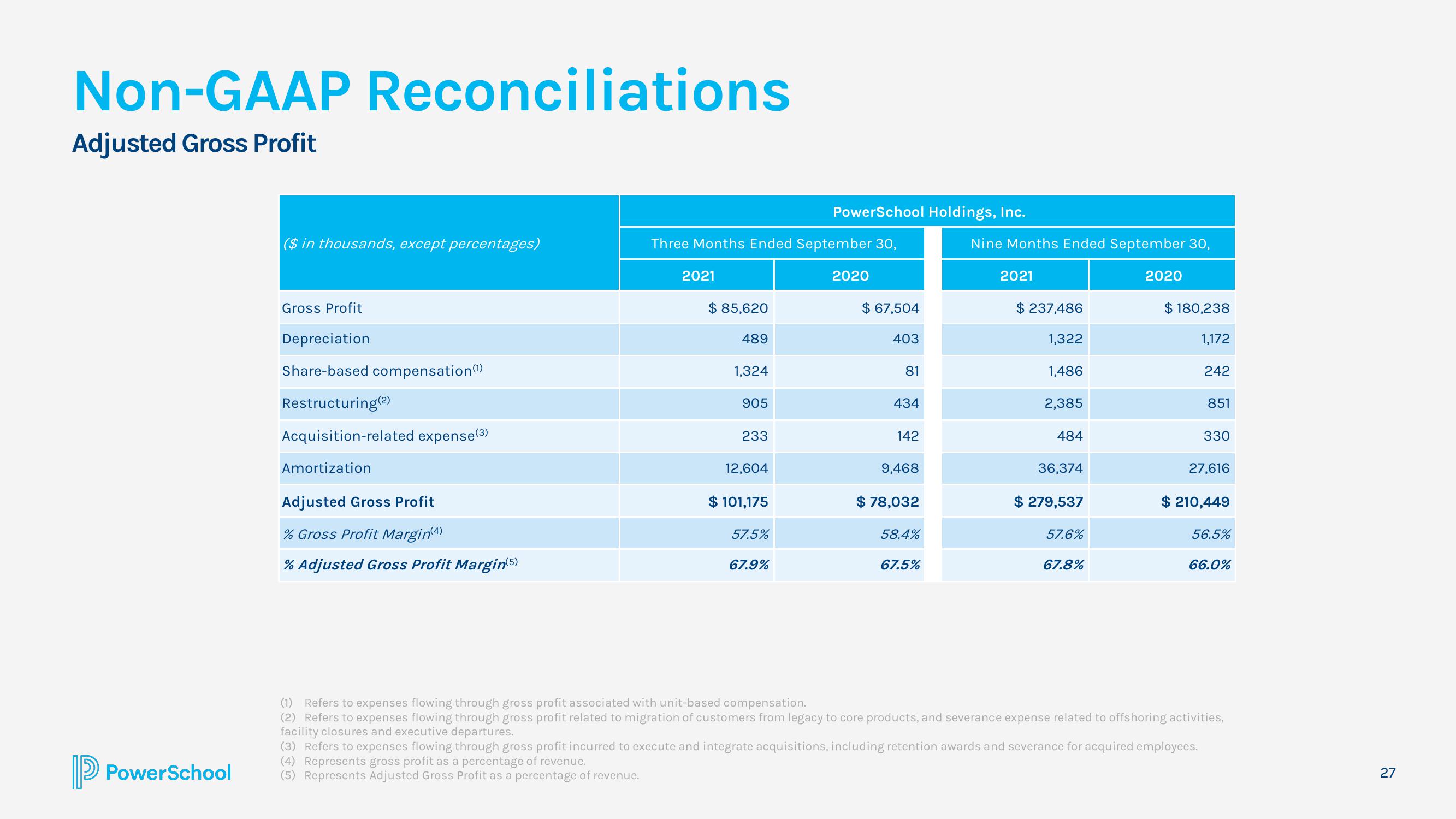

Adjusted Gross Profit

PowerSchool

($ in thousands, except percentages)

Gross Profit

Depreciation

Share-based compensation (¹)

Restructuring (2)

Acquisition-related expense(3)

Amortization

Adjusted Gross Profit

% Gross Profit Margin(4)

% Adjusted Gross Profit Margin(5)

Three Months Ended September 30,

2021

$ 85,620

489

1,324

905

233

12,604

$ 101,175

57.5%

PowerSchool Holdings, Inc.

67.9%

2020

$ 67,504

403

81

434

142

9,468

$ 78,032

58.4%

67.5%

Nine Months Ended September 30,

2021

$ 237,486

1,322

1,486

2,385

484

36,374

$ 279,537

57.6%

67.8%

2020

$ 180,238

1,172

242

851

330

27,616

$ 210,449

(3) Refers to expenses flowing through gross profit incurred to execute and integrate acquisitions, including retention awards and severance for acquired employees.

(4) Represents gross profit as a percentage of revenue.

(5) Represents Adjusted Gross Profit as a percentage of revenue.

56.5%

66.0%

(1) Refers to expenses flowing through gross profit associated with unit-based compensation.

(2) Refers to expenses flowing through gross profit related to migration of customers from legacy to core products, and severance expense related to offshoring activities,

facility closures and executive departures.

27View entire presentation