Playboy SPAC Presentation Deck

PLAYBOY 2020

25

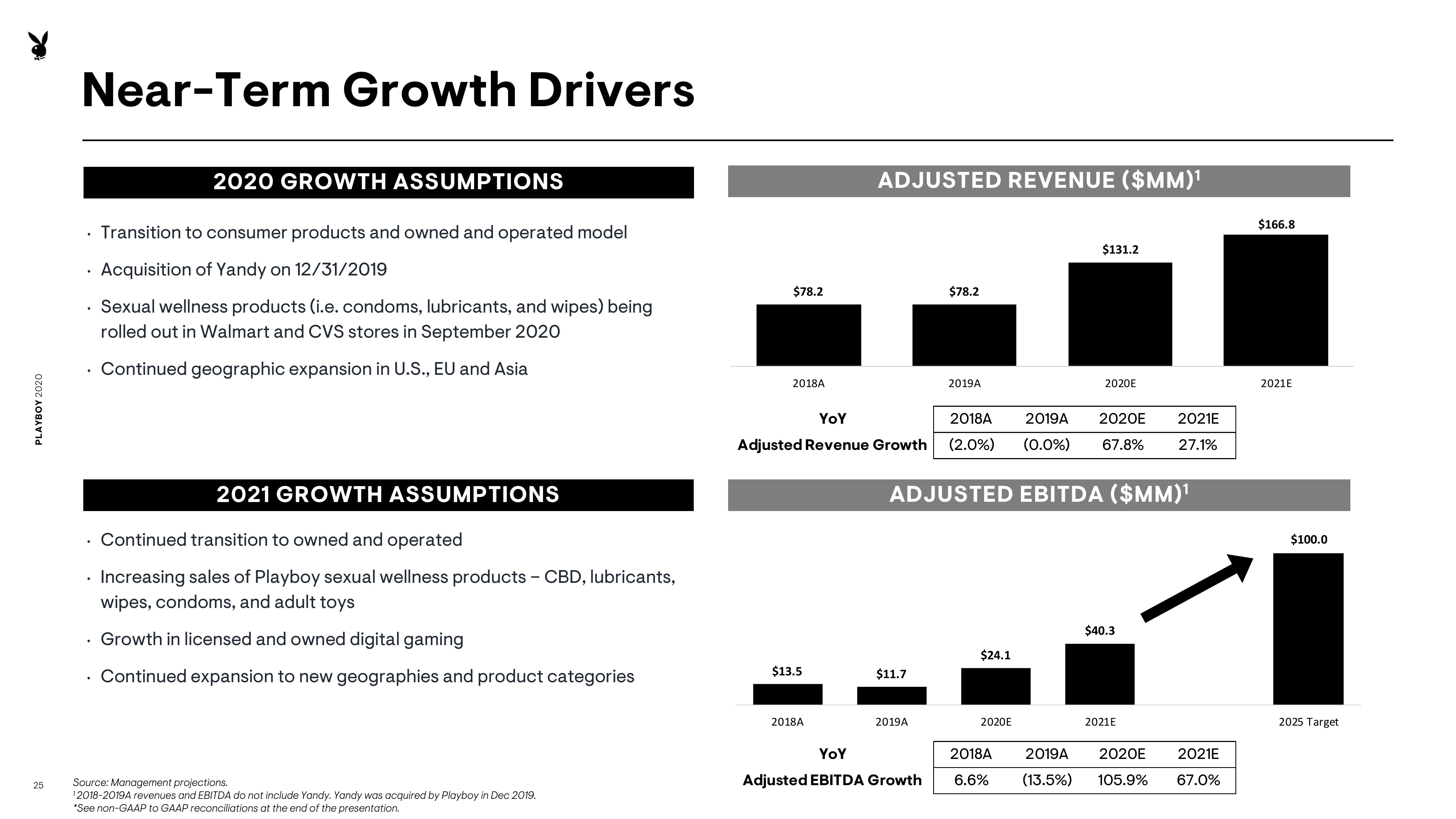

Near-Term Growth Drivers

2020 GROWTH ASSUMPTIONS

Transition to consumer products and owned and operated model

Acquisition of Yandy on 12/31/2019

Sexual wellness products (i.e. condoms, lubricants, and wipes) being

rolled out in Walmart and CVS stores in September 2020

. Continued geographic expansion in U.S., EU and Asia

2021 GROWTH ASSUMPTIONS

Continued transition to owned and operated

Increasing sales of Playboy sexual wellness products - CBD, lubricants,

wipes, condoms, and adult toys

. Growth in licensed and owned digital gaming

Continued expansion to new geographies and product categories

Source: Management projections.

12018-2019A revenues and EBITDA do not include Yandy. Yandy was acquired by Playboy in Dec 2019.

*See non-GAAP to GAAP reconciliations at the end of the presentation.

$78.2

2018A

$13.5

ADJUSTED REVENUE ($MM)¹

2018A

YOY

2018A

Adjusted Revenue Growth (2.0%)

$11.7

$78.2

2019A

2019A

2019A 2020E

(0.0%) 67.8%

ADJUSTED EBITDA ($MM)¹

YOY

Adjusted EBITDA Growth

$24.1

2020E

$131.2

2018A

6.6%

2020E

$40.3

2021E

2019A 2020E

(13.5%) 105.9%

2021E

27.1%

2021E

67.0%

$166.8

2021E

$100.0

2025 TargetView entire presentation