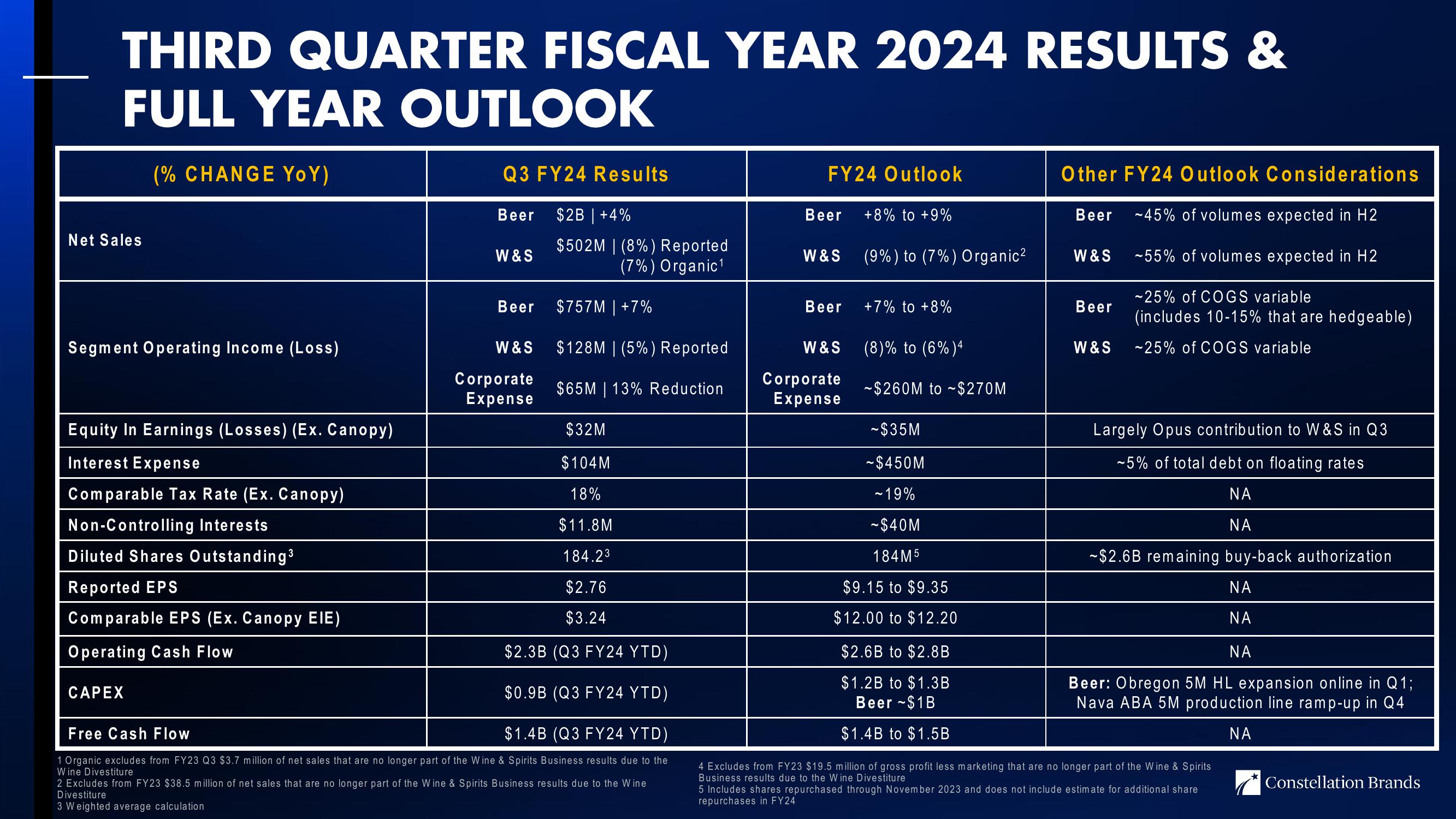

3Q24 Investor Update

THIRD QUARTER FISCAL YEAR 2024 RESULTS &

FULL YEAR OUTLOOK

(% CHANGE YoY)

Net Sales

Segment Operating Income (Loss)

Equity In Earnings (Losses) (Ex. Canopy)

Interest Expense

Comparable Tax Rate (Ex. Canopy)

Non-Controlling Interests

Diluted Shares Outstanding³

Reported EPS

Comparable EPS (Ex. Canopy EIE)

Operating Cash Flow

Q3 FY24 Results

$2B | +4%

$502M | (8%) Reported

(7%) Organic¹

CAPEX

$757M | +7%

$128M | (5%) Reported

$65M | 13% Reduction

$32M

$104 M

18%

$11.8M

184.2³

$2.76

$3.24

$2.3B (Q3 FY24 YTD)

$0.9B (Q3 FY24 YTD)

Free Cash Flow

$1.4B (Q3 FY24 YTD)

1 Organic excludes from FY23 Q3 $3.7 million of net sales that are no longer part of the Wine & Spirits Business results due to the

Wine Divestiture

Beer

W & S

Beer

W&S

Corporate

Expense

2 Excludes from FY23 $38.5 million of net sales that are no longer part of the Wine & Spirits Business results due to the Wine

Divestiture

3 Weighted average calculation

FY24 Outlook

Beer +8% to +9%

W&S

Beer

W&S

Corporate

Expense

(9%) to (7%) Organic²

+7% to +8%

(8)% to (6%)4

-$260M to $270M

-$35M

~$450M

- 19%

- $40M

184M5

$9.15 to $9.35

$12.00 to $12.20

$2.6B to $2.8B

$1.2B to $1.3B

Beer $1B

$1.4B to $1.5B

Other FY24 Outlook Considerations

~45% of volumes expected in H2

-55% of volumes expected in H2

-25% of COGS variable

(includes 10-15% that are hedgeable)

-25% of COGS variable

Beer

W&S

Beer

W & S

Largely Opus contribution to W&S in Q3

-5% of total debt on floating rates

ΝΑ

ΝΑ

~$2.6B remaining buy-back authorization

NA

ΝΑ

ΝΑ

Beer: Obregon 5M HL expansion online in Q1;

Nava ABA 5M production line ramp-up in Q4

ΝΑ

4 Excludes from FY23 $19.5 million of gross profit less marketing that are no longer part of the Wine & Spirits

Business results due to the Wine Divestiture

5 Includes shares repurchased through November 2023 and does not include estimate for additional share

repurchases in FY24

Constellation BrandsView entire presentation