Hagerty Investor Presentation Deck

TRANSPORT

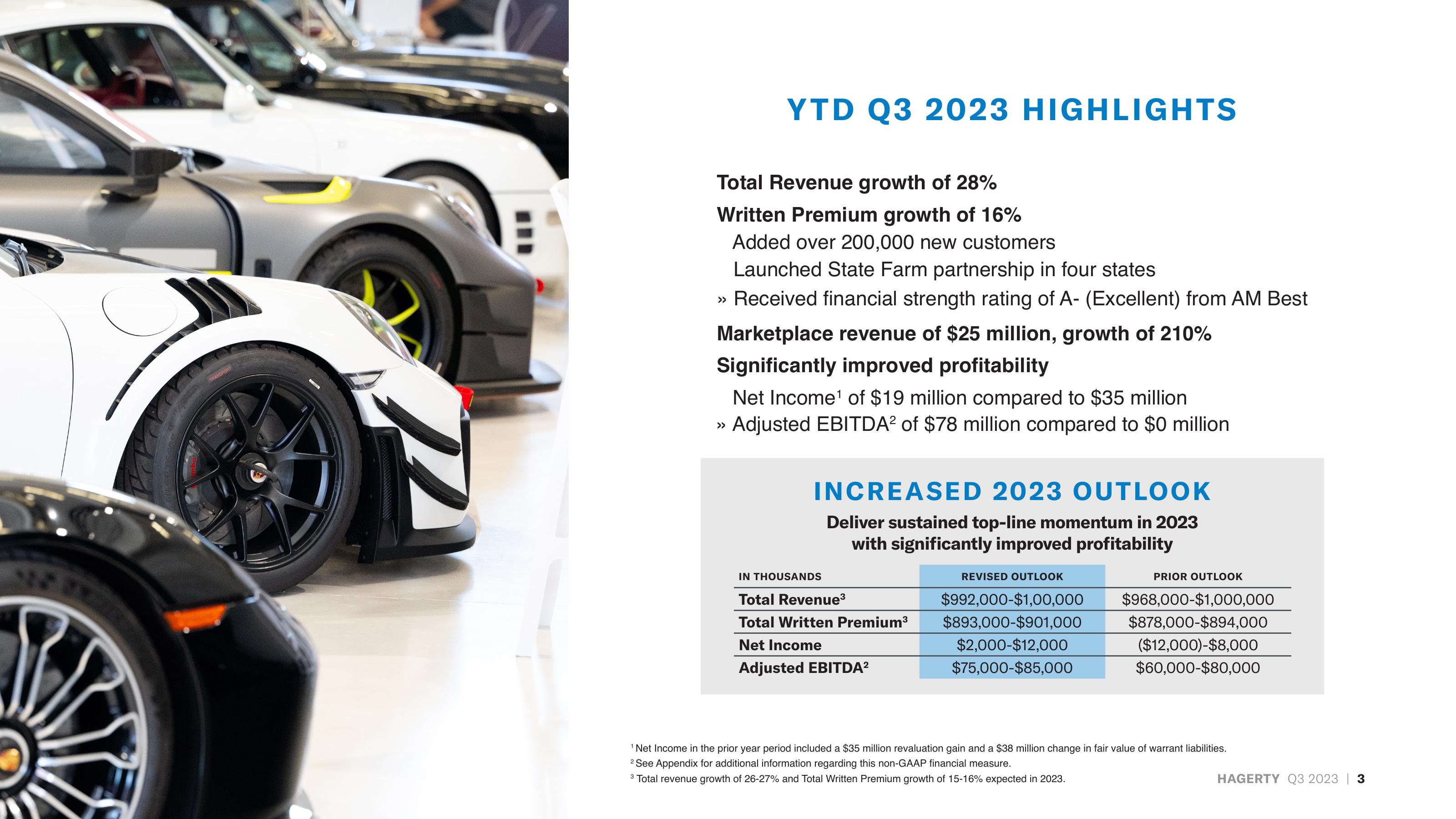

YTD Q3 2023 HIGHLIGHTS

Total Revenue growth of 28%

Written Premium growth of 16%

Added over 200,000 new customers

Launched State Farm partnership in four states

» Received financial strength rating of A- (Excellent) from AM Best

Marketplace revenue of $25 million, growth of 210%

Significantly improved profitability

Net Income¹ of $19 million compared to $35 million

Adjusted EBITDA² of $78 million compared to $0 million

INCREASED 2023 OUTLOOK

Deliver sustained top-line momentum in 2023

with significantly improved profitability

IN THOUSANDS

Total Revenue³

Total Written Premium³

Net Income

Adjusted EBITDA²

REVISED OUTLOOK

$992,000-$1,00,000

$893,000-$901,000

$2,000-$12,000

$75,000-$85,000

PRIOR OUTLOOK

$968,000-$1,000,000

$878,000-$894,000

($12,000)-$8,000

$60,000-$80,000

¹ Net Income in the prior year period included a $35 million revaluation gain and a $38 million change in fair value of warrant liabilities.

2 See Appendix for additional information regarding this non-GAAP financial measure.

3 Total revenue growth of 26-27% and Total Written Premium growth of 15-16% expected in 2023.

HAGERTY Q3 2023 | 3View entire presentation