WeWork Restructuring Presentation Deck

Transaction Summary

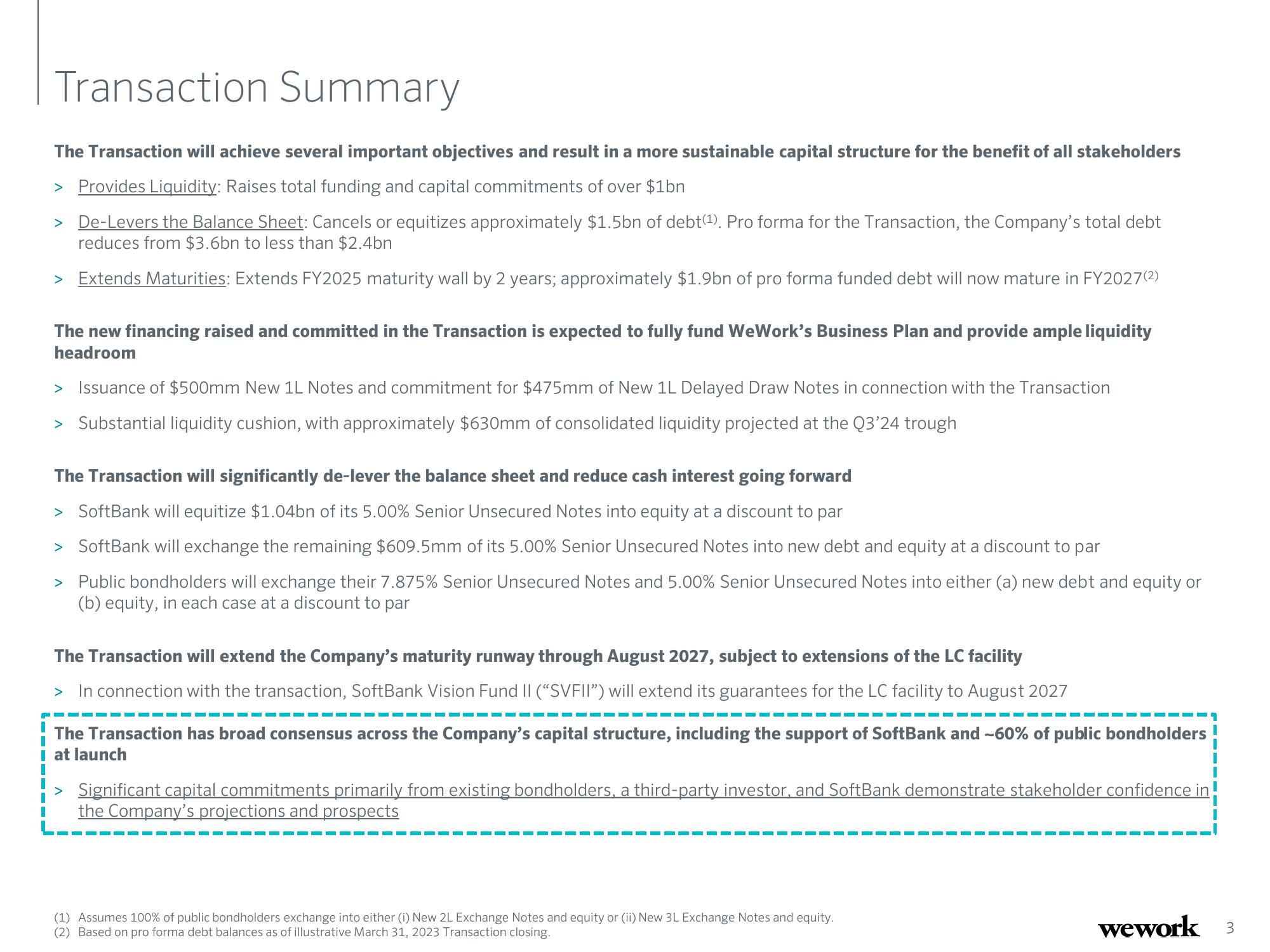

The Transaction will achieve several important objectives and result in a more sustainable capital structure for the benefit of all stakeholders

Provides Liquidity: Raises total funding and capital commitments of over $1bn

> De-Levers the Balance Sheet: Cancels or equitizes approximately $1.5bn of debt(¹). Pro forma for the Transaction, the Company's total debt

reduces from $3.6bn to less than $2.4bn

Extends Maturities: Extends FY2025 maturity wall by 2 years; approximately $1.9bn of pro forma funded debt will now mature in FY2027(2)

The new financing raised and committed in the Transaction is expected to fully fund WeWork's Business Plan and provide ample liquidity

headroom

> Issuance of $500mm New 1L Notes and commitment for $475mm of New 1L Delayed Draw Notes in connection with the Transaction

> Substantial liquidity cushion, with approximately $630mm of consolidated liquidity projected at the Q3'24 trough

The Transaction will significantly de-lever the balance sheet and reduce cash interest going forward

> SoftBank will equitize $1.04bn of its 5.00% Senior Unsecured Notes into equity at a discount to par

> SoftBank will exchange the remaining $609.5mm of its 5.00% Senior Unsecured Notes into new debt and equity at a discount to par

> Public bondholders will exchange their 7.875% Senior Unsecured Notes and 5.00% Senior Unsecured Notes into either (a) new debt and equity or

(b) equity, in each case at a discount to par

The Transaction will extend the Company's maturity runway through August 2027, subject to extensions of the LC facility

>

In connection with the transaction, SoftBank Vision Fund II ("SVFII") will extend its guarantees for the LC facility to August 2027

The Transaction has broad consensus across the Company's capital structure, including the support of SoftBank and -60% of public bondholders

I at launch

I

> Significant capital commitments primarily from existing bondholders, a third-party investor, and SoftBank demonstrate stakeholder confidence in

the Company's projections and prospects

I

(1) Assumes 100% of public bondholders exchange into either (i) New 2L Exchange Notes and equity or (ii) New 3L Exchange Notes and equity.

(2) Based on pro forma debt balances as of illustrative March 31, 2023 Transaction closing.

wework 3View entire presentation