Hostess Investor Presentation Deck

H♥

BRANDS

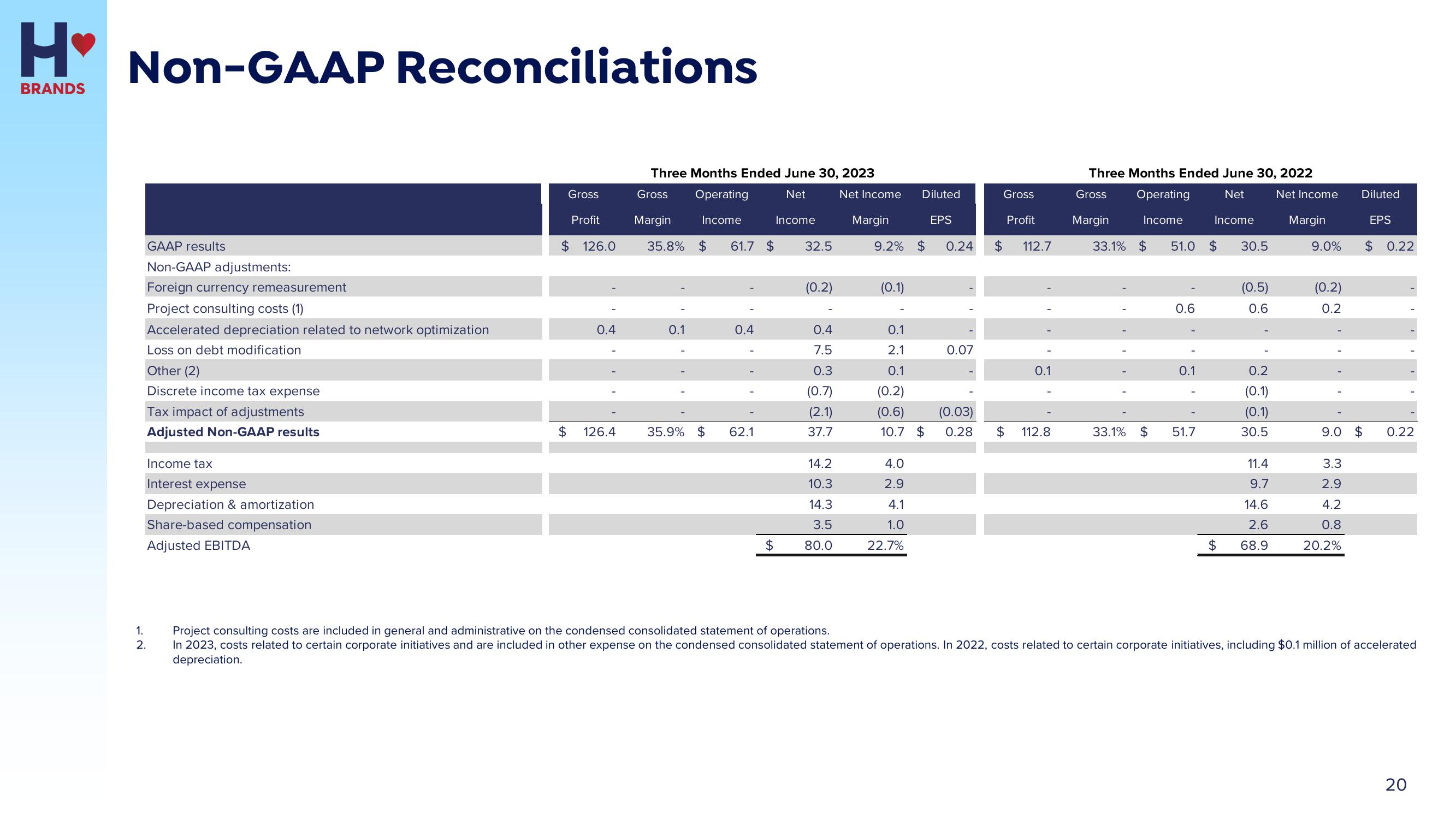

Non-GAAP Reconciliations

GAAP results

Non-GAAP adjustments:

Foreign currency remeasurement

Project consulting costs (1)

Accelerated depreciation related to network optimization

Loss on debt modification

Other (2)

Discrete income tax expense

Tax impact of adjustments

Adjusted Non-GAAP results

Income tax

Interest expense

Depreciation & amortization

Share-based compensation

Adjusted EBITDA

1.

2.

Gross

Profit

$126.0

0.4

$ 126.4

Three Months Ended June 30, 2023

Net Income

Net

Gross

Margin

35.8% $ 61.7 $

Operating

Income

0.1

0.4

35.9% $ 62.1

$

Income

32.5

(0.2)

0.4

7.5

0.3

(0.7)

(2.1)

37.7

14.2

10.3

14.3

3.5

80.0

Margin

9.2% $ 0.24 $

(0.1)

Diluted

EPS

4.0

2.9

4.1

1.0

22.7%

Gross

Profit

0.1

2.1

0.1

(0.2)

(0.6)

(0.03)

10.7 $ 0.28 $ 112.8

0.07

112.7

0.1

Three Months Ended June 30, 2022

Gross Operating Net Net Income

Margin Income

Margin

33.1% $

33.1% $

51.0 $

0.6

0.1

Income

51.7

$

30.5

(0.5)

0.6

0.2

(0.1)

(0.1)

30.5

11.4

9.7

14.6

2.6

68.9

9.0%

(0.2)

0.2

9.0

3.3

2.9

4.2

0.8

20.2%

Diluted

$

EPS

$ 0.22

0.22

Project consulting costs are included in general and administrative on the condensed consolidated statement of operations.

In 2023, costs related to certain corporate initiatives and are included in other expense on the condensed consolidated statement of operations. In 2022, costs related to certain corporate initiatives, including $0.1 million of accelerated

depreciation.

20View entire presentation