NuStar Energy Investor Conference Presentation Deck

NuStar

Crude Supply/Export

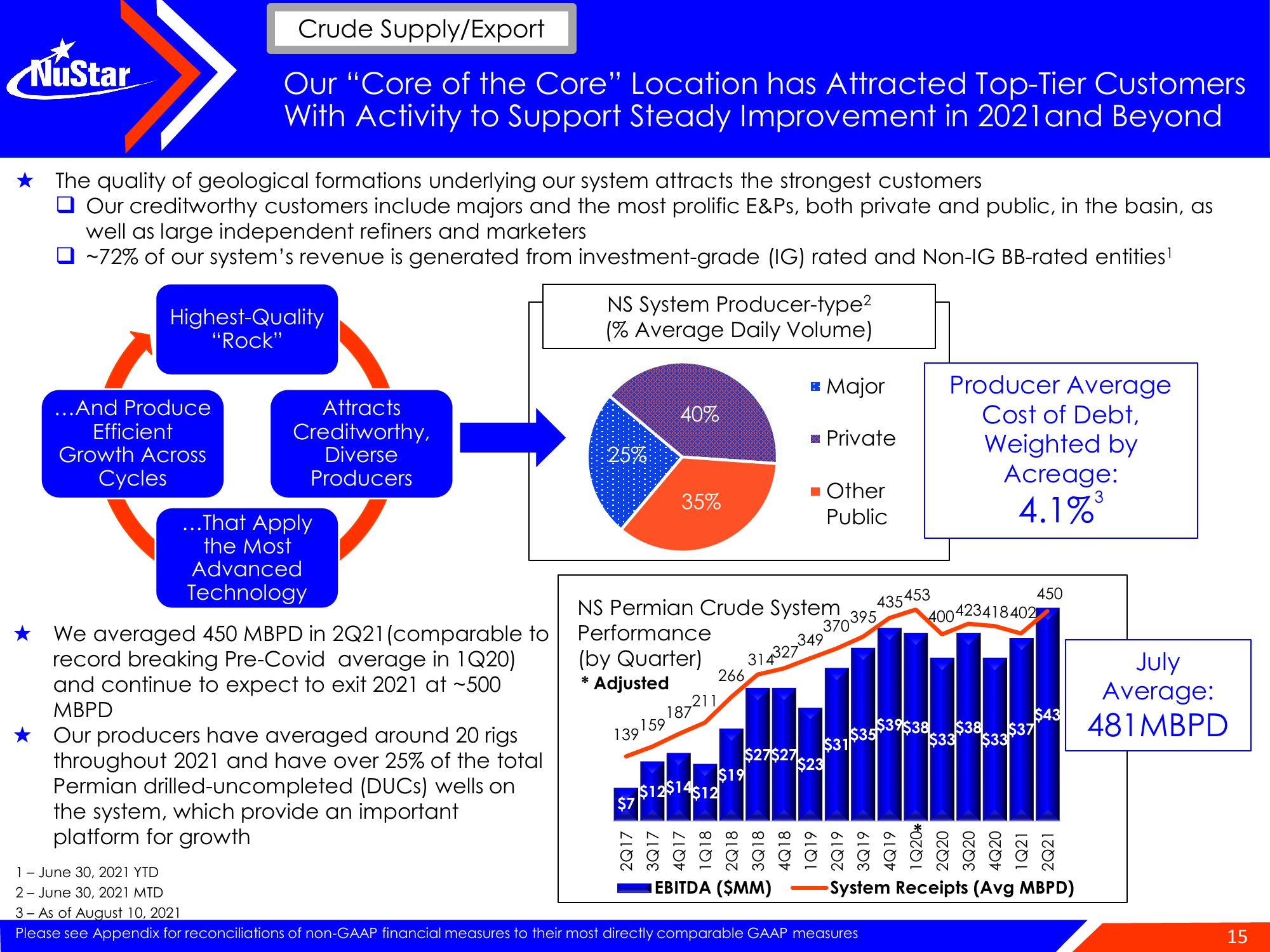

Our "Core of the Core" Location has Attracted Top-Tier Customers

With Activity to Support Steady Improvement in 2021 and Beyond

The quality of geological formations underlying our system attracts the strongest customers

Our creditworthy customers include majors and the most prolific E&Ps, both private and public, in the basin, as

well as large independent refiners and marketers

~72% of our system's revenue is generated from investment-grade (IG) rated and Non-IG BB-rated entities¹

Highest-Quality

"Rock"

...And Produce

Efficient

Growth Across

Cycles

Attracts

Creditworthy,

Diverse

Producers

...That Apply

the Most

Advanced

Technology

We averaged 450 MBPD in 2Q21 (comparable to

record breaking Pre-Covid average in 1Q20)

and continue to expect to exit 2021 at ~500

MBPD

Our producers have averaged around 20 rigs

throughout 2021 and have over 25% of the total

Permian drilled-uncompleted (DUCs) wells on

the system, which provide an important

platform for growth

NS System Producer-type²

(% Average Daily Volume)

25%

40%

$7

35%

(by Quarter)

*

*Adjusted

139159

2Q17

NS Permian Crude System

Performance

349

266

187211

314327

$12$14$12

$19

Major

■ Private

■ Other

Public

EBITDA ($MM)

$31

$27$27

$23

370395

1 - June 30, 2021 YTD

2 June 30, 2021 MTD

3- As of August 10, 2021

Please see Appendix for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures

435453

Producer Average

Cost of Debt,

Weighted by

Acreage:

3

4.1%³

400423418402

$38

$33 $33

$37

450

$43

-System Receipts (Avg MBPD)

July

Average:

481MBPD

15View entire presentation