LSE Investor Presentation Deck

London

Stock Exchange Group

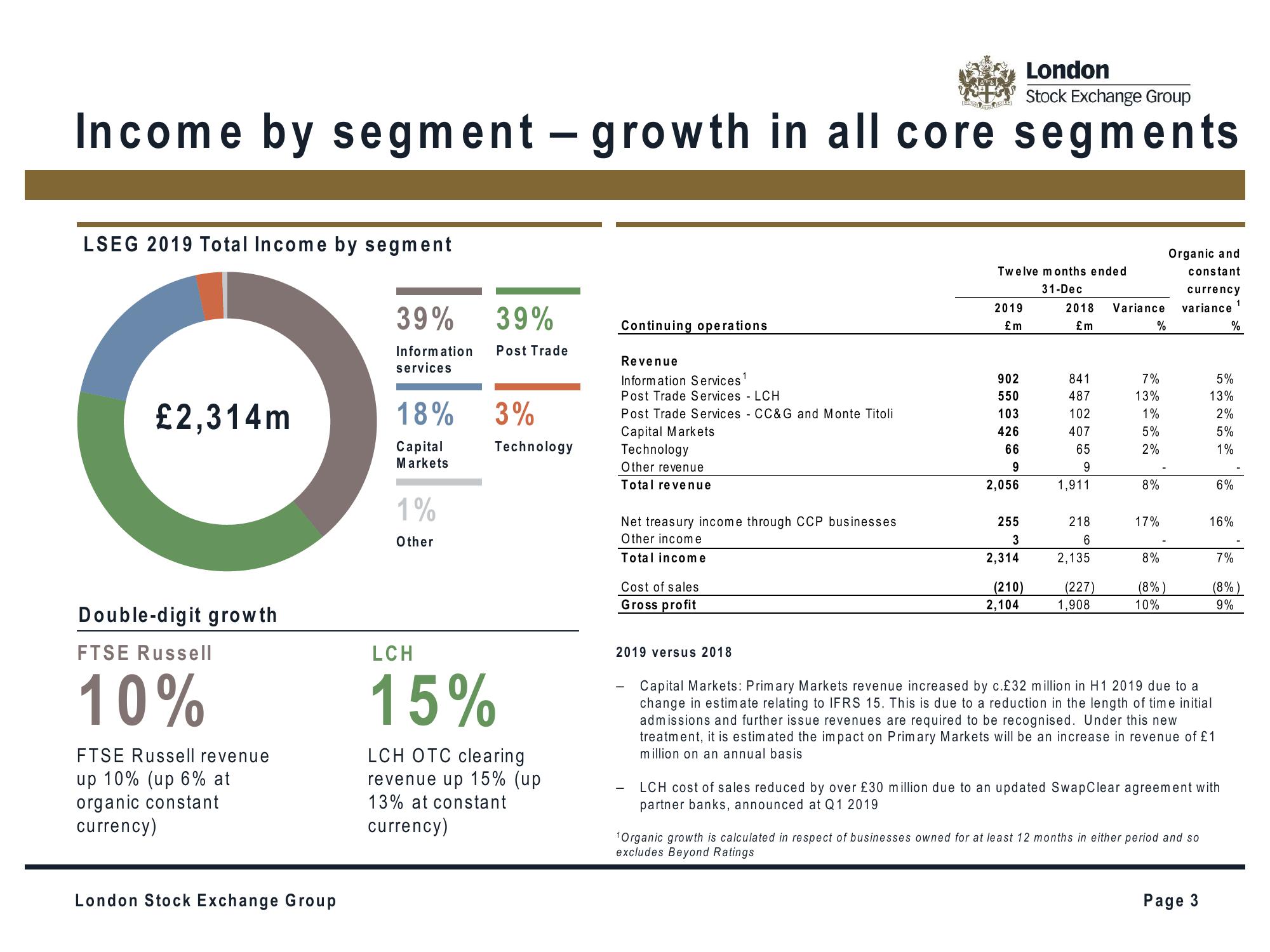

Income by segment - growth in all core segments

LSEG 2019 Total Income by segment

C

£2,314m

Double-digit growth

FTSE Russell

10%

FTSE Russell revenue

up 10% (up 6% at

organic constant

currency)

London Stock Exchange Group

39%

39%

Information Post Trade

services

18%

Capital

Markets

1%

Other

3%

Technology

LCH

15%

LCH OTC clearing

revenue up 15% (up

13% at constant

currency)

Continuing operations

Revenue

Information Services¹

Post Trade Services LCH

Post Trade Services CC&G and Monte Titoli

Capital Markets

Technology

Other revenue

Total revenue

Net treasury income through CCP businesses

Other income

Total income

Cost of sales

Gross profit

2019 versus 2018

Twelve months ended

31-Dec

2019

£m

902

550

103

426

66

9

2,056

255

3

2,314

(210)

Organic and

constant

currency

2018 Variance variance

£m

2,104

841

487

102

407

65

9

1,911

218

6

2,135

(227)

1,908

%

7%

13%

1%

5%

2%

8%

17%

8%

(8%)

10%

1Organic growth is calculated in respect of businesses owned for at least 12 months in either period and so

excludes Beyond Ratings

5%

13%

2%

5%

1%

Capital Markets: Primary Markets revenue increased by c.£32 million in H1 2019 due to a

change in estimate relating to IFRS 15. This is due to a reduction in the length of time initial

admissions and further issue revenues are required to be recognised. Under this new

treatment, it is estimated the impact on Primary Markets will be an increase in revenue of £1

million on an annual basis

Page 3

%

6%

16%

LCH cost of sales reduced by over £30 million due to an updated SwapClear agreement with

partner banks, announced at Q1 2019

7%

1

(8%)

9%View entire presentation