Dave Results Presentation Deck

Adjusted EBITDA

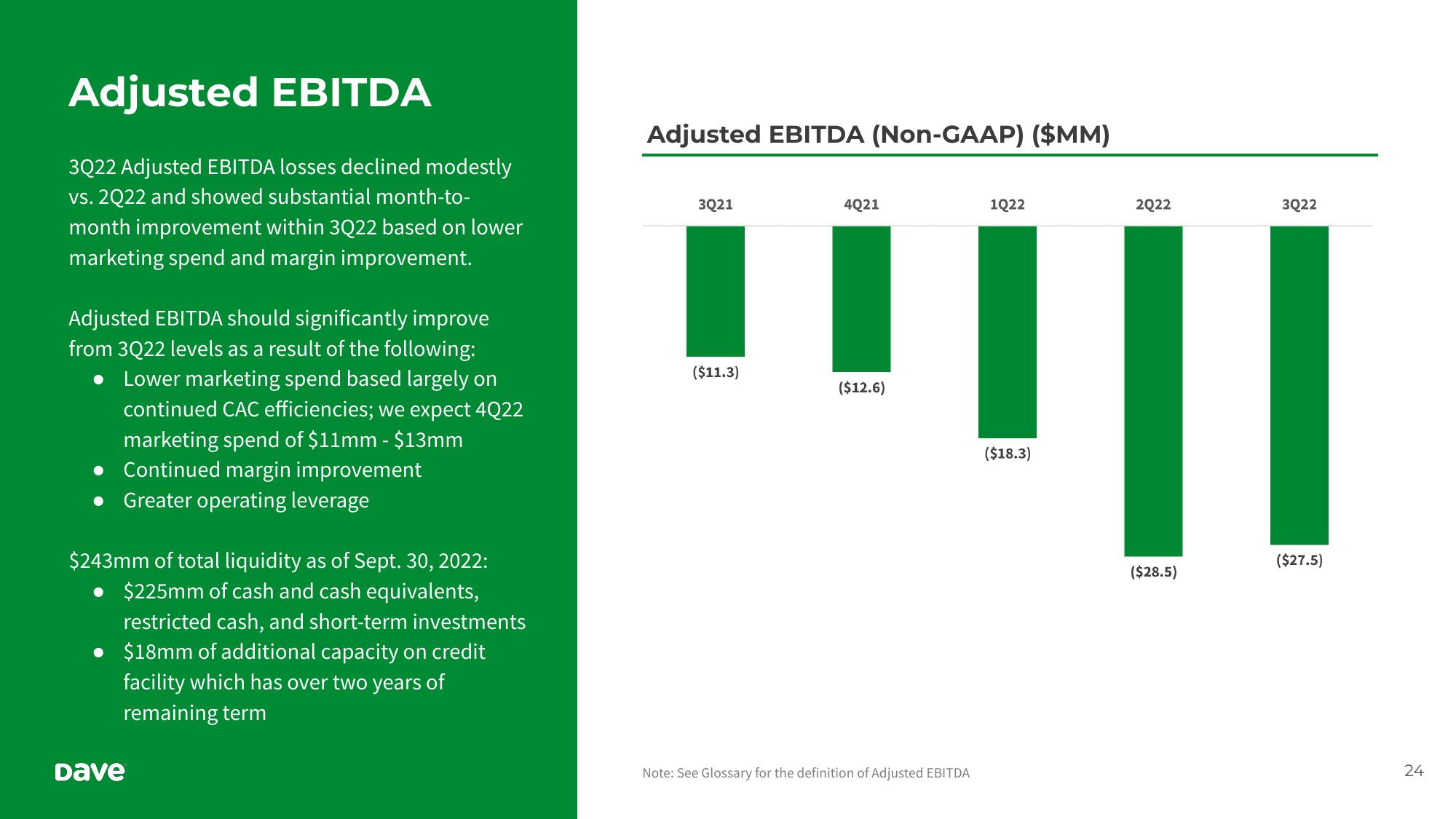

3Q22 Adjusted EBITDA losses declined modestly

vs. 2Q22 and showed substantial month-to-

month improvement within 3Q22 based on lower

marketing spend and margin improvement.

Adjusted EBITDA should significantly improve

from 3Q22 levels as a result of the following:

• Lower marketing spend based largely on

continued CAC efficiencies; we expect 4Q22

marketing spend of $11mm - $13mm

• Continued margin improvement

• Greater operating leverage

$243mm of total liquidity as of Sept. 30, 2022:

$225mm of cash and cash equivalents,

restricted cash, and short-term investments

$18mm of additional capacity on credit

facility which has over two years of

remaining term

Dave

Adjusted EBITDA (Non-GAAP) ($MM)

3Q21

($11.3)

4Q21

($12.6)

Note: See Glossary for the definition of Adjusted EBITDA

1Q22

($18.3)

2Q22

($28.5)

3Q22

($27.5)

24View entire presentation