Whitebread Annual Update

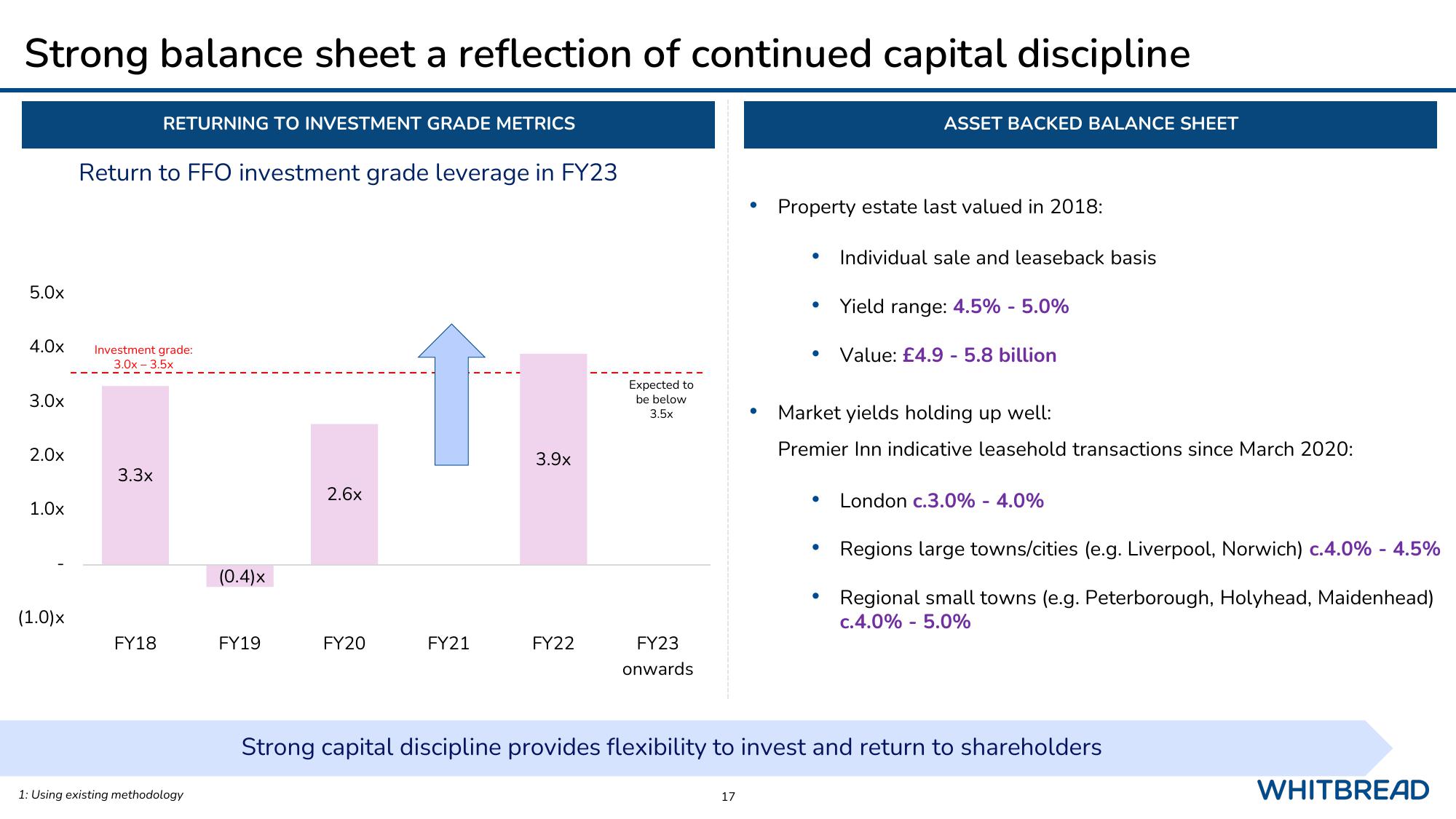

Strong balance sheet a reflection of continued capital discipline

5.0x

3.0x

4.0x Investment grade:

3.0x3.5x

2.0x

1.0x

(1.0)x

Return to FFO investment grade leverage in FY23

RETURNING TO INVESTMENT GRADE METRICS

3.3x

FY18

1: Using existing methodology

(0.4)x

FY19

2.6x

FY20

FY21

3.9x

FY22

Expected to

be below.

3.5x

FY23

onwards

17

ASSET BACKED BALANCE SHEET

Property estate last valued in 2018:

● Individual sale and leaseback basis

Yield range: 4.5% - 5.0%

Value: £4.9 5.8 billion

Market yields holding up well:

Premier Inn indicative leasehold transactions since March 2020:

London c.3.0% - 4.0%

Regions large towns/cities (e.g. Liverpool, Norwich) c.4.0% - 4.5%

Regional small towns (e.g. Peterborough, Holyhead, Maidenhead)

c.4.0% 5.0%

-

Strong capital discipline provides flexibility to invest and return to shareholders

WHITBREADView entire presentation