Bausch+Lomb Results Presentation Deck

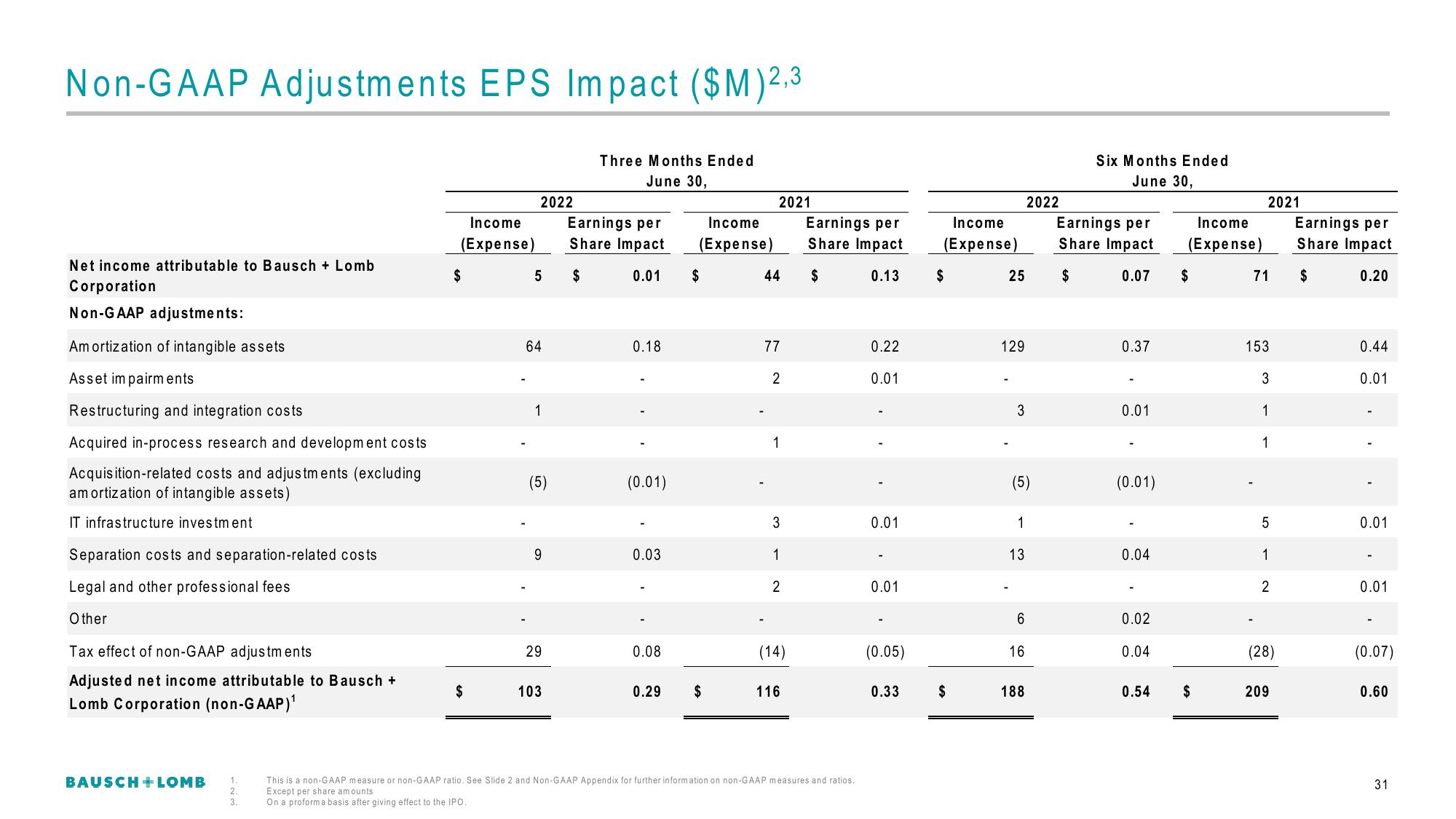

Non-GAAP Adjustments EPS Impact ($M) 2,3

Three Months Ended

June 30,

Net income attributable to Bausch + Lomb

Corporation

Non-GAAP adjustments:

Amortization of intangible assets

Asset impairments

Restructuring and integration costs

Acquired in-process research and development costs

Acquisition-related costs and adjustments (excluding

amortization of intangible assets)

IT infrastructure investment

Separation costs and separation-related costs

Legal and other professional fees

Other

Tax effect of non-GAAP adjustments

Adjusted net income attributable to Bausch +

Lomb Corporation (non-GAAP)¹

BAUSCH + LOMB

1.

2.

3.

Income

(Expense)

$

$

2022

5

64

1

(5)

9

29

103

Earnings per

Share Impact

$

0.01

0.18

(0.01)

0.03

0.08

0.29

Income

(Expense)

$

$

2021

44

77

2

1

3

1

2

(14)

116

Earnings per

Share Impact

0.13

$

This is a non-GAAP measure or non-GAAP ratio. See Slide 2 and Non-GAAP Appendix for further information on non-GAAP measures and ratios.

Except per share amounts

On a proforma basis after giving effect to the IPO.

0.22

0.01

0.01

0.01

(0.05)

0.33

Income

(Expense)

$

$

25

129

3

2022

(5)

1

13

6

16

188

Six Months Ended

June 30,

Earnings per

Share Impact

$

0.07

0.37

0.01

(0.01)

0.04

0.02

0.04

0.54

Income

(Expense)

$

$

2021

71

153

3

1

1

5

1

2

(28)

209

Earnings per

Share Impact

$

0.20

0.44

0.01

1

0.01

0.01

(0.07)

0.60

31View entire presentation