TPG Results Presentation Deck

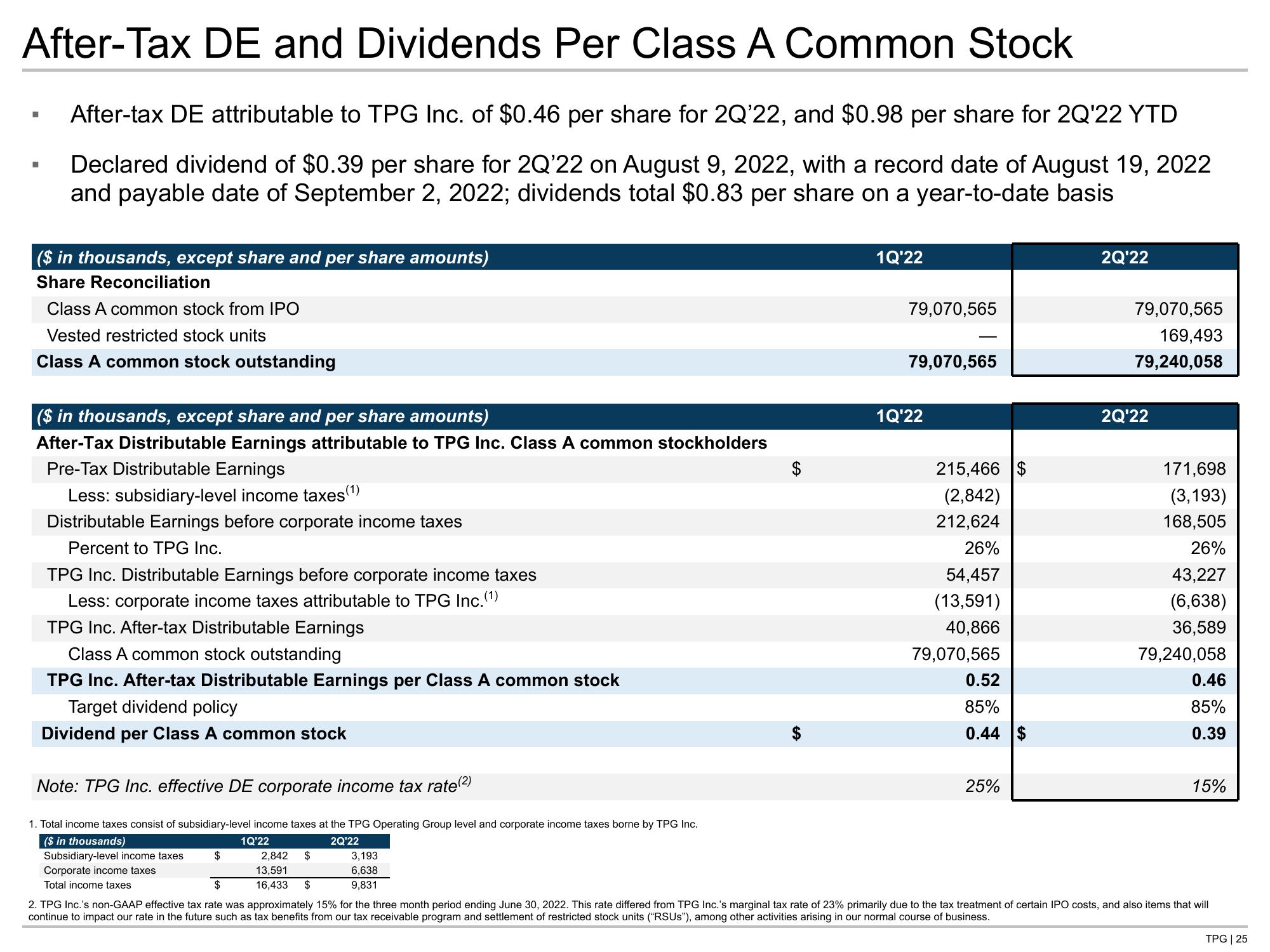

After-Tax DE and Dividends Per Class A Common Stock

After-tax DE attributable to TPG Inc. of $0.46 per share for 2Q'22, and $0.98 per share for 2Q'22 YTD

Declared dividend of $0.39 per share for 2Q'22 on August 9, 2022, with a record date of August 19, 2022

and payable date of September 2, 2022; dividends total $0.83 per share on a year-to-date basis

■

■

($ in thousands, except share and per share amounts)

Share Reconciliation

Class A common stock from IPO

Vested restricted stock units

Class A common stock outstanding

($ in thousands, except share and per share amounts)

After-Tax Distributable Earnings attributable to TPG Inc. Class A common stockholders

Pre-Tax Distributable Earnings

Less: subsidiary-level income taxes (1)

Distributable Earnings before corporate income taxes

Percent to TPG Inc.

TPG Inc. Distributable Earnings before corporate income taxes

Less: corporate income taxes attributable to TPG Inc. (¹)

TPG Inc. After-tax Distributable Earnings

Class A common stock outstanding

TPG Inc. After-tax Distributable Earnings per Class A common stock

Target dividend policy

Dividend per Class A common stock

Note: TPG Inc. effective DE corporate income tax rate(²)

1. Total income taxes consist of subsidiary-level income taxes at the TPG Operating Group level and corporate income taxes borne by TPG Inc.

($ in thousands)

1Q'22

2Q'22

Subsidiary-level income taxes

Corporate income taxes

Total income taxes

$

2,842 $

13,591

16,433 $

3,193

6,638

9,831

SA

1Q'22

79,070,565

79,070,565

1Q'22

215,466 $

(2,842)

212,624

26%

54,457

(13,591)

40,866

79,070,565

0.52

85%

0.44 $

25%

2Q'22

79,070,565

169,493

79,240,058

2Q'22

171,698

(3,193)

168,505

26%

43,227

(6,638)

36,589

79,240,058

0.46

85%

0.39

15%

$

2. TPG Inc.'s non-GAAP effective tax rate was approximately 15% for the three month period ending June 30, 2022. This rate differed from TPG Inc.'s marginal tax rate of 23% primarily due to the tax treatment of certain IPO costs, and also items that will

continue to impact our rate in the future such as tax benefits from our tax receivable program and settlement of restricted stock units ("RSUS"), among other activities arising in our normal course of business.

TPG | 25View entire presentation