KKR Real Estate Finance Trust Investor Presentation Deck

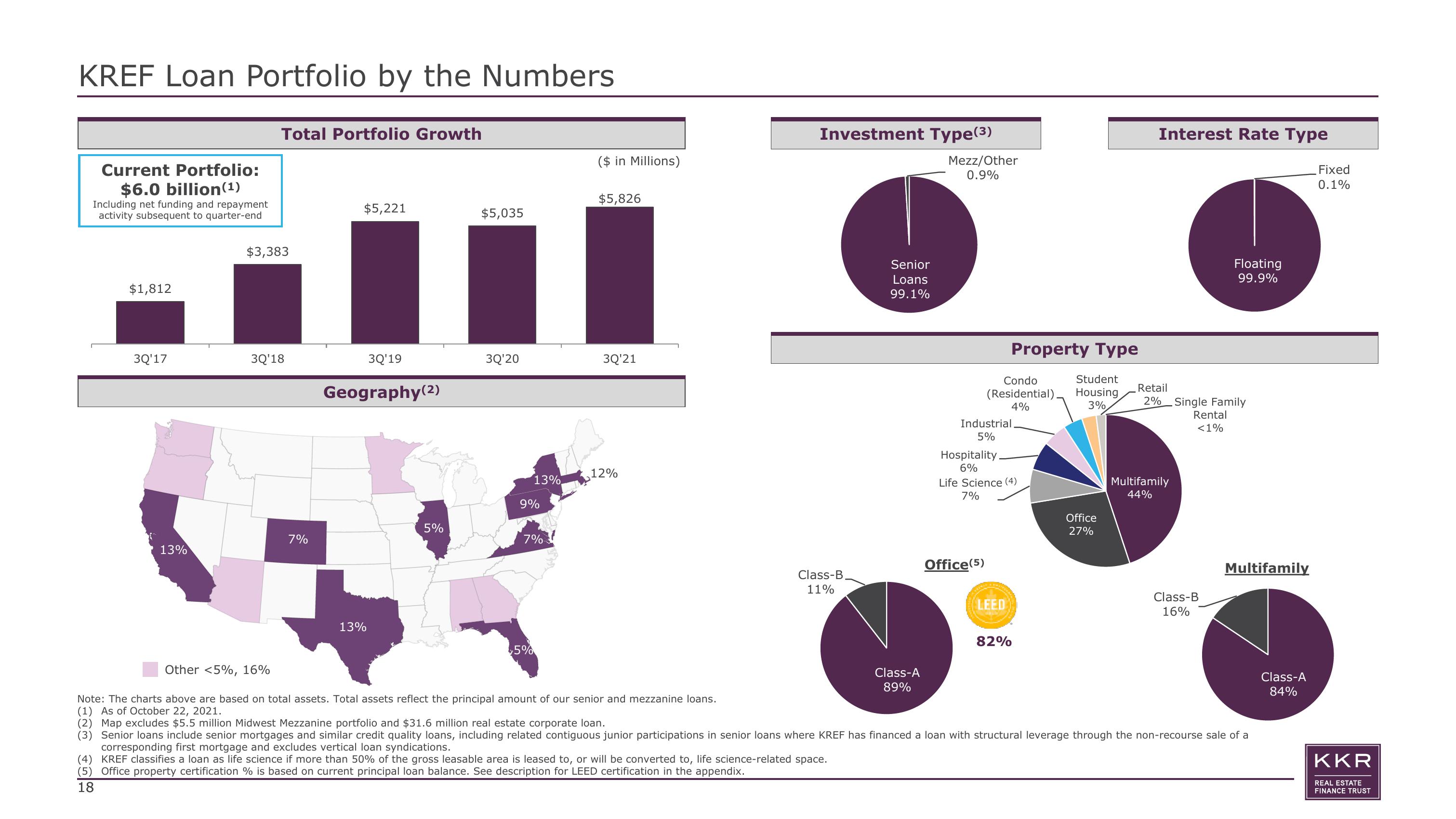

KREF Loan Portfolio by the Numbers

Current Portfolio:

$6.0 billion (1)

Including net funding and repayment

activity subsequent to quarter-end

$1,812

3Q'17

13%

Total Portfolio Growth

$3,383

3Q'18

7%

$5,221

3Q'19

Geography (2)

13%

5%

$5,035

3Q'20

13%

9%

7%

$5%

($ in Millions)

$5,826

3Q'21

12%

Other <5%, 16%

Note: The charts above are based on total assets. Total assets reflect the principal amount of our senior and mezzanine loans.

(1) As of October 22, 2021.

Investment Type(3)

Class-B

11%

Senior

Loans

99.1%

(4) KREF classifies a loan as life science if more than 50% of the gross leasable area is leased to, or will be converted to, life science-related space.

(5) Office property certification % is based on current principal loan balance. See description for LEED certification in the appendix.

18

Class-A

89%

Mezz/Other

0.9%

Condo

Student

(Residential) Housing

4%

3%

Industrial

5%

Hospitality

6%

Office (5)

Life Science (4)

7%

Property Type

MARINA

LEED

OREL

82%

Office

27%

Interest Rate Type

Retail

2%

Multifamily

44%

Floating

99.9%

Single Family

Rental

<1%

Class-B

16%

Multifamily

(2) Map excludes $5.5 million Midwest Mezzanine portfolio and $31.6 million real estate corporate loan.

(3) Senior loans include senior mortgages and similar credit quality loans, including related contiguous junior participations in senior loans where KREF has financed a loan with structural leverage through the non-recourse sale of a

corresponding first mortgage and excludes vertical loan syndications.

Class-A

84%

Fixed

0.1%

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation