Shift SPAC Presentation Deck

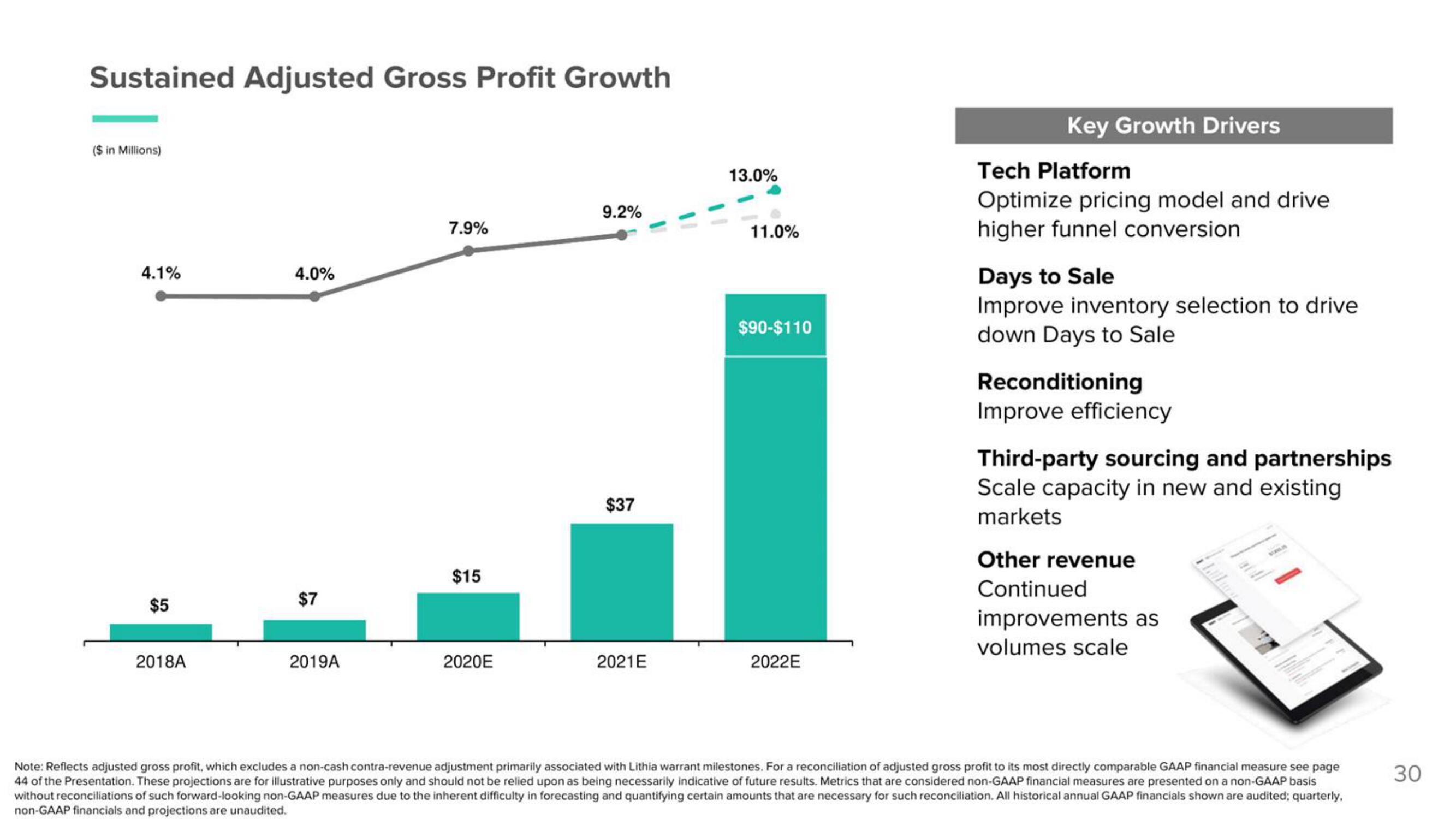

Sustained Adjusted Gross Profit Growth

($ in Millions)

4.1%

$5

2018A

4.0%

$7

2019A

7.9%

$15

2020E

9.2%

$37

2021E

13.0%

11.0%

$90-$110

2022E

Key Growth Drivers

Tech Platform

Optimize pricing model and drive

higher funnel conversion

Days to Sale

Improve inventory selection to drive

down Days to Sale

Reconditioning

Improve efficiency

Third-party sourcing and partnerships

Scale capacity in new and existing

markets

Other revenue

Continued

improvements as

volumes scale

Note: Reflects adjusted gross profit, which excludes a non-cash contra-revenue adjustment primarily associated with Lithia warrant milestones. For a reconciliation of adjusted gross profit to its most directly comparable GAAP financial measure see page

44 of the Presentation. These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. Metrics that are considered non-GAAP financial measures are presented on a non-GAAP basis

without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation. All historical annual GAAP financials shown are audited; quarterly,

non-GAAP financials and projections are unaudited.

30View entire presentation