Bank of America Investment Banking Pitch Book

Revenue

Gross

Margin

SG&A

Cash Flow/

Other Items

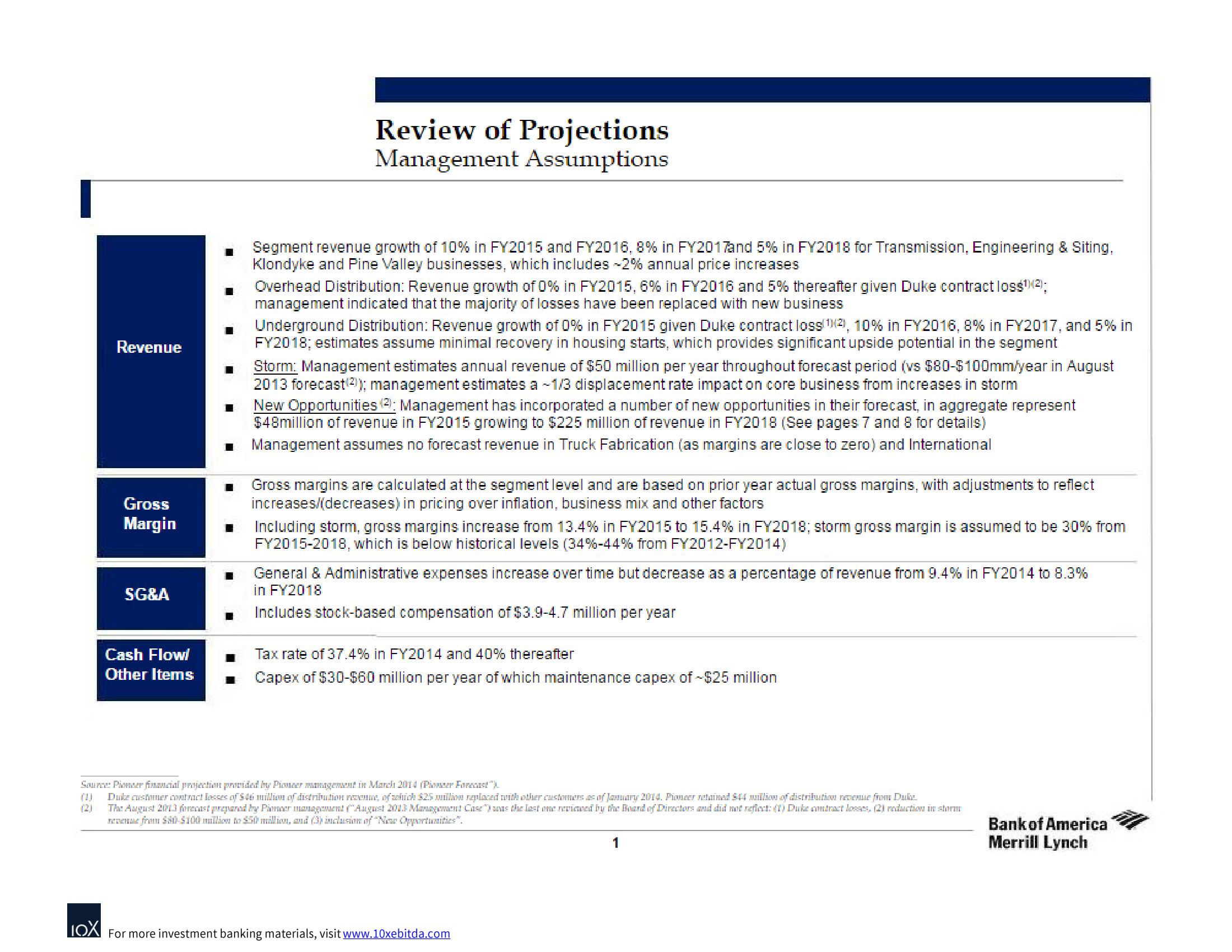

Review of Projections

Management Assumptions

Segment revenue growth of 10% in FY2015 and FY2016, 8% in FY2017and 5% in FY2018 for Transmission, Engineering & Siting,

Klondyke and Pine Valley businesses, which includes -2% annual price increases

Overhead Distribution: Revenue growth of 0% in FY2015, 6% in FY2016 and 5% thereafter given Duke contract loss¹) (2);

management indicated that the majority of losses have been replaced with new business

Underground Distribution: Revenue growth of 0% in FY2015 given Duke contract loss(1)(2), 10% in FY2016, 8% in FY2017, and 5% in

FY2018; estimates assume minimal recovery in housing starts, which provides significant upside potential in the segment

Storm: Management estimates annual revenue of $50 million per year throughout forecast period (vs $80-$100mm/year in August

2013 forecast (2); management estimates a 1/3 displacement rate impact on core business from increases in storm

New Opportunities (2): Management has incorporated a number of new opportunities in their forecast, in aggregate represent

$48million of revenue in FY2015 growing to $225 million of revenue in FY2018 (See pages 7 and 8 for details)

Management assumes no forecast revenue in Truck Fabrication (as margins are close to zero) and International

Gross margins are calculated at the segment level and are based on prior year actual gross margins, with adjustments to reflect

increases/(decreases) in pricing over inflation, business mix and other factors

Including storm, gross margins increase from 13.4% in FY2015 to 15.4% in FY2018; storm gross margin is assumed to be 30% from

FY2015-2018, which is below historical levels (34% -44% from FY2012-FY2014)

General & Administrative expenses increase over time but decrease as a percentage of revenue from 9.4% in FY2014 to 8.3%

in FY2018

Includes stock-based compensation of $3.9-4.7 million per year

Tax rate of 37.4% in FY2014 and 40% thereafter

Capex of $30-$60 million per year of which maintenance capex of -$25 million

Source: Pioneer financial projection provided by Pioneer management in March 2014 (Pioneer Forecast")

Duke customer contract losses of $46 million of distribution resene, of zelich $25 million replaced with other customers as of January 2014. Piouser retained $44 million of distribution revenue from Duke

The August 2013 forecast prepared by Pioneer management (August 2013 Management Case") was the last one reviewed by the Board of Directors and did not reflect: (1) Duke contract losses, (2) reduction in storm

revenue from $80-$100 million to $50 million, and (3) inclusion of "Neue Opportunities".

LOX For more investment banking materials, visit www.10xebitda.com

1

Bank of America

Merrill LynchView entire presentation